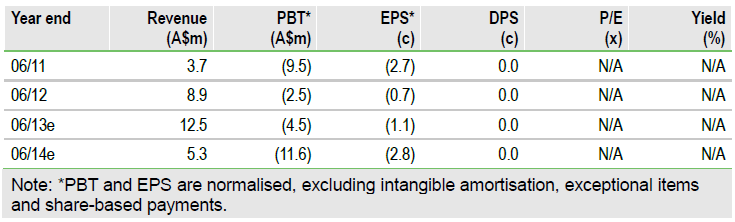

Bionomics has completed enrolment of the 135-patient randomised stage of its DisrupTOR-1 Phase II study of BNC105 in renal cell carcinoma. This puts data read-out on track for January 2014, which is likely to represent a major catalyst for the stock. Our risk-adjusted net present value of Bionomics’ pipeline remains A$275m and adjusting for cash indicates an overall value of A$300m or A$0.72/share.

DisrupTOR-1 study now fully enrolled

Bionomics has completed recruitment of the 135-patient randomised stage of the Phase II study in metastatic renal cell carcinoma (mRCC). The study, named DisrupTOR-1, examines BNC-105 in combination with Afinitor (everolimus, Novartis) in the second-line setting. The primary end point of the study is the PFS rate at six months, thus the read-out is expected in January 2014.

Affinitor confirmed as second-line therapy for RCC

Meanwhile, data presented at ASCO on Afinitor suggest this drug will not displace Sutent (sunitinib) as the first-line standard of care for mRCC and thereby confirms its position as a second-line agent. This is commercially important for Bionomics if it is to establish BNC-105 as the agent for combination with Afinitor. The Novartis-sponsored Evolve-3 Phase II study tested the sequencing of Sutent and Affinitor and failed to show non-inferiority in terms of PFS. This makes any further development of Afinitor as a front-line agent unlikely.

Proof of concept in animal model of melanoma

Separately, Bionomics’ joint venture with the Co-operative Research Centre for Cancer Therapeutics (CTx) reached a proof-of-concept milestone with CTx-0357927, a preclinical compound in an animal model of melanoma for inhibition of vascular growth receptor 3 (VEGFR3).

Valuation: A$0.72 per share

Our risk-adjusted net present value model for Bionomics’ clinical-stage R&D programmes, excluding cash, remains A$275m, which adding cash of $23m, yields an overall valuation of A$300m, equivalent to A$0.72/share. The risk-adjusted NPV can be expected to rise as products advance through development and justify higher probabilities of success. No value is currently attributed to Bionomics’ preclinical programmes, including BNC101 and BNC375, which represents upside to the investment case.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Bionomics Disrupting The Market In RCC

Published 06/30/2013, 05:15 AM

Updated 07/09/2023, 06:31 AM

Bionomics Disrupting The Market In RCC

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.