If the past few weeks are any indication of what’s ahead, we’d better buckle up for a volatile 2022.

Which means we should invest in the relative calm provided by monthly dividend stocks before the mainstream crowd starts looking this way. After all, what’s more soothing than thousands of dividend dollars paid every single month?

Monthly dividends are great because they line up with our expenses. Most blue-chip income stocks pay quarterly—not enough! These “lumpy” payouts result in equally lumpy retirement income. For instance, we might have a big January, but that’s followed by an OK February and a lean March where that check alone wouldn’t come close to covering the bills.

We could do what some investors do and build a “dividend calendar” in which you hold just the right number of specific companies’ shares so your monthly dividends even out. But if just one of those stocks cuts their distribution, your payment schedule will be knocked out of balance.

That’s where monthly dividend stocks come into play.

Only a tiny fraction of publicly traded stocks and funds deliver monthly income. But while these hidden gems aren’t exactly easy to find, they are out there, and some of them are backed by dependable businesses and savvy managers.

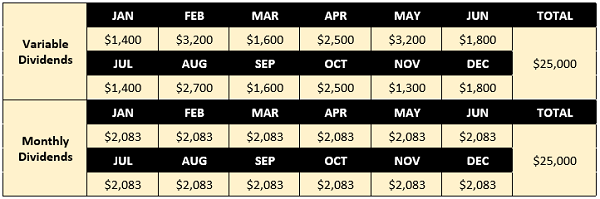

The table below illustrates two portfolios. Both pay roughly 5% each year on a $500,000 nest egg. Up top? A dividend portfolio made up of “normal” stocks—some quarterly yielders, but also some stocks with semiannual and annual payouts. Below that is a dividend portfolio made up of nothing but high-yielding monthly dividend stocks.

Both deliver the same $25,000 each year. But isn’t it clear which schedule we’d prefer?

My only issue with the monthly rows above is that my spending rates exceed $25,000 per year. (My wife will quickly verify this.) Which is why we’re going to focus on monthly payers that dish even more—up to 6.3%.

AllianceBernstein National Municipal Income Fund

Dividend Yield: 4.4%

We’ll get to a few traditional companies in a moment, but first, let’s discuss closed-end funds (CEFs).

If you’re not familiar, CEFs are similar to mutual funds and exchange-traded funds (ETFs) in that they bundle dozens or hundreds of stocks or bonds or other assets into an easily traded vehicle. But they have a few differences. Because they trade with a limited number of shares, they can trade at significant premiums or discounts to the value of the assets they hold; they can use debt leverage to amplify returns and income payments; and from time to time, they can even use options trading and other tactics to squeeze even more juice from the orange.

AllianceBernstein National Municipal Income Fund (NYSE:AFB) provides a great example of at least a couple of these traits.

As the name suggests, AFB is a municipal-bond fund that invests in various tax-free debt across the country. Management actively assesses risk—when markets are favorable, AllianceBernstein’s managers will seek out extra income, but when times warrant caution, they’ll be less aggressive.

As is the case with most national munibond funds, AFB’s 181 holdings are most heavily concentrated in California (12%), New York (11%) and Illinois (11%), with single-digit holdings across a bevy of other states.

Unlike a muni mutual fund or ETF, however, AFB “doubles down” on its bets with a hefty 37% in debt leverage—effectively putting 37% more money to work in its various holdings. That largely helps explain the CEF’s excellent 4.4% yield.

And if 4.4% doesn’t sound like very much to you, remember: These are municipal bonds, which are at a bare minimum exempt from federal income tax. For those in the highest tax bracket, that translates into a nearly 7% “tax-equivalent” yield, meaning a regular stock or fund would have to yield 7% to produce the same amount of after-tax income.

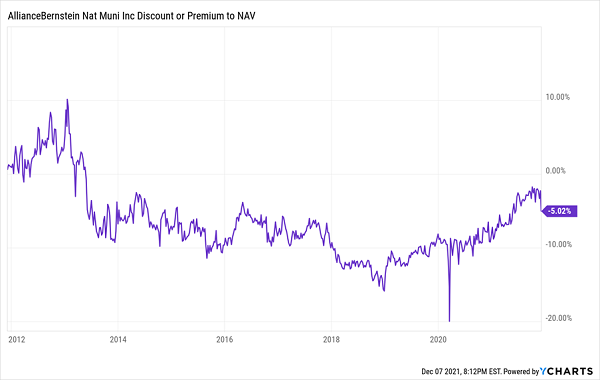

You can get all this at 95 cents on the dollar at the moment, as AFB currently trades at a 5% discount to its net asset value (NAV). It’s a decent deal, but understand that over the past five years, this CEF has traded at an average discount of closer to 9%.

Patient Bargain Hunters Can Do Well With This CEF

Realty Income

Dividend Yield: 4.4%

The only reason Realty Income Corp (NYSE:O) isn’t uttered in the same breath as the likes of Coca-Cola (NYSE:KO) and Procter & Gamble (NYSE:PG) is because it isn’t a household brand—as a real estate investment trust (REIT), it’s just a faceless landlord.

But otherwise, Realty Income is every bit as much a blue-chip operator, and it’s an unquestionable payout powerhouse. It shares the title Dividend Aristocrat with KO and PG, boasting not just 27 consecutive annual hikes to its monthly distribution, but 113 dividend raises (and counting!) since the company went public in 1994.

Realty Income is one of the largest REITs in the world, owning 7,000 predominantly single-tenant properties across all 50 states, Puerto Rico, the U.K. and Spain. And while retailers such as 7-Eleven and Walgreens Boots Alliance (NASDAQ:WBA) are its primary tenants, Realty Income leases out to companies in 60 different industries, from aerospace to electric utilities.

What makes Realty Income so attractive is its status as a “triple-net lease” REIT, which means its lease agreements are “net” of insurance, maintenance and taxes. Tenants take care of those. All Realty Income does is collects the rent. As a result, this REIT produces a stable and predictable profit stream that has allowed it to safely bill itself as “the Monthly Dividend Company.”

If there’s a knock on O shares, it’s that you can’t really expect much growth. Long-term profit-growth estimates are in the low single digits, which is no surprise, given the state of bricks and mortar. That means Realty Income is only good as a value play, and at 19 times forward-looking funds from operations (FFO, a measure of REIT profitability), it’s certainly not a screaming value at the moment.

Agree Realty

Dividend Yield: 4.0%

Agree Realty Corporation (NYSE:ADC) is a similar player. It too is a triple net-lease retail REIT, this one with 1,338 properties in 47 states. Most of its properties are freestanding, single-tenant pieces of real estate, and retail is its major industry, with Costco (NASDAQ:COST), Best Buy (NYSE:BBY) and Tractor Supply (NASDAQ:TSCO) among its tenants.

Also like Realty Income, you’re not buying breakneck growth here. The company has been acquisitive of late—including $340 million or so in purchases over the last quarter alone—but ultimately, ADC is collecting rent checks from retailers. It’s even conservative compared to its peers, with management previously having communicated leverage goals of 4x to 5x.

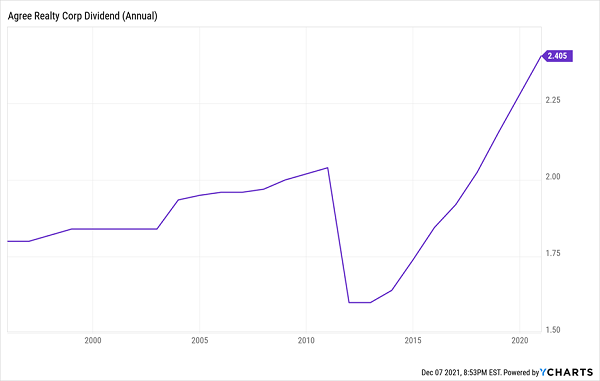

Agree hasn’t been as prolific a dividend grower since its IPO—yes, also in 1994—and even had to cut its payout by 22% in the wake of the Great Recession. But over the past few years, it has taken to increasing its payout multiple times a year. And in 2021, it switched from a quarterly payout schedule to a monthly one, presumably to better suit the needs of shareholders.

Just note its last similarity to Realty Income: At 21 times FFO estimates, ADC is also overpriced right now.

ADC: Not a Sterling Dividend Reputation, But It’s Rehabilitating

Whitestone REIT

Dividend Yield: 4.4%

Speaking of dividend rehabilitation, Whitestone REIT (NYSE:WSR) is on its own comeback path, slowly trying to repair its payout following a deep 63% cut announced a few months into the COVID pandemic.

Whitestone REIT owns, manages, develops and redevelops high-quality neighborhood, community and lifestyle retail centers. Its 59 properties are strategically placed in fast-growing, high-house-hold income markets, predominantly in the Sun Belt—cities such as Phoenix, Dallas and Fort Worth.

There’s a touch of irony to WSR’s woes. The REIT boasts that its properties are “e-commerce resistant,” yet the company lurched during the pandemic while e-commerce thrived. Shares lost more than 60% of their value, and again, management was forced to take a chainsaw to Whitestone’s dividend plan.

More positively, the company is just about fully recovered. Bad debt is back at pre-COVID levels, as are rent collections. The dividend is back on the rise, too, though it’s not in any hurry—Whitestone announced a 2.3% hike to 3.58 cents per share earlier this year, still miles away from its early 2020 distribution around 9.5 cents.

One thing that’s eating at shareholders (and that should give us pause), however, is a recent share issuance that was so big, it actually caused analysts to lower their earnings targets for WSR. Whitestone issued roughly 3 million shares, growing its float by about 7% to 46.3 million shares. Monthly dividends might be shareholder-friendly, but dilution like that isn’t.

EPR Properties

Dividend Yield: 6.3%

Another REIT trying to patch things up with income investors is EPR Properties (NYSE:EPR), which looks much more appealing now that the worst of the pandemic might indeed be behind us.

EPR Properties is a REIT, but it’s nothing like Realty Income and Agree Realty. Instead of convenience stores and grocery stores, it’s “experiential.” EPR’s 358 properties, covering 44 states and Canada, include theaters, ski resorts, water parks, TopGolf centers … even a few museums and private schools.

While EPR has always had its ups and downs, it at least seemed positioned in the right business for most of the past decade. “Things” were out. “Experiences” were in. And EPR deals in experiences.

But when COVID pulled the rug out from underneath the economy, EPR fell harder than most. Shares lost more than three-quarters of their value, and EPR didn’t just cut its dividend—it suspended it outright.

The good news? Now that the economy has largely reopened, business is back, the stock is in recovery (but nowhere near its pre-COVID prices), and the monthly dividend has returned—albeit, at 25 cents per share, it’s still 35% lower than where it was before. But at current prices, that’s still good for a fat 6%-plus yield.

EPR is also making a few tactical moves, including shifting away from theaters and education and doubling down on its remaining segments. But this REIT will remain an ultra-cyclical play that’s dependent on economic growth—great in boom times, but a possible liability for investors that need reliable income in any market.

TDisclosure: Brett Owens and Michael Foster are contrarian income investors who look for undervalued stocks/funds across the U.S. markets. Click here to learn how to profit from their strategies in the latest report, "7 Great Dividend Growth Stocks for a Secure Retirement."