Over the last five trading days, performance of bank stocks was bearish as a number of issues, including fears of domestic and global economic slowdown, shook the markets. These resulted in negative investor sentiments, leading to a slide in banking stocks.

Notably, broader U.S stock markets witnessed a decline on Thursday, with finance stocks in the lead. All three major indexes — S&P 500, Dow Jones and NASDAQ — were down nearly 1% or more. This followed the European Central Bank’s (ECB) move of reversing its course and announcing a new economic stimulus plan for the region, after putting a brake on it last December. Additionally, the central bank slashed the Eurozone’s growth forecast for 2019 and 2020 to 1.1% and 1.6%, respectively, from the previous outlook of 1.7% for both the years.

Nevertheless, having witnessed improvements in the capital planning of major banks, the Federal Reserve has agreed to release the same from the “qualitative” portion of annual stress test regime from 2019 onward. Such easing of regulations, coupled with the corporate tax reform and rising interest rates, are likely to provide a boost to banks’ profitability.

Regarding company-specific news related to banks, restructuring and streamlining initiatives continued. In addition, resolution of probes and lawsuits related to legacy matters persisted.

(Read: Bank Stock Roundup for the Week Ending Jan 25, 2019)

Important Developments of the Week

1. After coming to the conclusion that the private-prison industry is very risky, JPMorgan Chase & Co. (NYSE:JPM) has decided to refrain from financing the industry. This move comes as part of the bank’s evaluation process of the different sectors it serves to understand costs and benefits related to each of them. The bank has decided to stop extending new financing to private operators of prisons and detention centers, and also wants to get rid of its existing credit exposure to the industry at the earliest. This change comes after increased scrutiny. (Read more: JPMorgan Abstains From Financing Private Prison Industry)

2. All the long-term and short-term ratings of Bank of America (NYSE:BAC) , and long-term ratings and assessments of BofA’s primary banking subsidiary, Bank of America, N.A. (BANA), have been upgraded by Moody's Investors Service, the rating arm of Moody's Corporation (NYSE:C) , concluding the review for upgrade, initiated in December 2018. However, the rating firm’s outlook for the bank has been affirmed at “stable”. (Read more: BofA's Ratings Upgraded by Moody's, Outlook Stable)

3. Fifth Third Bancorp (NASDAQ:FITB) , headquartered at Cincinnati, OH, received the Federal Reserve’s approval to complete the acquisition of Chicago, IL-based MB Financial, Inc. (NASDAQ:MBFI) . The deal was entered into in May 2018, per which the former had agreed to be merged with the latter, for a total value of $4.7 billion. (Read more: Fed Okays Fifth Third-MB Financial Merger)

4. U.S. investors have sued BofA and The Royal Bank of Scotland (NYSE:RBS) for their alleged involvement in forming a cartel, along with six other banks, to manipulate the Eurozone bond market. The proposed class-action lawsuit, accusing the banks of violating the federal antitrust laws, was filed in the U.S. District Court in New Haven, CT. The lawsuit follows the Jan 31, 2019 announcement of the European Commission’s probe alleging traders of colluding to acquire and trade sovereign bonds issued by Eurozone governments to mislead competition, between 2007 and 2012. (Read more: BofA, RBS (LON:RBS) Face Lawsuit Over Eurozone Bond Trade Rigging)

5. In a latest development to the Wells Fargo & Company’s (NYSE:WFC) fake account scandal, the bank has reached a $240-million settlement with the shareholders to resolve “shareholder derivative lawsuits”. However, the settlement still awaits a judge's approval. The lawsuit was filed against current and former directors and officers of Wells Fargo, charging them of failure to detect and prevent employees from creating millions of unauthorized customer accounts. Insurers for about 20 current and former Wells Fargo executives and directors, including CEO Tim Sloan and his predecessor John Stumpf, would pay the settlement amount to the bank. (Read more: Wells Fargo Executives Enter Settlement Over Fake Accounts)

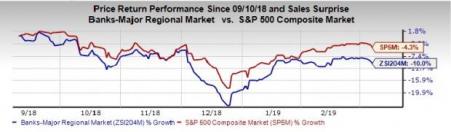

Price Performance

Here is how the seven major stocks performed:

Company | Last Week | 6 months |

JPM | -1.4% | -8.6% |

BAC | -2.6% | -6.5% |

WFC | -0.7% | -12.0% |

C | -4.0% | -9.9% |

COF | -3.5% | -16.6% |

USB | -2.0% | -5.1% |

PNC | -0.5% | -10.5% |

Over the last five trading sessions, Citigroup (NYSE:C) and Capital One Financial (NYSE:C) were the major losers, with their shares decreasing 4% and 3.5%, respectively. Moreover, shares of BofA have declined 2.6%.

In the past six months, shares of Capital One Financial and Wells Fargo have depreciated around 16.6% and 12%, respectively. Further, shares of PNC Financial (NYSE:PNC) have lost 10.5%.

What’s Next?

Over the next five trading days, performance of bank stocks will likely remain the same unless any unexpected event occurs.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2018, while the S&P 500 gained +15.8%, five of our screens returned +38.0%, +61.3%, +61.6%, +68.1%, and +98.3%.

This outperformance has not just been a recent phenomenon. From 2000 – 2018, while the S&P averaged +4.8% per year, our top strategies averaged up to +56.2% per year.

See their latest picks free >>

JPMorgan Chase & Co. (JPM): Free Stock Analysis Report

Fifth Third Bancorp (FITB): Free Stock Analysis Report

Bank of America Corporation (BAC): Free Stock Analysis Report

Wells Fargo & Company (WFC): Free Stock Analysis Report

The PNC Financial Services Group, Inc (PNC): Free Stock Analysis Report

Citigroup Inc. (C): Free Stock Analysis Report

Moody's Corporation (MCO): Free Stock Analysis Report

Royal Bank Scotland PLC (The) (RBS): Free Stock Analysis Report

MB Financial Inc. (MBFI): Free Stock Analysis Report

Capital One Financial Corporation (NYSE:COF): Free Stock Analysis Report

Original post

Zacks Investment Research