Friday June 17: Five things the markets are talking about

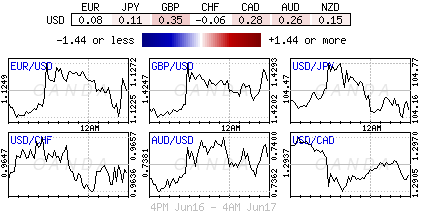

Two themes have dominated proceedings in capital markets this week, first the flight to safety hitting global markets has been particularly acute in Europe, as polls suggesting growing levels of support for Brexit, ahead of the U.K’s June 23 referendum on its European Union membership.

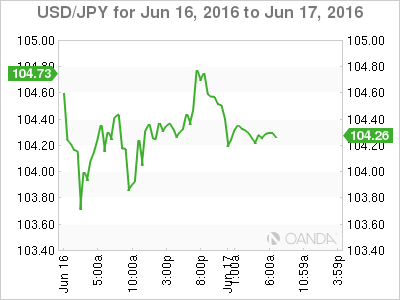

Second, central banks inactions and rhetoric. The FOMC, as expected stood pat, but lowered their rate forecasts. The number of Fed members who saw only one rate hike for this calendar year jumped to six from one at the last meeting. Following the Fed’s lead, the Bank of Japan (BoJ), Swiss National Bank (SNB) and the Bank of England (BoE) have all held rates steady over the last day. Collectively, Tier I central banks have warned the imminent threat to global markets from a Brexit vote.

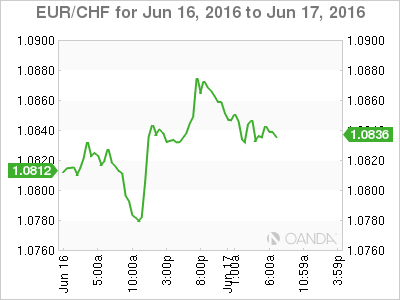

The fears of a U.K. vote to leave has managed to send GBP and the EUR sharply lower, while the safe haven JPY and CHF have made strong weekly gains, along with the dollar.

Due to thin market liquidity conditions, some of these risk-off price moves have been more severe than the usual intraday moves. This is expected to the “order of play,” at least until a U.K referendum outcome is know and been digested.

1. Global yields atop of their record low

Investors worried about Brexit continue to dump riskier debt product and pile into safe haven bonds.

This has sent the U.S 10-year note down to an intraday low yesterday of +1.519% (August 2012). If the U.K leaves the E.U some analysts believe that that the record closing low of +1.404% could be in danger.

Already this week, the Australian 10-year bond yield fell under +2.0% to its lowest ever, while government bonds in Japan sank to fresh lows below the zero percent mark. Germany’s 10-year Bund yield trades atop of negative territory, after falling to a record-low on Tuesday.

In Switzerland, from one-month to 33 years, almost the entire yield curve for Swiss bonds are in negative territory.

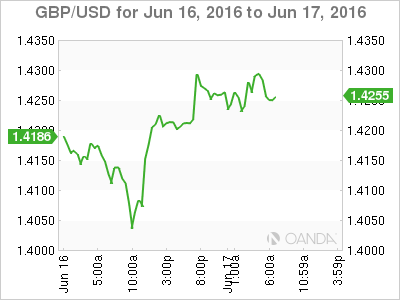

2. Sterling rises as U.K campaign pauses

The pound gains as U.K. campaigning before next week’s referendum on E.U membership is suspended following the tragic killing of a U.K. lawmaker yesterday. The reprieve, until tomorrow, could help the ‘Remain’ camp, given the recent momentum for ‘Leave’.

GBP/USD trades up +0.25% at £1.4287, while EUR/GBP is down -0.18% at €0.7871.

Many expect the gains to be limited, with concerns about the possibility of Brexit very much alive.

Global central banks are said to be preparing for a possible coordination of USD liquidity in event of any Brexit. Bank of Japan (BoJ) is supposedly ready to offer dollar funding along with five other central banks (including BoE and ECB) if markets get too turbulent from the Brexit vote.

3. BoE rhetoric being digested

Governor Carney did not pull any punches yesterday in his post BoE rate decision press conference.

The BoE warned that big economic decisions are already being delayed by uncertainty over the E.U vote, slowing U.K economic growth and sending shock waves through the global economy.

The BoE called the referendum the biggest immediate risk to UK markets.

“On the evidence of the recent behavior of the foreign exchange market, it appears increasingly likely that, were the UK to vote to leave the EU, sterling’s exchange rate would fall further, perhaps sharply,” read the statement.

Cable tested below £1.4050 immediately after the BoE rate decision, for fresh 10-week lows. The pounds demise was also aided by pressure from yet another dire Brexit poll crossing the wires. A Survation phone poll found +42% of respondents in favor of ‘stay’ and +45% for ‘leave’, with +13% undecided. This was a big reversal from the last Survation poll back on May 25th.

4. Global bourses bounce

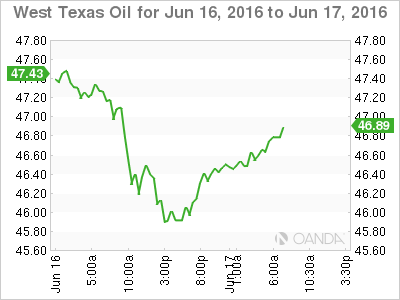

Global indices are closing out the week with a bounce. European equity indices opened sharply higher after a positive Asian session and as WTI ($46.76 +1.19%) and Brent ($47.96 +1.63%) contracts look to break this weeks their losing streaks as they trade on session highs ahead of the U.S open.

Financial stocks are leading the gains across Europe, retracing losses seen in yesterdays trade. While commodity stocks are generally positive, but mixed in the FTSE 100 on the back of intraday rising oil prices.

Gold prices are also rallying, as a softer dollar encourages demand for the precious yellow metal. Spot gold is up +0.6% at $1,284.89 an ounce ahead of the U.S open, pulling back from near its two-year high print yesterday (+$1,315.61).

Indices: Stoxx50 +1.3% at 2,861, FTSE +1.1% at 6,015, DAX +1.2% at 9,663, CAC-40 +1.2% at 4,204, IBEX-35 +2.1% at 8,374, FTSE MIB +2.4% at 16,746, SMI +1.5% at 7,751, S&P 500 Futures -0.1%

5. China sells U.S stocks

U.S Treasury data yesterday revealed that the People’s Bank of China (PBoC), owner of the world’s biggest foreign-exchange reserves, has burnt through -20% its war chest (approximately $250b of U.S debt) over the past two-years and used these proceeds to support the yuan and stem capital outflows.

While China’s sales of U.S debt have slowed, its holdings of U.S. equities are now showing steep declines. China’s hoard of U.S equities fell -$126b, or -38% over the past nine-months, to +$201b. That far outpaces selling by investors globally in that span – total foreign ownership fell just -9%.