Swiss pharmaceutical company Novartis AG (NYSE:NVS) is scheduled to report second-quarter 2017 results on Jul 18.

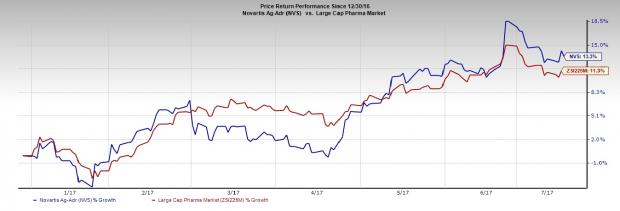

A look at Novartis’ share price movement year to date shows that the stock has outperformed the Zacks classified Large Cap Pharma industry. Its shares have rallied 13.3% compared with the industry’s gain of 11.3%.

In the last reported quarter, Novartis delivered a positive earnings surprise of 2.7%. The company has posted an average positive earnings surprise of 3.28% in the trailing four quarters. Let’s see how things are shaping up for this announcement.

Factors to Impact the Quarter

Novartis operates under three segments: Innovative Medicines (Pharmaceuticals), Alcon and Sandoz (Generics).

New products like Cosentyx and Entresto should boost the top line. Cosentyx has been strong and the company has grabbed market shares from rivals like AbbVie’s (NYSE:ABBV) Humira and Amgen’s (NASDAQ:AMGN) Enbrel. Cosentyx achieved the blockbuster status in 2016 and recorded over $1 billion of sales.

Novartis has broadened its oncology portfolio through acquisitions. FDA’s recent approval of Kisqali, for use in combination with an aromatase inhibitor for the first-line treatment of postmenopausal women with hormone receptor positive, human epidermal growth factor receptor-2 negative (HR+/HER2-) advanced or metastatic breast cancer will further boost the company's oncology portfolio. Meanwhile, the FDA has also recently approved a label expansion of Zykadia as the first-line treatment of patients with metastatic non-small cell lung cancer.

Additionally, Novartis’ generic arm, Sandoz, is making efforts to strengthen its biosimilars portfolio. The company plans to launch four biosimilars of major oncology and immunology biologics across key geographies by 2020. The company is, however, facing significant pricing pressures in the U.S. due to a delay in the launch of Glatopa 40mg. This is expected to impact the second-quarter results.

Also, exclusivity of some of the key drugs in Novartis’ portfolio is hurting the company’s top line. The company’s blockbuster drug, Diovan, is facing stiff generic competition in the U.S., the EU and Japan. Gleevec lost exclusivity in the U.S. in Feb 2016 and in the EU in Dec 2016, thereby leading to generic competition. Exforge is also facing generic competition in the U.S. and the EU. Furthermore, the oncology drugs are facing new competition in the form of immuno-oncology therapies.

The negative impact of generic competition is expected to impact sales by $2.5 billion in 2017.

The company’s ophthalmologic division, Alcon, continues to face challenges due to lower surgical equipments sales. Stiff competition faced by intraocular lens and a slowdown in demand for equipment purchases continue to act as dampeners. We do not expect any improving trends in the division’s sales in the to-be-reported quarter.

Earnings Whispers

Our proven model does not conclusively show that Novartis will beat on earnings this quarter. That is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) to be able to beat estimates. Unfortunately, that is not the case here, as you will see below.

Zacks ESP: The Earnings ESP for Novartis is 0.00%. This is because both the Most Accurate estimate and the Zacks Consensus Estimate are pegged at $1.16. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Novartis currently carries a Zacks Rank #3. Although the rank is favorable, the company’s 0.00% ESP makes surprise prediction difficult.

Note that we caution against stocks with a Zacks Rank #4 or 5 (Sell rated) going into the earnings announcement, especially when the company is seeing negative estimate revisions.

Stock to Consider

Here is one stock in the healthcare sector that you may want to consider, as our model shows that it has the right combination of elements to post an earnings beat this quarter.

Vertex Pharmaceuticals Incorporated (NASDAQ:VRTX) has an Earnings ESP of +16.7% and a Zacks Rank #1. The company is scheduled to release results on Jul 26. You can see the complete list of today’s Zacks #1 Rank stocks here.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020. Click here for the 6 trades >>

Novartis AG (NVS): Free Stock Analysis Report

AbbVie Inc. (ABBV): Free Stock Analysis Report

Vertex Pharmaceuticals Incorporated (VRTX): Free Stock Analysis Report

Amgen Inc. (AMGN): Free Stock Analysis Report

Original post

Zacks Investment Research