The CAC index has started the week with strong gains. In the Monday session, the index has gained 0.94% and is currently trading at 5313.30 points. It’s a quiet start to the week, with no eurozone or French numbers on the schedule. ECB President Mario Draghi will speak at the ECB Forum on Central Banking in Portugal.

It was anything but a quiet weekend in Rome, as the Italian government announced that would bail out two ailing banks, Banca Popolare di Vicenza and Veneto Banca. This deal will cost the Italian taxpayer 5.2 billion euros, and the government provided additional guarantees of 12 billion euros. Italy has already agreed to bail out another Italian bank, Monte dei Pashci di Siena, for up to 6.6 billion euros.

The Italian government has set aside 20 billion euros to bail out struggling banks, and potentially may have used up the entire amount for these bailouts, depending on how the actual size of the bailouts. European stock markets have reacted positively to the move. On the CAC, bank stocks have posted gains, with Credit Agricole (PA:CAGR) up 1.41% and BNP Paribas (PA:BNPP) gaining 0.62%. These moves remove a major headache for European regulators and should strengthen the fragile Italian banking sector, which has had times been in crisis mode, threatening the stability of the eurozone financial sector.

Global stock markets have lost ground recently, as falling oil prices have weighed on energy sector stocks. Last week, the CAC dropped close to 1 percent. Brent crude has plunged 108% in June, as crude trades around $45 a barrel. As crude prices continue to fall, there are rising concerns of disinflation, and this has soured investor confidence. The US, Japan and much of Europe are struggling with low inflation, and lower levels could hamper economic growth.

OPEC members continue to discuss lowering production in an effort to boost prices, but so far, their efforts have been for naught. OPEC is already bound by a production agreement and compliance is over 100%, yet this has failed to prevent the collapse in oil prices. Another headache for major producers is the increase in production from the US, Libya and Nigeria. If crude prices continue to head lower, we could see further drops on global stock markets.

Economic Calendar

Monday (June 26)

- 13:30 ECB President Mario Draghi Speaks

Tuesday (June 27)

- 4:00 ECB President Mario Draghi Speaks

*All release times are EDT

*Key events are in bold

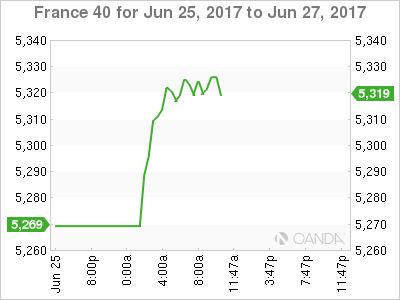

CAC, Monday, June 26 at 9:00 EDT

Open: 5266.12 High: 5324.50 Low: 5294.50 Close: 5313.30