Investing in innovation and growth

BTG (LONDON:BTG) is making significant progress in its ongoing business transformation into a leading player in interventional medicine (IM). The 2013 acquisitions of TheraSphere and EKOS have been fully integrated, which coupled with the FDA approval of Varithena represent an inflection point for BTG’s IM business and show how BTG is building scale in this area. It now has four commercial-stage products targeting the fast-growing interventional oncology and interventional vascular markets, with plans to drive growth and maintain its competitive edge. Management appears increasingly confident of achieving its $1bn+ IM revenue target for 2021 and has articulated its strategy for growth. This should be achieved organically and through parallel investment in innovation, R&D and commercial activities.

Interventional Medicine: Upside from Varithena

BTG’s FY14 IM revenues were £79.1m; we expect this to grow to £471m in FY21. Our forecast only includes only the US reimbursed segment for Varithena, which is currently undergoing a ‘soft launch’ focused on high-volume early adopting physicians. Expansion into the US self-pay (cosmetic) market and ex-US regions would unlock upside and help achieve BTG’s 2021 Varithena $500m+ sales target.

Speciality Pharma and Licensing: Steady progress

The Specialty Pharma (SP) and Licensing (LG) divisions remain highly cash generative and provide funding for investment in IM. 5% growth in SP revenue was underpinned by solid DigiFab and Voraxaze sales (both up 15%). We continue to project high single-digit growth in SP revenues (6% CAGR FY15-21) and highlight that new SP products are sought to bolster growth. LG revenue is mainly derived from growing Zytiga royalties (£83.8m); Lemtrada royalties are expected in FY15.

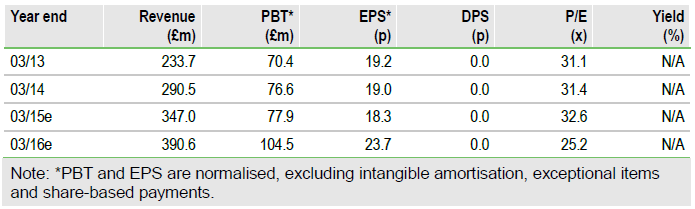

Financials: Organic growth and positive deal impact

FY14 benefited from both organic growth and a positive impact from acquisitions. Increased parallel investment in innovation, R&D and commercial activities in FY15 should further boost growth potential, with FY15 revenue guidance of £330-345m.

Valuation: Fair value of £2.3bn (635p/share)

Our valuation of £2.3bn (635p/share) is based on a 10-year probability-weighted SOTP DCF. Pipeline success could see this rise to £2.43bn or 673p/share. Our fair value is underpinned by a valuation of 411p for marketed assets, which rises to 622p following Varithena commercial launch in Q3, implying considerable downside protection if the pipeline fails to achieve key clinical and regulatory milestones.

To Read the Entire Report Please Click on the pdf File Below