Bristol-Myers Squibb Company (NYSE:BMY) reported better-than-expected results for the third quarter of 2019 on stellar performance of its blood thinner drug, Eliquis. However, sales growth of its PD-1 inhibitor, Opdivo, was weak.

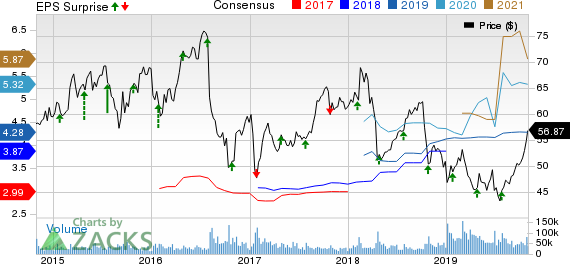

Shares were down in pre-market trading following the earnings release. Bristol-Myers’ shares have increased 9.4% in the year so far compared with the industry’s rise of 2.6%.

Third-quarter 2019 earnings of $1.17 per share easily beat the Zacks Consensus Estimate of $1.06 and increased from the year-ago quarter’s earnings of $1.09.

Total revenues of $6 billion comprehensively beat the Zacks Consensus Estimate of $5.8 billion and increased 6% from $5.69 billion in the year-ago period. Strong sales of Eliquis, Sprycel and Orencia contributed to the company’s top line in the reported quarter.

Quarterly Details

Revenues were up 7% year over year when adjusted for foreign exchange impact. Revenues increased 7% to $3.5 billion in the United States and 3% outside the country. Ex-U.S. revenues were up 7% when adjusted for foreign exchange impact.

Eliquis witnessed strong growth and became the top revenue generator for the company yet again. Sales of the drug rose 22% to $1.93 billion. We note that Bristol-Myers has a collaboration agreement with Pfizer (NYSE:PFE) for Eliquis. Sales of Opdivo, which is approved for multiple cancer indications, were up 1% year over year to $1.8 billion. While sales of Eliquis rose 23%, Opdivo sales were down 5% in the United States.

Leukemia drug, Sprycel, raked in sales of $558 million, up 14% year over year. Sales of rheumatoid arthritis drug, Orencia, were up 14% to $767 million. Melanoma drug, Yervoy, contributed $353 million to the top line, down 8% year over year.

Multiple myeloma drug, Empliciti, recorded sales of $89 million, up 51% year over year .

The performance of key drugs in the Virology unit were disappointing. Sales of Baraclude declined 17% to $145 million. Sales of other brands (including Sustiva, Reyataz, Daklinza and all other products that have lost exclusivity in major markets) fell 35% year over year to $350 million.

Adjusted research and development (R&D) expenses in the quarter were up 7.9% to $1.36 billion. Adjusted marketing, selling and administrative expenses decreased 4.4% to $1.1 billion.

Gross margin was 69.9% in the quarter compared with 71.1% in the year-ago quarter.

Celgene Acquisition Update

Earlier in the year, the company announced that it will acquire biotech bigwig Celgene Corporation (NASDAQ:CELG) for a whopping $74 billion. The acquisition was finally given a green signal a few months back after it faced opposition from some of the shareholders. In July, the company’s acquisition offer was granted unconditional approval by the European Commission (“EC”). In August, Celgene entered into an agreement with Amgen (NASDAQ:AMGN) to sell its global rights to psoriasis drug, Otezla. The deal was announced following a concern raised by the U.S. Federal Trade Commission about a possible overlap between Otezla and Bristol-Myers’ tyrosine kinase 2 (TYK2) inhibitor, BMS-986165, which is being evaluated in several autoimmune diseases, including psoriasis. Bristol-Myers now expects to conclude the merger by the end of 2019.

Pipeline Update

In a major achievement, Bristol-Myers announced earlier this month that the pivotal, phase III study — CheckMate-9LA — evaluating a combination regimen of Opdivo in first-line advanced non-small cell lung cancer (NSCLC) met its primary endpoint of superior overall survival at a pre-specified interim analysis.

In October, the EC approved flexible dosing options of a flat dosing schedule of Opdivo 240 mg infused over 30 minutes every two weeks or 480 mg infused over 60 minutes every four weeks as an adjuvant treatment of adult patients with melanoma with involvement of lymph nodes or metastatic disease having undergone complete resection.

2019 Guidance Updated

Bristol-Myers updated its adjusted earnings expectation for 2019. The company projects earnings of $4.25-$4.35 per share (previous guidance: $4.20-$4.30). The Zacks Consensus Estimate for earnings is pegged at $4.28.

Our Take

Bristol-Myers’ performance in the third quarter was encouraging. Earnings and sales beat estimates primarily on robust sales of Eliquis and Sprycel. However, weak growth in Opdivo sales is a concern. Although successful completion of the CheckMate-9LA study is encouraging, pending detailed data from the study will be needed to access the actual benefit of the Opdivo regimen compared to other approved immuno-oncology drugs as first-line treatment for advanced NSCLC patients.

Zacks Rank

Bristol-Myers currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Free: Zacks’ Single Best Stock Set to Double

Today you are invited to download our just-released Special Report that reveals 5 stocks with the most potential to gain +100% or more in 2020. From those 5, Zacks Director of Research, Sheraz Mian hand-picks one to have the most explosive upside of all.

This pioneering tech ticker had soared to all-time highs and then subsided to a price that is irresistible. Now a pending acquisition could super-charge the company’s drive past competitors in the development of true Artificial Intelligence. The earlier you get in to this stock, the greater your potential gain.

Bristol-Myers Squibb Company (BMY): Free Stock Analysis Report

Pfizer Inc. (PFE): Free Stock Analysis Report

Celgene Corporation (CELG): Free Stock Analysis Report

Amgen Inc. (AMGN): Free Stock Analysis Report

Original post

Zacks Investment Research