The CAC index has started the week with losses, dropping 0.89% on Monday. Early in the North American session, the CAC is at 5253.30 points. On the release front, there are no French or eurozone events on the schedule. On Tuesday, France releases Nonfarm Payrolls and the eurozone releases ZEW Economic Sentiment.

European stock markets have sagged on Monday, following sharp losses on the NASDAQ, which dropped 1.8% on the Friday session. Heavyweight technology stocks such as Apple (NASDAQ:AAPL), Facebook (NASDAQ:FB), and Google (NASDAQ:GOOGL) were all down by more than 3 percent. Apple led the downturn with losses of close to 4 percent.

On the French stock exchange, BNP Paribas (PA:BNPP) has dropped 1.60%, and Societe Generale (PA:SOGN) is down 1.92 percent. On the political front, there was little suspense in the first round of French parliamentary elections, as President Emmanuel Macron led with 28% of the vote. Macron is expected to win a huge majority in the second round of voting on Sunday, which will determine the makeup of the 577 seats in the National Assembly.

Macron, whose party is just a year old, is expected to put forward pro-business legislation, which will not sit well with the powerful labor unions. Macron wants to streamline government and overhaul labor laws, in order to revive a weak economy. Any changes to France’s generous employment benefits is bound it be contentious, but a strong majority in parliament will make it easier for Macron to push through reforms.

The ECB meeting did not make any moves at last week’s meeting, but it did tweak its monetary stance. The ECB kept the benchmark rate pegged at 0.00% and maintained its asset-purchase plan (QE) of EUR 60 billion/month. The cautious ECB did, however, remove its guidance on rate cuts, as the ECB rate statement said that it expected interest rates to remain at “present levels” for an extended period of time. This was slightly more hawkish than the April statement, which said that policymakers expected rates to remain at present or lower levels” for an extended period.

As well, Mario Draghi characterized risks to the economy as “broadly balanced”, compared to previous warnings that risks were “tilted to the downside. The subtle nuance in wording appears to be a nod to improving economic conditions in the euro-area, and could be a sign that the ECB may look to wind up its stimulus program before it terminates in December, if the economy continues to improve. The ECB has revised upwards its growth forecast for 2017 and 2018, although it has lowered its inflation forecast, which may have weighed on the euro and prevented any gains following the ECB rate meeting.

Politics Lifts Euro, Dollar Fed Focused

Economic Events

Monday (June 12)

- There are no German or eurozone events

Tuesday (June 13)

- 1:30 French Final Nonfarm Payrolls. Estimate 0.3%

- 5:00 Eurozone ZEW Economic Sentiment. Estimate 37.2

*All release times are EDT

*Key events are in bold

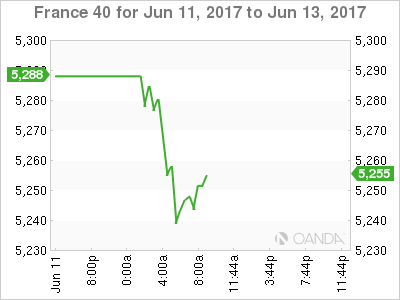

CAC, Monday, June 12 at 8:35 EDT

Open: 5280.00 High: 5284.15 Low: 5232.50 Close: 5253.30