If you look hard enough, you can find a whole lot of things that are wrong with the “B” in BRIC. The country’s GDP growth is virtually non-existent. Government regulatory intervention in both the energy sector as well as the financials segment has been increasing. And Brazil’s currency lost approximately 7% against the dollar on a year-over-year basis, hurting unhedged investment in the nation.

On the other hand, if India, China and Russia can find their way out of the emerging market bear cave, wouldn’t there be reason for some optimism on Brazil? The central bank there has cut rates 5.25% over the previous 15 months; assuredly, that stimulus should find its way into the economy as well as equity markets. What’s more, the government has reduced taxes while investing in infrastructure for the upcoming games (i.e., 2014 World Cup, 2016 Olympics).

Indeed, a Brazilian stock bull may soon override pervasive negativity. Consider the Brazilian currency via WisdomTree Dreyfus Brazilian Real (BZF). The “real” has been in a dreadful downtrend since July of 2011.

And yet, for the first time in more than 3 years, it appears that BZF’s 50-day trendline may cross above its 200-trendline. Note: The bullish technical event is known as a “golden cross,” and it represents the opposite of what iShares 20+ U.S. Treasury Bond (TLT) is experiencing with its “death cross.”

Granted, a stronger currency may hinder some Brazilian exports. However, the currency is well below its July 2011 peak, meaning that exporters are on better footing than they’ve been in quite some time. What’s more, Brazil’s relatively low unemployment and consumer spending potential can power unhedged Brazilian ETFs in the small-cap and infrastructure arena.

Whereas WisdomTree Hedged Japan (DXJ) and WisdomTree Hedged Europe Equity (HEDJ) may be a way to profit from strong global corporations in a falling yen or euro environment, Market Vectors Small Brazil (BRF) or iShares Small Cap Brazil (EWZS) can benefit from strong domestic companies in a rising “real” climate. In fact, both BRF and EWZS have set the tone with bullish golden crosses of their own.

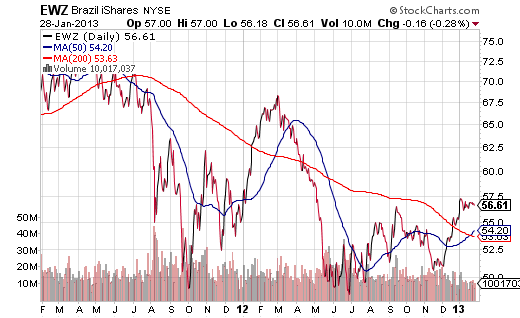

Even the idea that global economic demand for commodities has slowed is a concept in need of review. If China’s turnaround is genuine, large-cap commodity heavy iShares MSCI Brazil (EWZ) may surprise on the upside. EWZ recently served up a golden cross as well.

Is investing in Brazil ETFs as pulpy keen as an Acai berry? Probably not. Consumers in Brazil are still in the process of deleveraging, much the same way than Americans have been.

That said, employment is strong in Brazil. Wages are rising. And the incredible drop in rates is helping to ease the debt burden for consumers. Aggressive investors who understand ETF risk management techniques should take a look at the possibilities.

Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Brazil ETFs: Should Investors Buy The Gold Medals And Golden Crosses?

Published 01/29/2013, 01:57 AM

Updated 03/09/2019, 08:30 AM

Brazil ETFs: Should Investors Buy The Gold Medals And Golden Crosses?

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.