H118 results were broadly in line with our expectations and Carbios (PA:ALCRB) retains sufficient cash to finance its business until H219. The company continues to make progress with its transformation from a research body to a commercial enterprise. We expect the first commercial revenues from Carbiolice in 2020. Our DCF indicates a valuation for Carbios of €15/share.

H118 results on track for full year

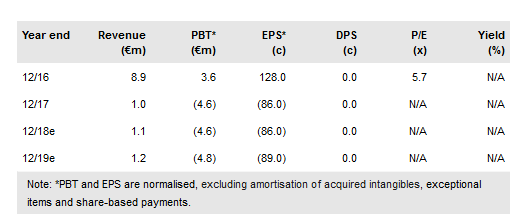

H118 revenue declined by 33% but remains broadly in line with our FY18 projection of €1.1m. Operating expenses rose by 15% versus H117, but operating losses of €2.3m were in line with our expectations for an FY18 operating loss of €4.6m. Net income was helped by a tax credit of €0.635m and at the net income level the loss of €1.7m shows that Carbios is well on track to meet our FY18 expectation of a loss of €3.9m. Cash of €6.7m was c €2m higher than H117, thanks to the equity issue in H217 (€4.2m), but €0.9m (due to cash burn) lower than FY17. Carbios believes its cash position is sufficient to cover its financing needs until H219.

To read the entire report Please click on the pdf File Below: