CASI Pharmaceuticals Inc (NASDAQ:CASI) has announced that it launched Evomela China, making it officially a commercial stage company. The product for multiple myeloma was approved in China under priority review and will be the first formulation of melphalan available. Additionally, the company continues to expand its R&D operation with the licensing of the worldwide rights to a CD19 CAR-T (CNCT19) from the Chinese cell therapy developer Juventas. The company acquired the rights to the pre-Phase I asset for an ¥80m (US$11.6m) investment in Juventas and it owes undisclosed milestones and royalties.

Evomela off to the races

Evomela will be the company’s first commercial product and we expect there to be immediate demand because the treatment was previously unavailable in China but providers are already familiar with its use in other regions. It is used as a conditioning regimen for patients undergoing stem cell transplant for multiple myeloma, which we believe affects an estimated 17,000 patients in China a year.

Juventas: Building manufacturing in Tianjin and Wuxi

We have relatively few details regarding the new agreement or CASI’s partner Juventas. The latter was founded and is chaired by the new CASI CEO Weiwu He (appointed in April 2019). In addition to the CASI investment, the company received ¥163m in a series A in December 2018. Juventas is building a 7,000 square foot production facility in Tianjin and plans to build a facility in Wuxi.

CAR-T indications: Less prevalent but still sizable

We expect the initial indications that CASI will seek approval for will be diffuse large B-cell lymphoma (DLBCL, the most common subtype of NHL) and adult ALL, similar to other approved CD19 CAR-T programs. Patients with hematologic malignancies are currently underserved in China. The rates of these diseases are lower in China than in the west (estimated at 1.3 and 1.7 per 100,000 respectively), but still significant in absolute size given the underlying population.

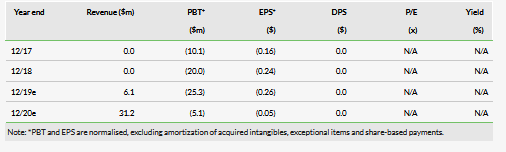

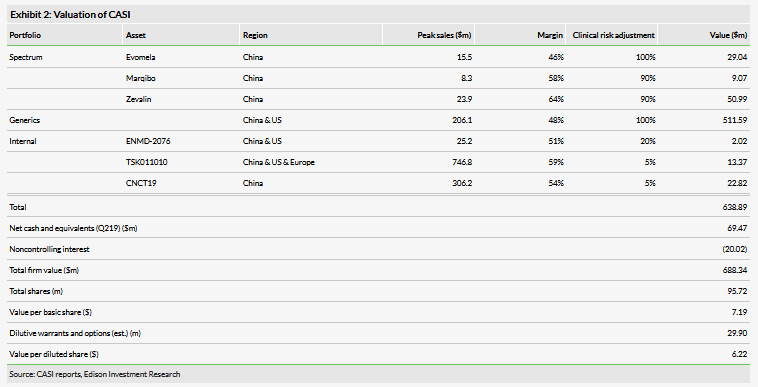

Valuation: Increased to $688m or $7.19

We have increased our valuation to $688m or $7.19 per basic share from $680m or $7.11 per basic share. This increase is driven predominantly by the inclusion of CNCT19 in our model, with an initial valuation of $22m. This assumes that CASI will realize approximately 80% of the value of this asset after milestones and royalties, and carries a 5% probability of success. The increase is offset by an adjustment to near-term generics revenue estimates.

Business description

CASI Pharmaceuticals is a pharmaceutical company that has acquired or licensed a series of drugs that it intends to market in China. These include proprietary drugs licensed from Spectrum Pharmaceuticals and a portfolio of ANDAs. The goal is to seek approval through new pathways that have been opened in the quickly changing Chinese regulatory environment.

Evomela on the market

The company announced the official launch of Evomela in China on 12 August 2019. The product is a formulation of melphalan, a chemotherapy drug used in the stem cell transplant procedure. Such so-called conditioning treatments are used to destroy a patient’s native bone marrow before receiving the transplant. This will be the first approval of a melphalan product in the country, and therefore we expect immediate interest from hematology centers and other opinion leaders in the country who are already familiar with the drug’s use in other geographies. The company will be marketing the product through its distribution partner China Resources Guokang Pharmaceuticals (CRGK), a subsidiary of China Resources Pharmaceuticals (CRP, 3320.HK, 2018 revenue: HK$189bn).

Multiple myeloma, like other forms of hematologic cancers, is substantially less common in China (and other East Asian countries) than in the west. There are varying estimates of the epidemiology of the disease in China, but the most consistent estimates we have found based on reported cases indicate an age-adjusted incidence of approximately one per 100,000.1,2 There are an estimated 17,000 new cases of multiple myeloma in China every year, which makes it the second largest geography of the disease after the US (~24,000).

A deal to develop CAR-T therapies

CASI announced on 17 June 2019 that it had signed an agreement with Chinese company Juventas Cell Therapy to license the worldwide rights to the latter’s anti-CD19 CAR-T therapy CNCT19. The therapy was developed at the Institute of Hematology and Blood Diseases Hospital in Tianjin, one of the premier hematological cancer centers in the country.

A joint venture was established (80% owned by CASI) that will invest ¥80m (US$11.6m) in Juventas as well as provide for undisclosed future development milestones and royalties. The new CEO of CASI, Weiwu He (appointed in April 2019), is also the chairman and a founder of Juventas (although he recused himself from the deal process).

The announcement stated that Juventas would be responsible for future development of the treatment (although CASI would be on a steering committee). Juventas has already submitted two IND applications with the NMPA for the treatment of non-Hodgkin lymphoma (NHL) and acute lymphoblastic leukemia (ALL), which are pending approval. Juventas previously announced in December 2018 that it received ¥163m in a series A to support CAR-T development. Neither CASI nor Juventas have released further details regarding the collaboration.

We have made several assumptions regarding the program. First, we expect initial indications for these programs to be diffuse large B-cell lymphoma and adult ALL respectively, as these are the target indications that already have approved CD19 CAR-T therapies. Additionally, although CASI has stated that it intends to market the therapy worldwide, we expect the initial market to be China. Autologous cell therapies require a substantial manufacturing footprint to process patients’ cells and establishing this manufacturing and the associated supply chains are a greater barrier to market entry than traditional intellectual property protections. Moreover, it is currently illegal for cell therapies (or other products containing genetic material) manufactured in China to leave the country. Juventas has a 1,400 square foot lab in Tianjin and has announced that it is building a 7,000 square foot production facility in Tianjin and plans to build a facility in Wuxi. We therefore expect the company to establish initial operations in China, but may amend this assumption in the future.

CD19 CAR-T therapy

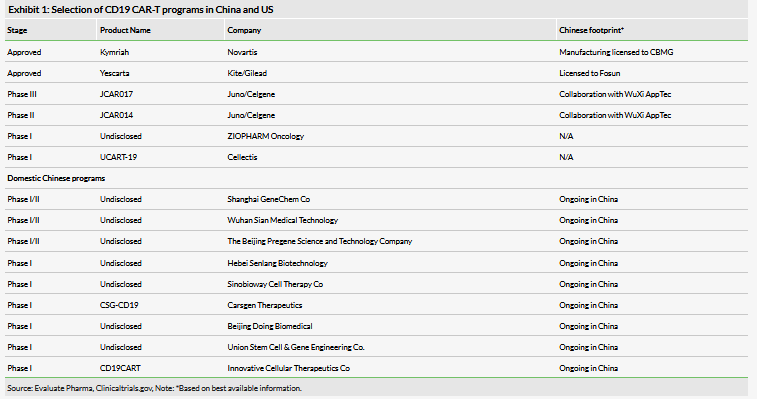

CD19 is the most prominent target for CAR-T therapy in the industry. The protein is a marker for immature B-cells (those that are not terminally differentiated into plasma cells), and is present on the abnormal cells of B-cell cancers. There has been significant interest in developing CD19 CAR-T therapies both in China and worldwide. The two CAR-T therapies currently approved in the US Kymriah (tisagenlecleucel, Novartis) and Yescarta (Axicabtagene ciloleucel, Kite/Gilead), as well as prominent development-stage candidates JCAR017 and JCAR014 from Juno/Celgene all also target CD19. All of these programs have footprints in China (albeit structured differently) with the goal of entering this market.

We expect these companies to seek approval in China, where applicable, through the priority review pathway for foreign approved drugs, which allows for speedy approval using foreign clinical trial data for drugs already approved overseas. A potential limitation of this strategy is that these companies must replicate an identical product in China. Because of restrictions on the export of human tissue in China, these companies cannot use overseas manufacturing to support Chinese sales, and therefore must reconstitute their manufacturing and controls domestically, which may be expensive. Moreover, trade disputes may affect the ability of these companies to import components of their CAR-T products, such as viruses.

We expect that a fully domestic CD19 CAR-T like that being developed by CASI will be able to better realize efficiencies in China and provide a lower cost product, which may provide a competitive edge with patients and payers. There are a number of such domestic CD19 CAR-T development programs in China, with ongoing clinical studies (Exhibit 1). According to clinicaltrials.gov, there are current 46 ongoing industry sponsored CD19 CAR-T clinical studies in China, although the status of many of these studies is largely unconfirmed.

We expect the first domestic CD19 CAR-T that is included on state insurance formularies to command significant market share. In the case of CASI, we have previously been impressed at the company’s ability to quickly navigate the new regulatory framework in China in order to get Evomela approved quickly, but there can be no concrete assurances that it will be able to bring CNCT19 to market first.

DLBCL

DLBCL is the most common variety of non-Hodgkin lymphoma, making up approximately 30% of all new cases of the disease. Like other B-cell lymphomas, it is characterized by the proliferation of abnormal B-cells that accumulate in the lymph nodes and destroy their underlying structure. The genetic causes of the disease are diverse and truly it represents an underlying cluster of diseases based on the precise defect and histology. Because of this, the disease can be complex to treat, with widely varying prognoses depending on subtype. For instance, the five-year survival is only 10% when the disease affects bone marrow, compared to over 60% in the disease as a whole.3 DLBCL is one of the most common hematologic cancers in the western world, with approximately seven cases per 100,000 in the US. By comparison, the rate in China is much lower: the underlying rate of lymphoma in China is 6.4 people per 100,000 (including all NHL subtypes, Hodgkin’s lymphoma, and others),4 so we estimate a rate of DLBCL of approximately 1.3 per 100,000.

Adult ALL

ALL is similar to DLBCL in that it is caused by the over proliferation of lymphocytes, although unlike DLBCL, these dysfunctional cells accumulate primarily in the bone marrow. In the majority of ALL cases, B-cells or B-cell progenitors over proliferate (so called B-ALL, approximately 75% of cases), although T-cells can be affected in a minority,5 and therapies such as CD19 CAR-Ts would not be appropriate for these patients. Unlike the vast majority of cancers, ALL afflicts children as well as adults and 30% of ALL cases occur before the age of 15. It is the most common childhood cancer and leading cause of cancer deaths among children despite the fact that the five-year survival rate among children is high at 90%. By comparison the survival for adult patients is significantly lower at 40% for those aged 25 to 64 and 15% for those 65 and older. The disease is most common in Caucasian populations, but tends to be more aggressive in non-Caucasians. We estimate the incidence of ALL in China at 1.4 per 100,0006 compared to 1.7 per 100,000 in the US.7

Valuation

We have increased our valuation to $688m or $7.19 per basic share from $680m or $7.11 per basic share. This increase is driven by the addition of CNCT19 to our model with a value of $22.8m. At this time we only model commercialization of the product in China due to the considerations described above regarding the product’s manufacturing. We model the product launching in 2026 with a price of $75,000. This is a significant discount to CAR-T pricing announced (eg Kymriah at $475,000), and a significant hurdle for patients in the Chinese reimbursement market, but achievable to a degree with a combination of insurance and cash. We currently model commercialization for DLBCL and adult-ALL. We expect penetration of 30% for both indications. We expect clinical trials for these programs to be significantly less expensive than trials performed in the US, costing an estimated $30,000 per patient. Finally, we believe that the company can significantly constrain COGS using its efficient manufacturing platform, and we expect COGS in the 25% range. Additionally, our model includes $5m in capex costs associated with establishing manufacturing in China. Although the precise details of the licensing agreement have not been released, our valuation assumes that CASI will retain 80% of the value of the product (after royalties and milestones). Our probability of success is 5%, which is our standard for pre-Phase I assets.

The above increase in valuation is offset by adjustments made to our estimates for the generics portfolio. We have moderated our US sales timeline slightly (which has reduced peak sales to $206m from $212m) as we see the company shifting towards a more purely China centric strategy and on the back of US China trade conflicts. Additionally, we had a small amount of China generics sales in 2019 (~$3m), which we have delayed into 2020 based on the progress to date establishing its Wuxi manufacturing operation.

Additional changes to our valuation include rolling forward our NPVs and adjusting for new net cash ($69.5m at 30 June 2019). Additionally, we include a term for the non-controlling interest in the Wuxi manufacturing venture.

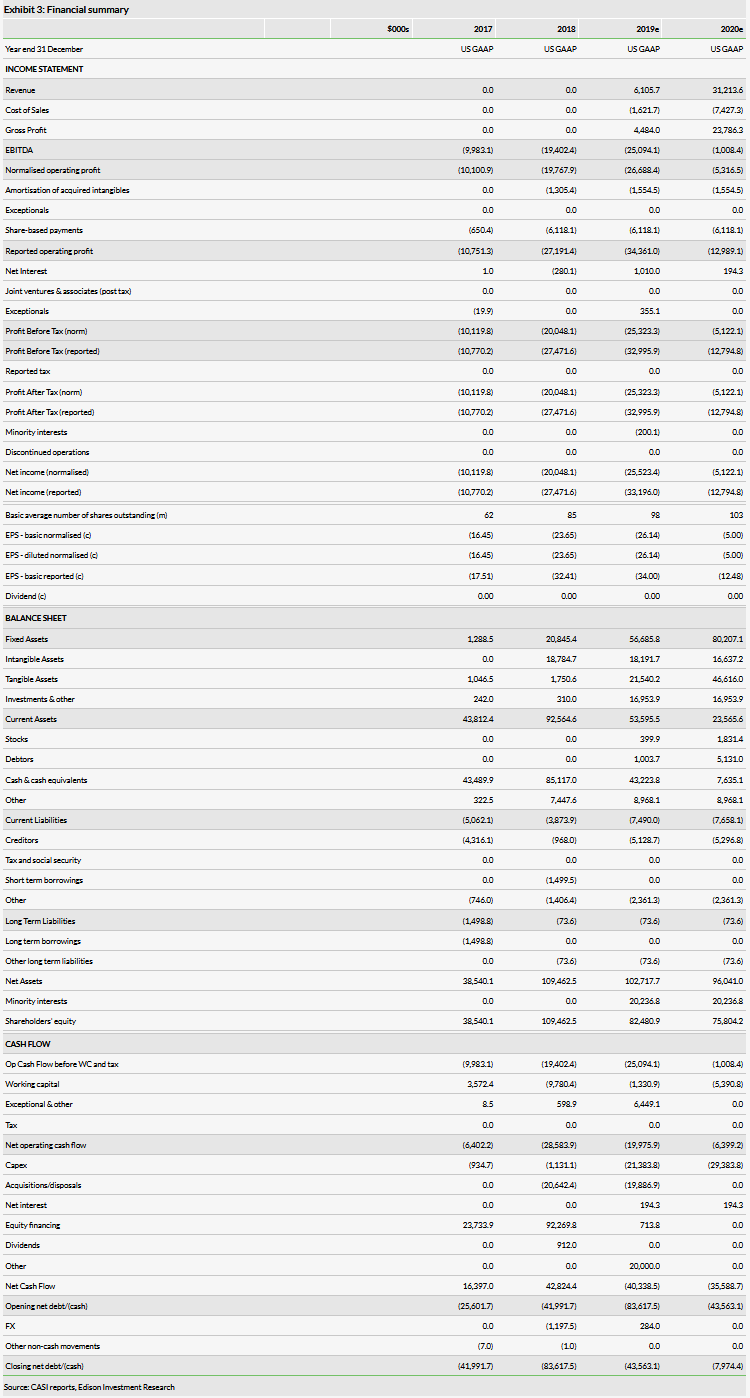

Financials

The company reported an operating loss of $15.8m for Q219, driven in large part by a non-cash charge of $5.8m for acquired in process R&D associated with the recent acquisitions. Otherwise operational expenses were similar to other recent quarters with expenses in the range of $8–10m, We expect both commercial and R&D costs to accelerate in later years (reported opex excluding COGS of $38.8m in 2019 and $36.8m in 2020) as sales increase and more products are developed. We assume that the costs associated with the CAR-T program will be recorded on the Juventas financials, although we may add cash-flows from milestones, etc, if those details are released.