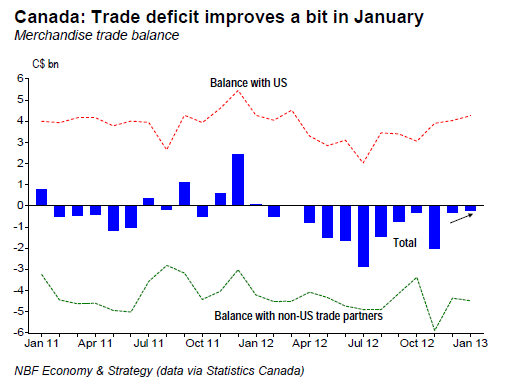

Canada’s merchandise trade deficit narrowed to C$0.24 bn in January, from a revised C$0.33 bn deficit. The improvement was due to exports (+2.1%) rising faster than imports (+1.9%). The energy trade surplus rose C$0.1 bn to reach C$4.9 bn, the highest since June of last year, helped offset the C$0.03 bn widening of the nonenergy trade deficit. Aside of energy (+6.7%), there were export gains for basic industrial goods (+5.6%), electronic equipment (+6.9%) and consumer goods (+3.5%). Those gains more than offset the declines in autos (-7.6%), aircraft equipment and parts (-2.8%) and metal ores (- 16%). Imports were supported by healthy gains in energy and industrial machinery. The goods trade surplus with the US rose to C$4.25 bn, the highest since March of last year (top chart). In real terms, both exports and imports rose 1.8%.

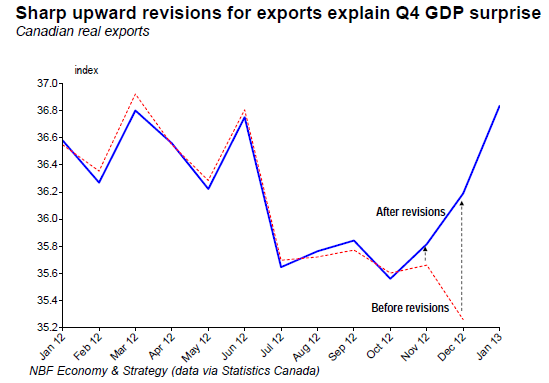

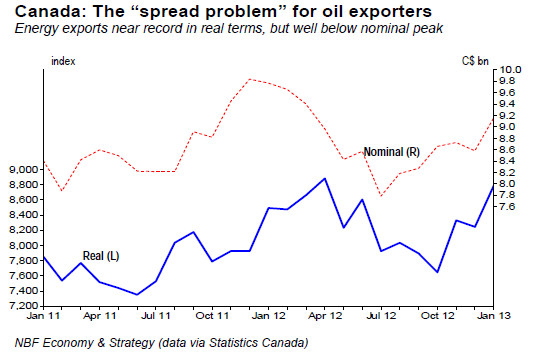

OPINION: Canada's January trade report was better than expected given the healthy exports. The trade report also explains the upside surprise for exports in the Q4 GDP report last week. We’re now told by Statistics Canada that both November and December exports were revised up sharply. There is room for further improvement in trade if, as we expect, our auto exports bounce back in response to the solid US auto demand. With one month of data in Q1, total export volumes are tracking an annualized increase of around 11.4%. That comes after a relatively weak export performance last year. That also signals a pick-up in Canadian GDP growth, after a disappointing second half of 2012, consistent with our call for growth of just under 2% annualized in Q1. That’s not to say that all is now good for Canadian trade. Challenges remain for exporters as the lagged impacts of the strong Canadian dollar are felt particularly in the non-resource sector. The energy sector also faces challenges as evidenced by a still-wide spread between WCS and WTI oil prices, something that explains why our nominal energy exports remain well below 2011 levels despite near record volumes.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Canadian Trade Deficit Narrowed In January

Published 03/11/2013, 08:55 AM

Updated 05/14/2017, 06:45 AM

Canadian Trade Deficit Narrowed In January

FACTS:

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.