On Jul 5, we issued an updated research report on AutoZone, Inc. (NYSE:AZO) .

The company is one of the leading specialty retailers and distributor of automotive replacement parts and accessories in the United States. It operates in the Do-It-Yourself (“DIY”) retail, Do-It-for-Me (“DIFM”) auto parts and products markets.

AutoZone’s net sales are positively impacted by the growing market presence of its DIY retail and commercial businesses. In third-quarter fiscal 2019, the company’s commercial business opened 43 net new programs, thereby improving market share and offering optimistic view for the fourth quarter of 2019. It expects revenue growth to continue for the rest of fiscal 2019, aided by fast deliveries, high-quality products and store merchandising.

Further, the company is focusing on expanding its favorably located core business and developing its supply-chain network. This will enable it to offer products at the local level, where customer demand is immediate.

However, high capital and operating expenses are concerning for the company. It expects capital and operating expenses to rise over the next few years on opening of distribution centers, mega hubs and stores; technology investments; and accelerated wage pressure.

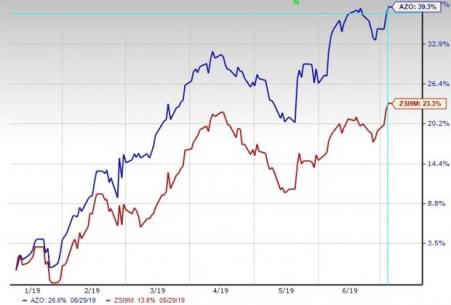

In the past six months, shares of AutoZone have outperformed the industry it belongs to. Shares of the company rallied 39.3% compared with the industry’s growth of 23.3%.

Zacks Rank & Other Key Picks

AutoZone currently carries a Zacks Rank #2 (Buy).

A few other top-ranked stocks in the auto space are PACCAR Inc (NASDAQ:PCAR) , CarMax, Inc. (NYSE:KMX) and Ford Motor Company (NYSE:F) , each currently carrying a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

PACCAR has an expected long-term growth rate of 8.4%. In the past six months, shares of the company have gained 18.6%.

CarMax has an expected long-term growth rate of 12.6%. In the past six months, shares of the company have rallied 36.3%.

Ford has an expected long-term growth rate of 7.3%. In the past six months, shares of the company have risen 21.8%.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

CarMax, Inc. (KMX): Free Stock Analysis Report

PACCAR Inc. (PCAR): Free Stock Analysis Report

Ford Motor Company (F): Free Stock Analysis Report

AutoZone, Inc. (AZO): Free Stock Analysis Report

Original post

Zacks Investment Research