In Q113, the key profit driver for Banca IFS (IF) has been the government bond portfolio, which contributed €32.4m (Q112: €26.9m). There was a good underlying performance from the core business, where SME trade receivables income rose 29%. IFIS has adopted a more aggressive management of non-performing loans (NPLs) leading to higher-than-expected impairments in Q113. The direction of the results was flagged in the AGM statement on 30 April and we do not expect a material reaction to them.

Bond portfolio

The bond portfolio delivered profits of €32.4m in Q113, with a further c €4.5m taken directly to equity increasing in valuation reserves. With most bonds accounted for on a held-to-maturity basis, volatility in market prices is significantly neutralised (unrealised net gains €14.7m vs €74.5m at end-2012). Given that market movements since end-March have been driven by greater political confidence, the current unrealised gain is around €90m, well above end-Q113 and end-2012 levels.

The size of the portfolio has only been increased modestly to €7.5bn (year-end €7.2bn) and we believe any further increases from here will be small. The bonds continue to be funded through the repos market at a cost of 20-25bp.

Core business

Market concerns over the enactment of the EU Late Payments Directive have yet to materialise. Core business loans increased by 5%, and turnover by 8%. Customer numbers rose by 19%, as IFIS targeted smaller customers to maintain margins. The group continues to expand the NPL business, buying €130m notional value loans at around 3c in the euro. Income in the NPL division increased 35.5%, and in trade receivables by 28.8%.

Valuation: Some upside

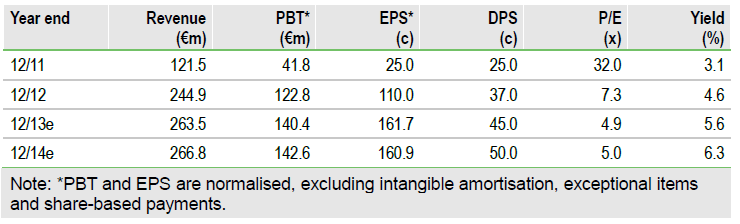

Our earnings forecasts are largely unchanged, although the further gains in equity from the bond portfolio increase our Gordon’s growth model from €9.7 to €9.75.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Banca IFIS: Government Bond Portfolio Profits Continue

Published 05/10/2013, 06:19 AM

Updated 07/09/2023, 06:31 AM

Banca IFIS: Government Bond Portfolio Profits Continue

Government bond portfolio profits continue

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.