Wall Street and Asian equities traded in the green yesterday and early today, perhaps due to hopes that there may be some progress in talks between Russia and Ukraine. The Ukrainian President confirmed that this was the case. As for today, the main event on the agenda may be the Fed decision. While a 25 bps hike is fully priced in, investors may be eager to determine how many more officials anticipate by the end of the year.

Peace Talks Between Russia and Ukraine Lift Sentiment

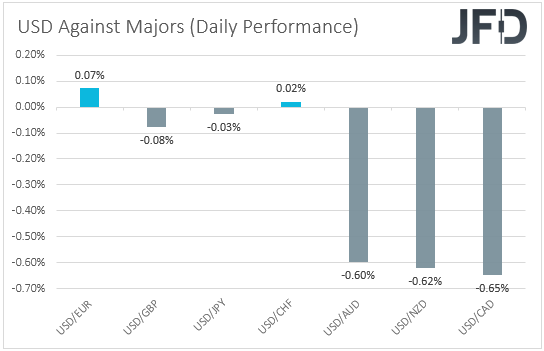

The US dollar traded lower or unchanged against all but one of the other major currencies on Tuesday and during the Asian session Wednesday. It gained slightly only against EUR. The greenback lost the most ground versus CAD, NZD, and AUD, in that order, while it was found virtually unchanged against JPY and CHF.

With the dollar found nearly unchanged against the safe-havens, yen, and franc, we cannot say whether the strengthening of the commodity-linked Aussie, Kiwi, and Loonie, was due to improving risk sentiment, or due to further escalation in the Russia-Ukraine crisis pushing commodity prices higher. For clarifying that, we prefer to turn our gaze to the equity world.

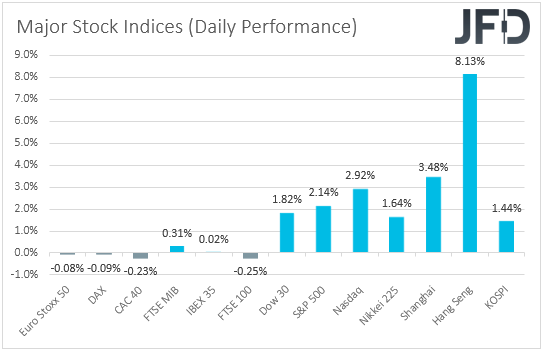

There we see that major European indices traded mixed, within a ±0.35% range, as investors may have stayed nervous due to the surging coronavirus cases in China, but also due to a looming FOMC decision later today. However, Wall Street traded and closed in the green, with the improving optimism rolling into the Asian session today.

This may have been due to hopes that some progress could eventually be made in negotiations between Russia and Ukraine, as yesterday’s talks lasted more than the previous rounds, which fell apart very quickly. Indeed, during the Asian session today, Ukrainian President Volodymyr Zelensky said that peace talks sounded more realistic this time, though more time is needed.

This is the first time we have made progress in negotiations between the two nations. However, we will not get overly excited, and despite equity indices and other risk-linked assets having the potential to trade higher for a while more, we prefer to take the sidelines for now.

We prefer to wait for an actual accord before we get confident in a more robust recovery in market sentiment. With strikes and attacks still taking place in Ukraine, even amid negotiations, we cannot rule out another fallout in peace dialogs and further escalation in the conflict.

How Many Hikes Will the New “Dot Plot” Point To?

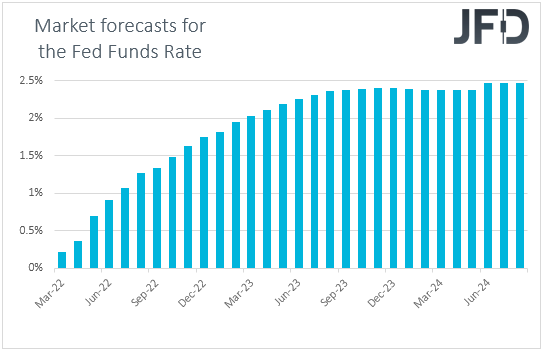

As for today, investors may turn their gaze to the FOMC decision. With Fed Chair Jerome Powell saying, when testifying before Congress, that he will support a 25 bps hike at this gathering, such a move is fully priced in.

Thus, in our view, a quarter-point hike by itself is unlikely to prove a significant market mover. We believe that investors will quickly turn their attention to the accompanying statement, the updated economic projections, and especially the new “dot plot”.

Remember that when testifying, Powell also said that he is ready to use larger or more frequent rate hikes if inflation doesn’t slow, with last week’s CPI data revealing further acceleration in both headline and underlying inflation. With market participants now pricing in almost seven quarter-point hikes by the end of the year, it will be interesting to see how many hikes the dot plot point will be.

Anything less than what the market currently suggests could disappoint and perhaps result in a setback in the dollar, while equities are likely to extend their gains. For the US dollar to continue marching higher, we would like to see officials matching or exceeding market expectations, something we see as a problematic case if we consider that the December dot plot pointed only to three rate increases in 2022.

As for the Rest of Today’s Events

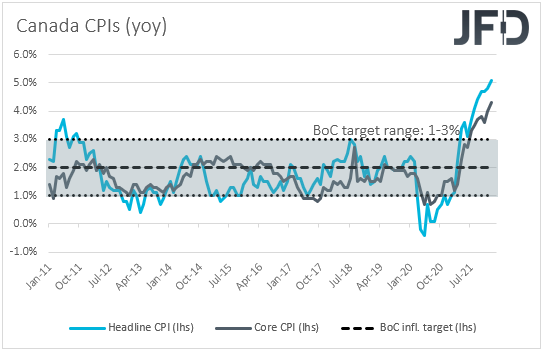

Ahead of the FOMC decision, we have Canada’s CPIs for February, with the headline rate expected to have risen further, to +5.5% YoY from +5.1%. No forecast is available for the core rate. At their latest gathering, BoC policymakers hiked by 25 bps, as was widely anticipated.

While they acknowledged the uncertainty surrounding Russia’s invasion in Ukraine, they added that rising commodity prices would fuel further inflation and that growth for the first quarter of 2022 now looks more solid than previously projected.

This may have encouraged Loonie traders to add to their bets regarding future rate hikes by this Bank, and accelerating inflation is likely to allow them to add some more and thereby buy more Loonies.

Tonight, during the Asian session Thursday, Australia releases its employment report for February. The unemployment rate is expected to have ticked down to 4.1% from 4.2%, while the net change in employment is forecast to show that the economy has added 37k jobs after adding 12.9k in January. In our view, these numbers point to a decent report, which may allow market participants to keep their RBA hike bets elevated and thereby support the Aussie further.

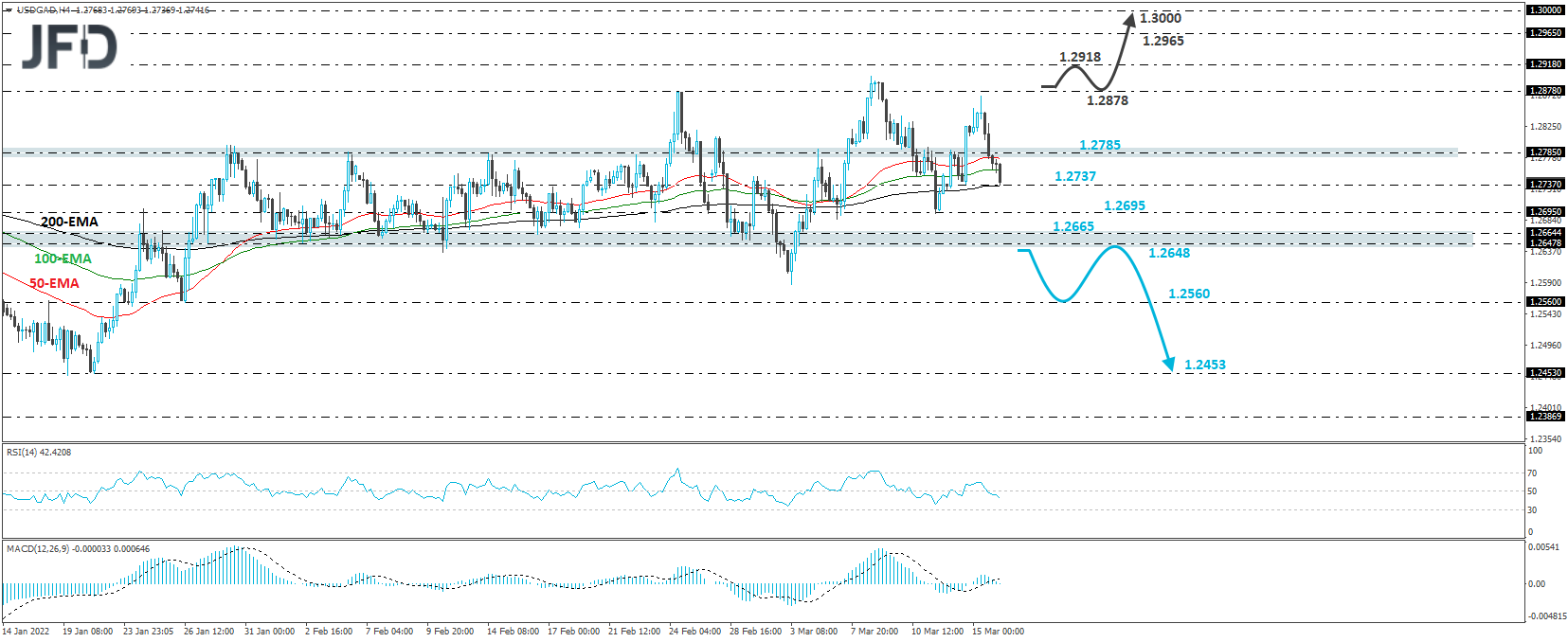

USD/CAD – Technical Outlook

USD/CAD traded lower yesterday, breaking back below the key 1.2785 barrier, which acted as the upper bound of the sideways range that contained the price action between Jan. 26 and Feb. 24. The lower bound is near the 1.2648 zone. We will still class the territory between those boundaries as neutral, thus, with the rate trading back within that range. We will adopt a flat stance for now.

To get confident that more significant declines could occur, we would like to see a strong dip below 1.2648. This could encourage the bears to dive towards the low of Jan. 26, at 1.2560, where another break could set the stage for larger negative extensions, perhaps towards the 1.2453 barrier, which acted as a decent floor between Jan. 13 and 19.

On the upside, we would like to see a clear break above 1.2878 before we get start examining whether the bulls have gained complete control. This could initially target the 1.2918 barrier, marked by an intraday swing high formed on Dec. 22, the break of which could target the peak of Dec. 20, at 1.2965.

If this level cannot stop the bulls either, then we may experience extensions towards the psychological round number of 1.3000.

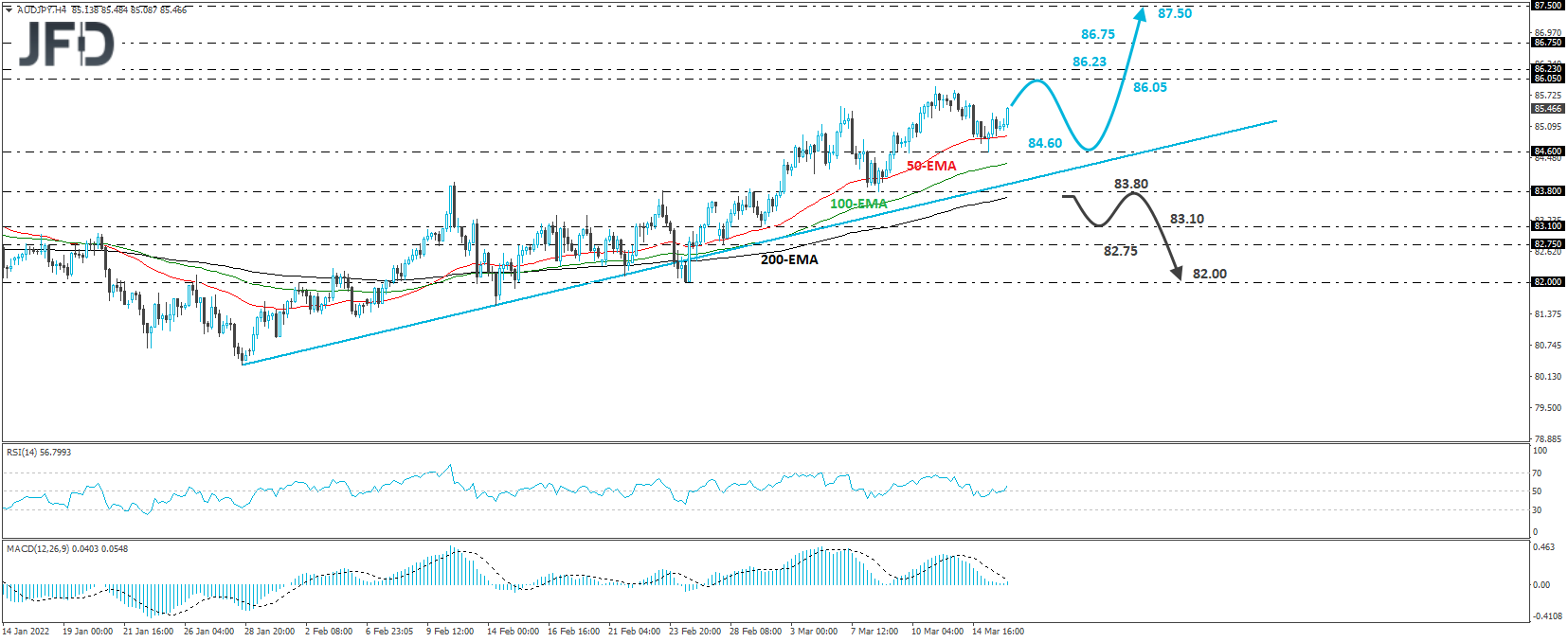

AUD/JPY – Technical Outlook

AUD/JPY traded higher yesterday and today during the Asian session, after it hit support at 84.60. Although the pair has yet to test the key territories of 86.05 and 86.23, it remains above the upside support line drawn from the low of Jan. 28, and thus, we will consider the short-term outlook to be still positive.

If the bulls are strong enough to stay in the driver’s seat, we could soon see them aiming for the aforementioned key levels, marked by the highs of Nov. 1 and Oct. 21, respectively. If they don’t stop there, then we may experience extensions towards the high of Feb. 6, 2018, at 86.75, the break of which could target the high of the day before, at around 87.50.

On the downside, we would like to see a clear break below 83.80, the low of Mar. 8, before we start examining a bearish reversal. This could confirm the break below the pre-mentioned upside line and may initially target the low of Mar. 1, at 83.10, or the low of Feb. 28, at 82.75. If the bears are unwilling to stop there, we may see them driving towards the low of Feb. 24, at 82.00.