Bitcoin (BTC) has done well at defending its footing in the mid $3,000 range to kick off the beginning of the new year.

Just before 2018 came to a close, BTC hit a yearly low of $3,150 after a rapid 50 percent loss from the $6,500 level in early November.

BTC is still a ways off from breaking out of the downward trend that it has been in for the past 13 months now, and would need to close over $6,500 before the trend could be considered broken.

At the time of writing Bitcoin is trading at $3,620 on the Coinbase exchange and has a total market cap of $64.1 billion — just over 52 percent dominance over the rest of the market.

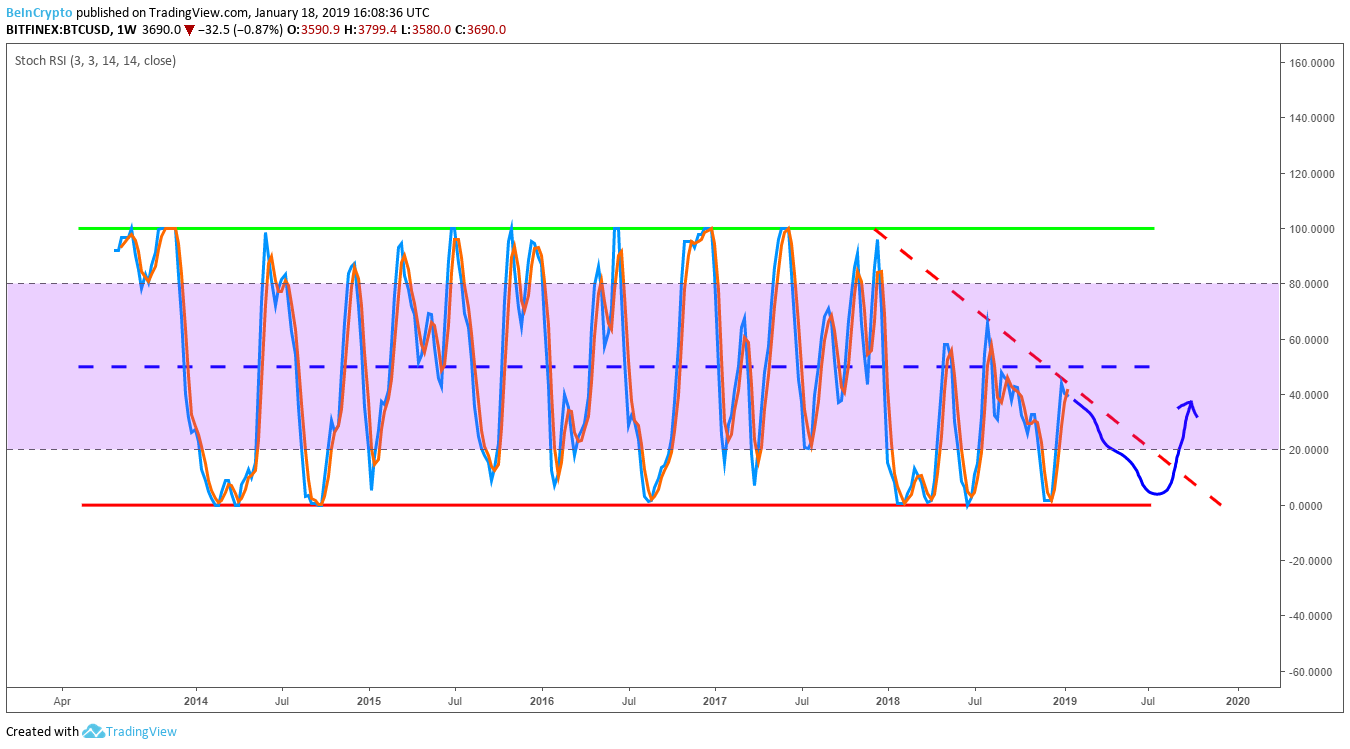

Stochastic RSI

Taking a look at the stochastic relative strength index (RSI), Bitcoin looks to be approaching a heavy descending resistance which began after falling from its peak of nearly $20,000 in December of 2017.

Considering the relatively low volume, it does not seem as though Bitcoin bulls will have enough buying power to break this trend just yet. The Stochastic RSI will most likely need to recharge between 0 and 20 before Bitcoin is out of the woods.

Not Yet Bullish

The daily BTC/USD chart from Bitfinex shows the price of Bitcoin to be near the bottom of the wide descending channel that it has been stuck in.

The price at the moment is in line with the launching point of Bitcoin back in September of 2017, just before the final explosive leg of the bull run. This is acting as strong horizontal support for the time being, but a slip here would most likely see the price take a dive to the bottom support of the downward channel in the range of $2,800 to $3,000.

If Bitcoin follows the pennant formation on the weekly chart, the price does have the potential to regain some ground in the neighborhood of $4,000 before making a breakout in either direction.

However, taking into consideration the stochastic RSI and dwindling volume, that dive may come soon than later. Traders may want t hold off entering a position before key support or resistance levels are met to avoid getting burned.

Do you think Bitcoin has already seen a bottom at $3,150, or will 2019 have new lows in store? Will 2019 be the year that BTC breaks its previous high of $20,000? Let us know your thoughts in the comments below!