We issued an updated research report on CarMax, Inc. (NYSE:KMX) on Dec 27.

CarMax operates as a specialty retailer of used and new vehicles. The Richmond, VA-based company pursues an aggressive store expansion strategy. During third-quarter fiscal 2019, the company opened four stores in new television markets of Wilmington, NC; Lafayette, LA; Corpus Christi, TX; and Shreveport, LA. Additionally, the company is investing in its digital platform to drive traffic.

CarMax focuses more on the used-car market. The company holds a competitive advantage in used vehicle retailing due to high degree of customer satisfaction on account of low prices and a customer-friendly sales process.

In the third quarter of fiscal 2019, CarMax posted earnings per share of $1.09, up 34.6% from a year ago. Earnings surpassed the Zacks Consensus Estimate of $1.01. Revenues however slightly missed the Zacks Consensus Estimate but improved year over year.

Meanwhile, high selling, general and administrative expense is a serious concern. In the first nine months of fiscal 2019, CarMax’s selling, general and administrative expenses rose roughly 7.7% year over year to $1.3 billion. This can be mainly attributed to expenses pertaining to store openings. Increasing investments in technologies and digital platforms, and escalating compensation expenses are adding to the expenses.

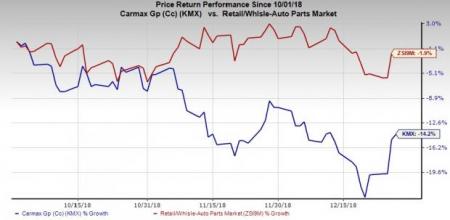

CarMax currently has a Zacks Rank #3 (Hold). Over the past three months, shares of the company have underperformed the industry it belongs to. Over this time frame, the stock has plunged 14.2%, compared with the industry’s fall of 1.9%.

Over the past seven days, the Zacks Consensus Estimate for current-quarter earnings declined 0.9% to $1.05 while the mark for current-year earnings moved 1.1% north to $4.68.

A few better-ranked stocks in the auto space are Allison Transmission Holdings, Inc. (NYSE:ALSN) , Fox Factory Holding Corp. (NASDAQ:FOXF) and CarGurus, Inc. (NASDAQ:CARG) . While Allison Transmission and Fox Factory currently sport a Zacks Rank #1 (Strong Buy), CarGurus carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Allison Transmission has an expected long-term growth rate of 10%. Over the past six months, shares of the company have increased 2.3%.

Fox Factory has an expected long-term growth rate of 17.9%. Over the past six months, the stock has climbed 15.6%.

CarGurus has an expected long-term growth rate of 5%. Over the past year, shares of the company have rallied 3.8%.

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge.

With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research.

It's not the one you think.

See This Ticker Free >>

CarMax, Inc. (KMX): Free Stock Analysis Report

Fox Factory Holding Corp. (FOXF): Free Stock Analysis Report

Allison Transmission Holdings, Inc. (ALSN): Free Stock Analysis Report

CarGurus, Inc. (CARG): Free Stock Analysis Report

Original post

Zacks Investment Research