- Top forex event risk ahead warns of big US Dollar, Euro moves

- Euro breaks key resistance but fails to close above $1.38, shaping up for a big week

- The fact that the S&P 500 closed at fresh records leaves the Dollar at risk

It’s shaping up to be a big week for the US Dollar, particularly against the Euro, as traders bet on sharp price moves ahead of key forex economic event risk.

The Euro stands at pivotal price resistance versus the Greenback as the US currency tumbles, but EUR/USD failure at its multi-year closing high of $1.3800 sets the stage for a showdown.

Euro Tests but Fails to Close above Multi-Year Resistance

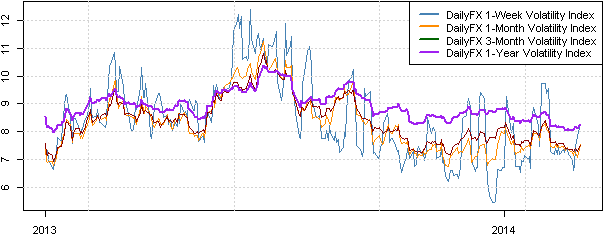

In fact the combination of a European Central Bank interest rate decision as well as the infamous US Nonfarm Payrolls report leaves short-term volatility prices at their highest levels in a month. Clearly the stage is set for sharp price moves, but how might we trade the week ahead?

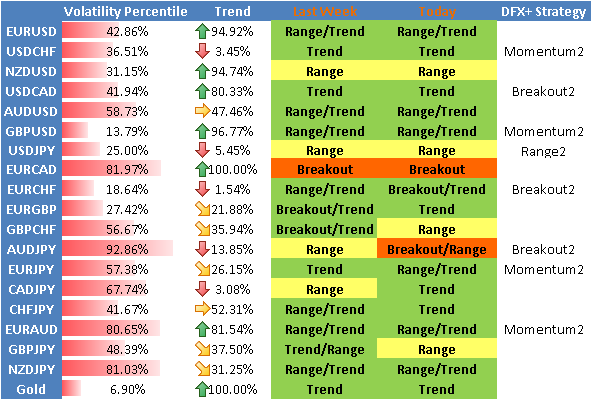

We’re keeping an especially close eye on Dollar and Euro pairs for trading opportunities. The table below highlights which trading strategies we think may do well in the days ahead.

Forex Volatility Prices Spike Ahead of Big Week for Euro and US Dollar

Source: OTC FX Options Prices from Bloomberg; DailyFX Calculations

DailyFX Individual Currency Pair Conditions and Trading Strategy Bias

--- Written by David Rodriguez, Quantitative Strategist for DailyFX.com