Bank of America’s (NYSE:BAC) Chief Executive Officer, Brian T. Moynihan received a 15% hike in his total compensation for 2018, after the bank reported record earnings. In a regulatory filing, the company stated that the board of directors has approved his 2018 incentive plan.

Moynihan received total compensation of $26.5 million for 2018, up from $23 million for 2017 and $20 million for 2016.

Of the total compensation, $25 million is in the form of stock grants. This equity incentive marks an increase from $21.5 million paid in 2017.

The remaining $1.5 million is his annual salary, which remained unchanged. Notably, he hasn’t received cash bonus since 2007, although a portion of his stock award will be settled in cash when it vests.

Further, of the total equity incentive that BofA provides, half is performance-based restricted stock units (RSUs), which are paid only if the company meets certain financial goals (including growth in book value and return on assets) over three years. The remaining half is time-based RSUs and does not vary with the performance of the company.

Notably, the compensation hike for Moynihan comes after BofA delivered strong 2018 results. Its results benefited from net interest income growth, primarily driven by higher rates and loan growth, along with prudent expense control and lower corporate tax rates. Also, improving asset quality and rise in deposit balances supported the bank’s profitability despite a tough operating backdrop.

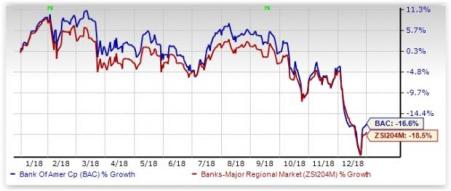

Shares of BofA lost 16.6% in 2018 compared with 18.5% decline for the industry. Significant volatility and investor concerns related to several matters were the main reasons for the share price decline.

Currently, BofA carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Other Wall Street biggies that have announced compensations for CEOs include JPMorgan (NYSE:JPM) , Morgan Stanley (NYSE:MS) and Goldman Sachs (NYSE:GS) , with a hike in the range of 5-10%. Other big banks — Citigroup (NYSE:C) and Wells Fargo (NYSE:WFC) — have not yet revealed the latest compensation.

Is Your Investment Advisor Fumbling Your Financial Future?

See how you can more effectively safeguard your retirement with a new Special Report, “4 Warning Signs Your Investment Advisor Might Be Sabotaging Your Financial Future.”

Click to get it free >>

Bank of America Corporation (BAC): Get Free Report

JPMorgan Chase & Co. (JPM): Get Free Report

The Goldman Sachs Group, Inc. (GS): Free Stock Analysis Report

Morgan Stanley (MS): Free Stock Analysis Report

Original post

Zacks Investment Research

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

BofA (BAC) CEO Moynihan's 2018 Compensation Increases 15%

Published 02/11/2019, 06:53 AM

Updated 07/09/2023, 06:31 AM

BofA (BAC) CEO Moynihan's 2018 Compensation Increases 15%

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.