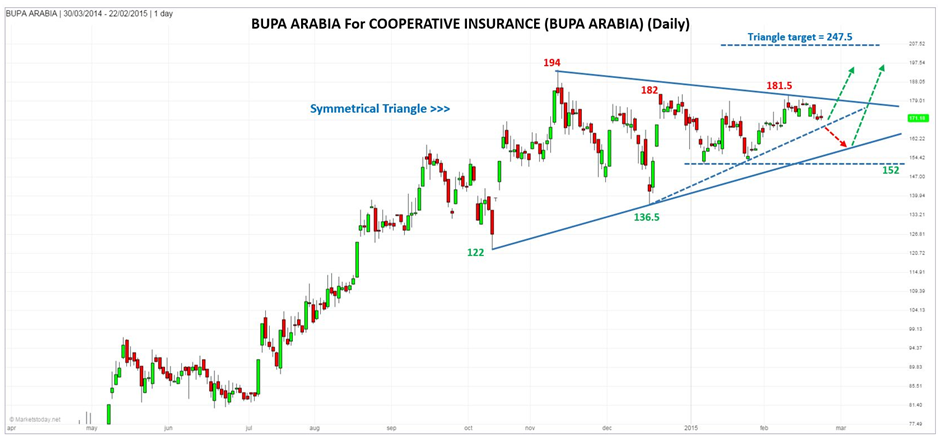

Bupa Arabia for Coop. Insurance (SE:8210) has been consolidating into a Symmetrical Triangle pattern for the past couple of months. Although it may continue to form over the next few weeks, there is a chance for an upside breakout in the near future.

A bullish signal is generated on a decisive jump above 181.50, and subsequent daily close above that price level. Further confirmation of strength would be indicated on trade above 182, followed by 194. Just based on the triangle formation, Bupa Arabia would have a minimum target of 247.50 once an upside breakout occurs.

However, there is a lower and higher probability target zone from 208.50 to 209.60. That zone is the confluence of two measures. An AB=CD pattern completes at the first price level, and the second is the 127.2% Fibonacci extension of the larger retracement within the triangle.

If the triangle continues to form then a move down to the lower uptrend line across the bottom of the triangle is possible, followed by a rally back up to, and eventually through the top line.