Celanese Corporation (NYSE:CE) said that it will increase the selling prices of selective products like Dibutyl Maleate (DBM), Dioctyl Maleate (DOM) and Plasticizer WVC 3800.

BASF SE (BASFY): Free Stock Analysis Report

Celanese Corporation (CE): Free Stock Analysis Report

Koninklijke DSM NV (RDSMY): Free Stock Analysis Report

Chemours Company (The) (CC): Free Stock Analysis Report

Original post

The company will increase the price of DBM and DOM in Europe by €100/MT. Also, prices of Plasticizer WVC 3800 (3G8) in Europe will witness a rise of €100/MT while in Asia price are slated to increase by $150/MT. The price hikes are effective immediately or as contracts permit.

Celanese also recently announced the hike in prices for vinyl acetate ethylene (VAE) emulsions in Asia (outside of China) by $80/MT, effective Jun 21 or as contracts permit.

The company is actively taking pricing actions in response to a spike raw material costs. Celanese witnessed raw material price inflation in its Acetyl Chain business in the last reported quarter. These price actions are expected to support the company’s margins and top line in 2017.

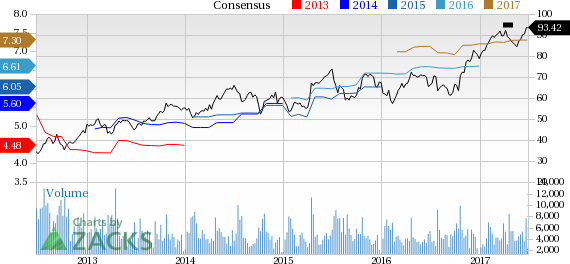

Celanese has outperformed the Zacks categorized Chemicals-Diversified industry over the last six months. The company’s shares have moved up around 18.6% over this period, compared with roughly 8.8% gain recorded by the industry.

Celanese’s strategic measures including cost savings through productivity actions are expected to lend support to its earnings in 2017. The company is also likely to gain from capacity expansion and growth initiatives like acquisitions. Moreover, Celanese remains focused on returning value to shareholders.

Celanese Corporation Price and Consensus

Zacks Rank & Key Picks

Celanese currently carries a Zacks Rank #3 (Hold).

Some better-ranked companies in the chemical space include Koninklijke DSM NV (OTC:RDSMY) , The Chemours Company (NYSE:CC) and BASF SE (OTC:BASFY) .

Koninklijke has expected long-term growth of 7.7% and sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here..

Chemours has expected long-term growth of 15.5% and flaunts a Zacks Rank #1.

BASF has expected long-term growth of 8.9% and carries a Zacks Rank #2 (Buy).

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +18.8% from 2016 - Q1 2017, our top stock-picking screens have returned +157.0%, +128.0%, +97.8%, +94.7%, and +90.2% respectively.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - Q1 2017, the composite yearly average gain for these strategies has beaten the market more than 11X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation. See Them Free>>

BASF SE (BASFY): Free Stock Analysis Report

Celanese Corporation (CE): Free Stock Analysis Report

Koninklijke DSM NV (RDSMY): Free Stock Analysis Report

Chemours Company (The) (CC): Free Stock Analysis Report

Original post