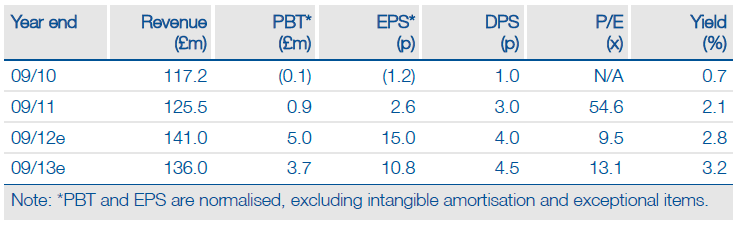

Good interim results underpin our expectation of very strong profits growth in FY12. Avesco is a major beneficiary of the Olympics but also of a more general trend to live events, internationally. The departing CEO has presided over a successful period of growth and we believe that Avesco is in good shape to deliver sustained profitability, with the potential 2013 Disney payout (worth up to 140p) an added attraction.

Interim results showed like-for-like revenue up 12% and normalised PBT of £1.4m (FY11: loss of £0.3m). Creative Technology performed strongly and Full Service benefited from the prior year restructuring. Our full year estimates are unchanged, with H2 benefiting from major events in the UK: the Diamond Jubilee (Avesco provided the giant screens in Trafalgar Square and St James’s Park), Euro 2012 and the Olympics.

The announcement was accompanied by news that CEO Ian Martin is leaving after a successful 10 years at the helm. He has presided over a decade of organic growth and international expansion, albeit with ups and downs in profitability in what is inherently a cyclical business. The head of CT Europe (David Crump) has been promoted to the board (after 25 years with the group), a new non-exec appointed (Carmit Hoomash) and a decision about a new CEO will be made in due course.

Management’s confidence in the future is reflected in the introduction of a 1.0p interim dividend. FY13 will be a quieter ‘odd’ year, reflected in our revenue estimate, but the risk to profit estimates is probably on the upside as underlying margins are improving. The verdict on the Disney/Celador case is still expected in 2013. We will release a full Outlook report shortly. After drifting back slightly in the last few months the shares stand below the 146p NAV and an 8.7x FY12e EV/EBIT multiple is undemanding, even before the hoped-for US$60m Disney windfall (worth 140p per share).

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Avesco Results And Board Change

Published 06/14/2012, 11:10 AM

Updated 07/09/2023, 06:31 AM

Avesco Results And Board Change

A Busy Summer

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.