Performances of most of the banks that released their first-quarter 2018 results till now were decent. Driven by higher rates and modest improvement in loan balances, banks reported an increase in their net interest income. Also, given the rebound in trading activities during the quarter, trading revenues improved.

However, lower mortgage income and dismal investment banking performance adversely impacted overall fee income to some extent.

On the cost front, while the absence of considerable legal expenses since the last few quarters is encouraging, increased investments in technology to improve digital offerings might escalate costs moderately.

Per the latest Earnings Trends, overall earnings for the finance sector (of which banks are a major part) in the first quarter are projected to jump 26.3% year over year.

Let’s have a look at what can be expected from Bank of Hawaii Corporation (NYSE:BOH) , Zions Bancorporation (NASDAQ:ZION) , TCF Financial Corporation (NYSE:TCF) and Old National Bancorp (NASDAQ:ONB) , which are expected to report their quarterly results on Apr 23.

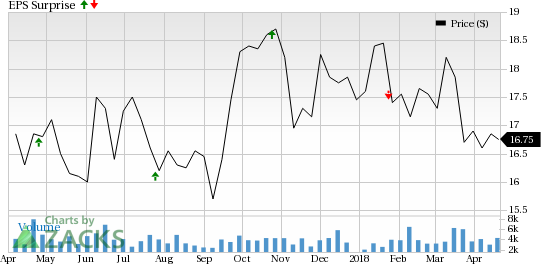

The earnings of Bank of Hawaii are projected to register year-over-year growth in first-quarter 2018. Its Zacks Consensus Estimate for earnings of $1.23 reflects an increase of 2.5% from the prior-year quarter.

However, the Zacks Consensus Estimate for sales is $160.91 million, which reflects a year-over-year decline of 2.9%.

Notably, according to our quantitative model, chances of Bank of Hawaii beating the Zacks Consensus Estimate in the first quarter are low. This is because it does not have the right combination of the two key ingredients — a positive Earnings ESP and a Zacks Rank #3 (Hold) or better — to increase the odds of an earnings beat.

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

The Earnings ESP of Bank of Hawaii is -0.90% and it carries a Zacks Rank #2 (Buy). While a strong Zacks Rank increases the predictive power of ESP, we also need a positive ESP to be confident of an earnings beat.

Given the modest improvement in lending, along with higher rates, Zions is expected to report an increase in net interest income in first-quarter results. While an increase in trading activities during the quarter are expected to positively impact fee income growth, muted growth in mortgage banking revenues might offset this impact to some extent.

The company’s Zacks Consensus Estimate for sales for the to-be-reported quarter is $666.1 million, which reflects a year-over-year improvement of 7.3%.

Also, the Zacks Consensus Estimate for earnings of 83 cents reflects a year-over-year improvement of 36.1%.

Zions currently carries a Zacks Rank #3. (Read more: Will Loan Growth & Fee Income Aid Zions’ Q1 Earnings?)

The Zacks Consensus Estimate for earnings of TCF Financial is 37 cents and it reflects a year-over-year improvement of 48%.

Also, its Zacks Consensus Estimate for sales of $349.39 million reflects year-over-year growth of 7.3%.

However, chances of the company beating earnings estimates in the first quarter are low. This is because it has an Earnings ESP of -2.17% and a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Also, chances of Old National Bancorp beating the Zacks Consensus Estimate in the to-be-reported quarter are low. This is because it has an Earnings ESP of -0.86% and a Zacks Rank #4 (Sell).

Nonetheless, its Zacks Consensus Estimate for earnings of 29 cents reflects a year-over-year improvement of 3.6%.

Also, the Zacks Consensus Estimate for sales of $170.43 million reflects year-over-year growth of 14.6%.

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Click for details >>

Old National Bancorp (ONB): Free Stock Analysis Report

Zions Bancorporation (ZION): Free Stock Analysis Report

Bank of Hawaii Corporation (BOH): Free Stock Analysis Report

TCF Financial Corporation (TCF): Free Stock Analysis Report

Original post

Zacks Investment Research