Brown & Brown, Inc. (NYSE:BRO) third-quarter 2019 adjusted earnings of 39 cents per share matched the Zacks Consensus Estimate and grew 2.6% year over year.

The company’s performance was driven by increased investment income, commissions and fees and recent acquisitions.

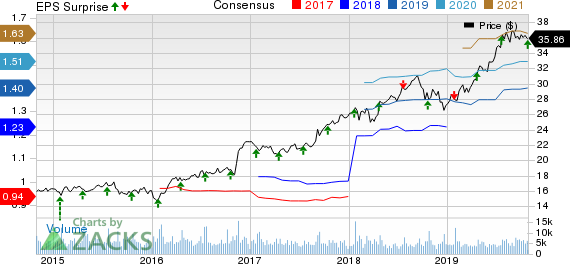

Brown & Brown, Inc. Price, Consensus and EPS Surprise

Behind the Headlines

Total revenues of $619 million beat the Zacks Consensus Estimate by 1.7%. Moreover, the top line rose 16.6% year over year on higher commissions and fees plus net investment income.

Commissions and fees grew 16.5% year over year to $617.4 million.

Investment income surged 112.5% year over year to $1.7 million.

Total expenses increased 20.2% to $466.8 million, driven by a rise in employee compensation and benefits, amortization, depreciation as well as other operating expenses and interest expense.

EBITDAC was $195 million, up 9.5% year over year. EBITDAC margin contracted 200 basis points year over year to 31.5%.

Financial Update

Brown & Brown exited the third quarter of 2019 with cash and cash equivalents of $497.5 million, up 13.3% from 2018-end level.

Long-term debt of $1.5 billion as of Sep 30, 2019 was up 3.8% from 2018 end.

Net cash provided by operating activities in the first nine months of 2019 was $447.1 million, up 25.8% year over year.

Dividend Update

The company paid out cash dividend of 8 cents per share in the third quarter, up 6.7% year over year.

Acquisition Update

Brown & Brown closed five acquisitions in the reported quarter.

Zacks Rank

Brown & Brown currently has a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Other Insurance Releases

Of the insurance industry players that have reported third-quarter results so far, Global Life (NYSE:GL) , Arthur J. Gallagher (NYSE:AJG) and RLI Corp. (NYSE:RLI) beat the respective Zacks Consensus Estimate for earnings.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +98%, +119% and +164% in as little as 1 month. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

Brown & Brown, Inc. (BRO): Free Stock Analysis Report

Arthur J. Gallagher & Co. (AJG): Free Stock Analysis Report

RLI Corp. (RLI): Free Stock Analysis Report

Globe Life Inc. (GL): Free Stock Analysis Report

Original post