Ruby Tuesday (N:RT) Consumer Discretionary - Hotels, Restaurants and Leisure | Reports January 7, After Market Closes

Key Takeaways

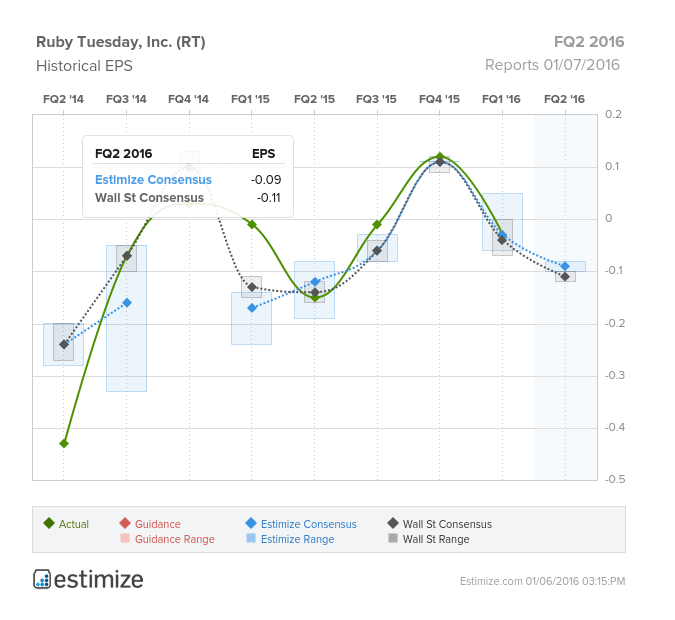

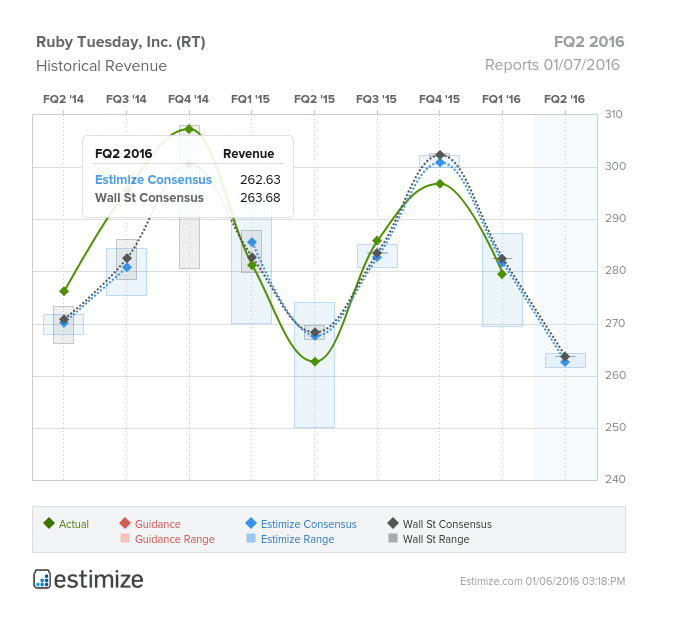

- The Estimize consensus calls for revenue of $262.47 million and EPS of -$0.09 for FQ2 2016 earnings

- Ruby Tuesday is aggressively transforming its brand to differentiate itself in a crowded bar and grill market

- The overall casual dining industry has wavered with the emergence of fast casual dining

What was once a thriving industry, the casual dining experience has suffered with the emergence of fast casual restaurants. Changing demographics, the demand for fresh ingredients and digital disruptions have all put pressure on casual dining’s need for change and innovation. Besides Chipotle's (N:CMG) meteoric fall, many restaurants have underperformed in 2015 due to increasing competition and the threat of a minimum wage hike. Ruby Tuesday, which reports January 7th after the market closes, is expected to miss revenue estimates as it has done 4 of the last 5 quarters. In the past, the chain failed to differentiate itself from a crowded bar and grill sector, leading to its weaker sales. That being said, Ruby Tuesday is aggressively pursuing a brand transformation, to revitalize its status in the restaurant industry. This includes new menu items, limited time offers and marketing campaigns to reimage its restaurants. Despite the company’s initiatives, the Estimize consensus calls for EPS of -$0.09, two cents higher than Wall Street, and revenue of $262.47M, just slightly lower than what the Street is expecting. Compared to FQ2 2015, this represents a YoY increase in EPS of 25%. In the short term, Ruby Tuesday’s is expected to experience waning sales growth as it continues promote new initiatives.

Over the past few years, Ruby Tuesday has been plagued by weak sales in an overcrowded casual dining market. The company has only recently devoted resources to differentiate itself and abandon underperforming stores. By transforming the core brand, Ruby Tuesday has successfully reduced costs and improved margins. Based on its new initiatives, Ruby Tuesday expects same store sales and comps to grow in the second half of fiscal 2016. Despite the positive momentum Ruby Tuesday has generated, the prospect of increasing minimum wage, inflationary cost pressures, and competition in a crowded market will take a toll on the company’s profits with share prices to falling 20% in 2015.