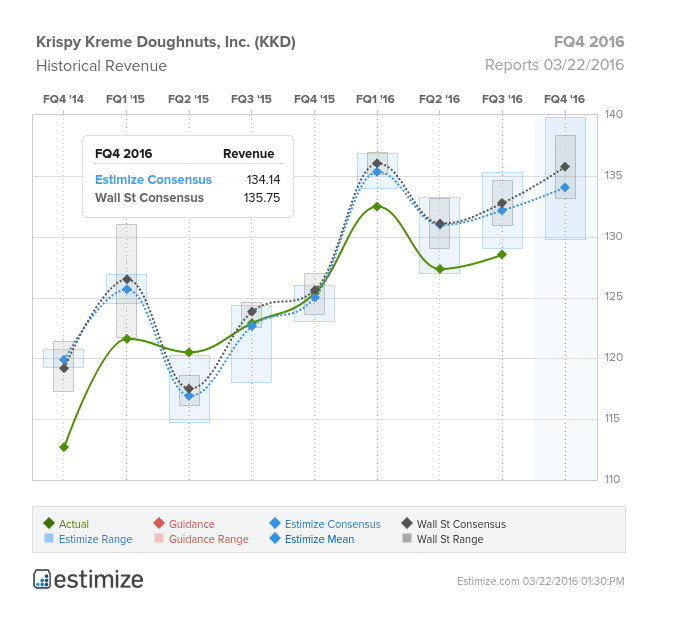

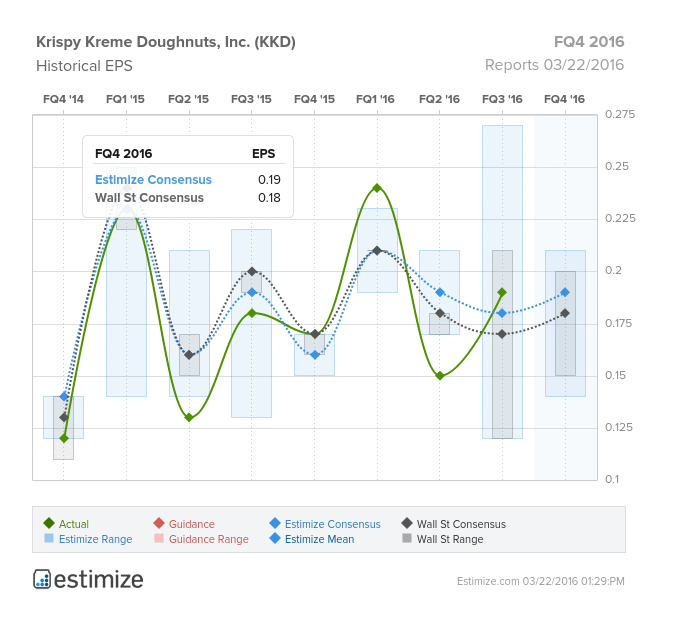

- The Estimize consensus calls for EPS of $0.19, 8% higher than Wall Street, with revenue expectations of $134.14 million, roughly $1 million below the Street

- As Americans become more health conscious, sugary treats such as doughnuts have begun to lose favor to spinach and kale

- Yet Krispy Kreme still plans to open 130 new stores, 20 domestic and 110 international, by the end of fiscal 2016

As Americans become more health conscious, sugary treats such as doughnuts have begun to lose favor to spinach and kale. This comes to the displeasure of iconic doughnut maker, Krispy Kreme (NYSE:KKD) who is due to report fourth quarter earnings tomorrow, after the closing bell. The past year has been a mixed bag of good and bad earnings, with the Estimize community expecting a slight beat tomorrow.

The Estimize consensus calls for EPS of $0.19, one penny higher than Wall Street, with revenue expectations of $134.14 million, roughly $1 million below the Street. Krispy Kreme is expected to maintain respectable year over year growth with earnings predicted to grow 11% on a 7% increase in sales. The Estimize community has been optimistic regarding profitability, revising EPS estimates up 6% since the company last reported. On average, Krispy Kreme consistently beats expectations, trumping Estimize 42% and Wall street 56% of record quaters

This past year has been full of ups and (mostly) downs for Krispy Kreme. The iconic doughnut chain is coming off a mixed third quarter in which it missed on the top line but beat its earnings expectations. Domestic same store sales rose 3.4% while international franchise same store sales declined 3.7% as the negative effects of a stronger U.S. dollar continue to take their toll. The company’s biggest problem lately hasn’t been profitability, but revenues, which have missed expectations in each of the last 3 quarters. Consequently, shares have dropped 20.8% in the past 12 months.

It’s well known that Krispy Kreme has suffered in recent years as the U.S. undergoes a systemic shift in consumer preferences. Americans are increasingly opting for healthy snacks over sugary treats like doughnuts and other baked goods. Even so, Krispy Kreme is taking an aggressive stance in its short term expansion. The company expects to open 20 new domestic franchise stores and over 100 to 110 new international stores by the end of fiscal 2016. Moreover, Krispy Kreme has maintained a clean balance sheet, ending the most recent quarter with $37 million in cash and less than $12 million in debt. If the company can deliver on its growth strategy and maintain sound financials, investors may recoup their losses.