Bristol-Myers Squibb (NYSE:BMY) and Celgene (NASDAQ:CELG) are expected to merge into a single company before the end of the year. The deal will create the fifth largest pharmaceutical company in the world with sales of approximately $42 billion in 2019.

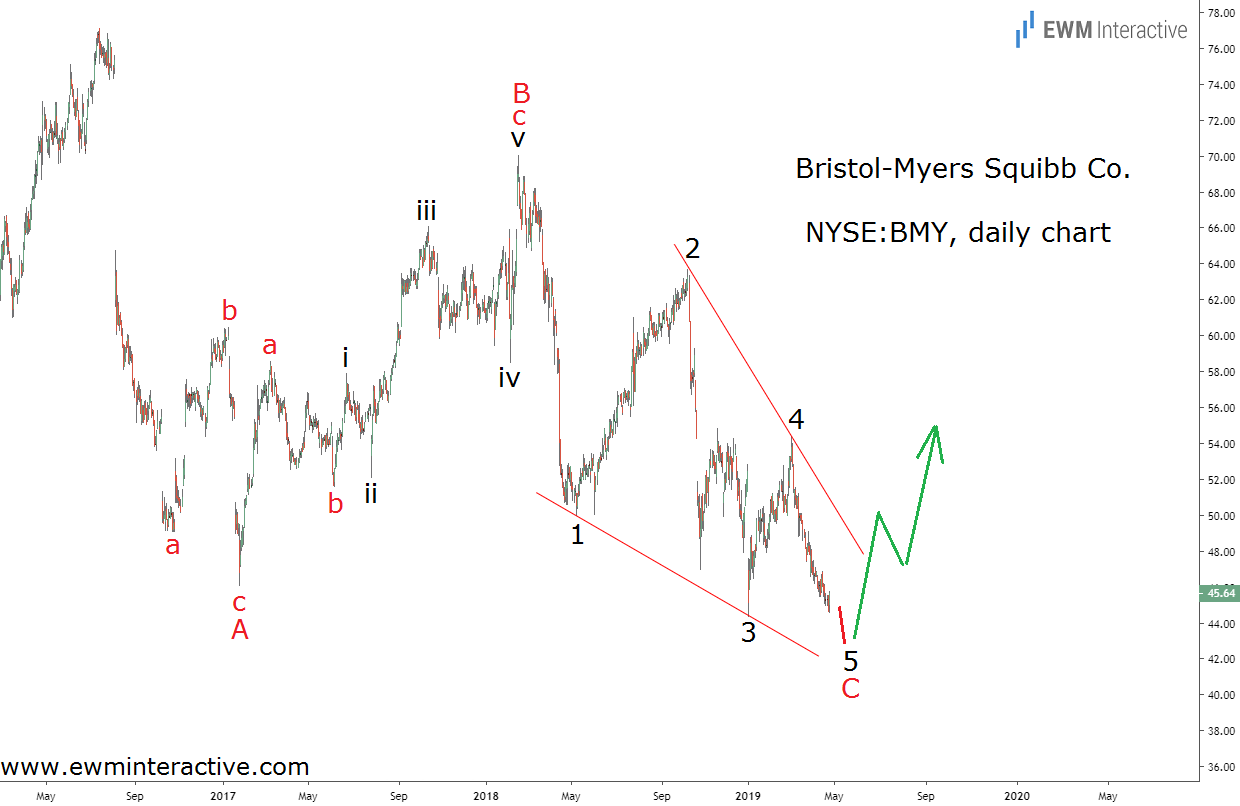

Bristol-Myers fell sharply after the deal was announced in early-January. In late-April, the stock was still in the doldrums and it seemed like the market does not approve the Celgene (NASDAQ:CELG) deal. But a quick Elliott Wave analysis of BMY’s daily chart revealed a different picture. We shared it with our readers on April 26th.

Bristol-Myers was hovering below $46 a share, down from $77 in 2016. However, the structure of this decline looked like an A-B-C flat correction. Waves A and B were simple a-b-c zigzags, while wave C was shaping up as an ending diagonal pattern.

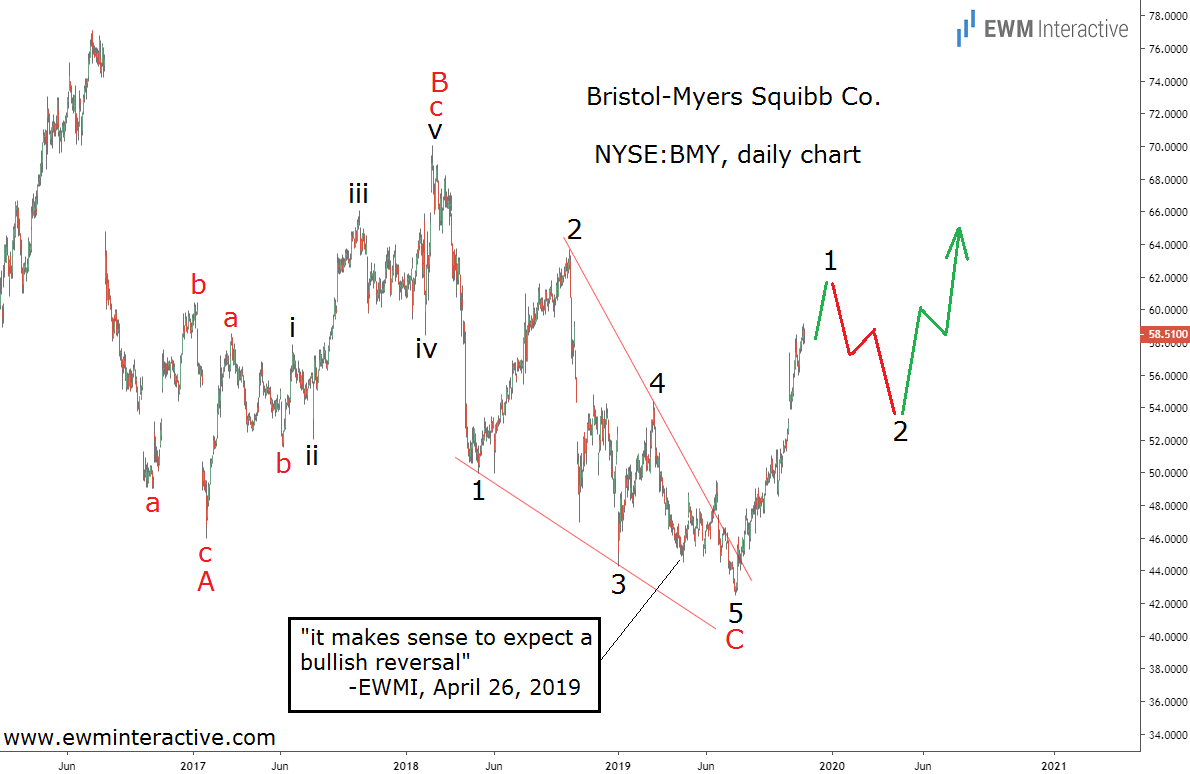

According to the theory, once a correction is over the larger trend resumes. Since Bristol-Myers was clearly in an uptrend prior to July 2016, we thought “it makes sense to expect a bullish reversal” once wave 5 of C is over. As of this writing, the BMY-CELG deal is still pending, but the market seems to be much more optimistic about it.

Wave 5 fell to $42.48 in July to complete the ending diagonal in wave C. Yesterday, the stock closed at $58.51 for a total gain of 37.7% in less than four months. With the bullish reversal already in place we can confirm Bristol-Myers’ uptrend has resumed. Of course, it won’t move in a straight line, but as long as the $42.48 bottom holds investors can feel confident buying the dips.