AUD/NZD is looking very bullish in my view, and I think it will break to a new high above 2020’s peak in the coming weeks. So, here is one way to take advantage of the potential rally.

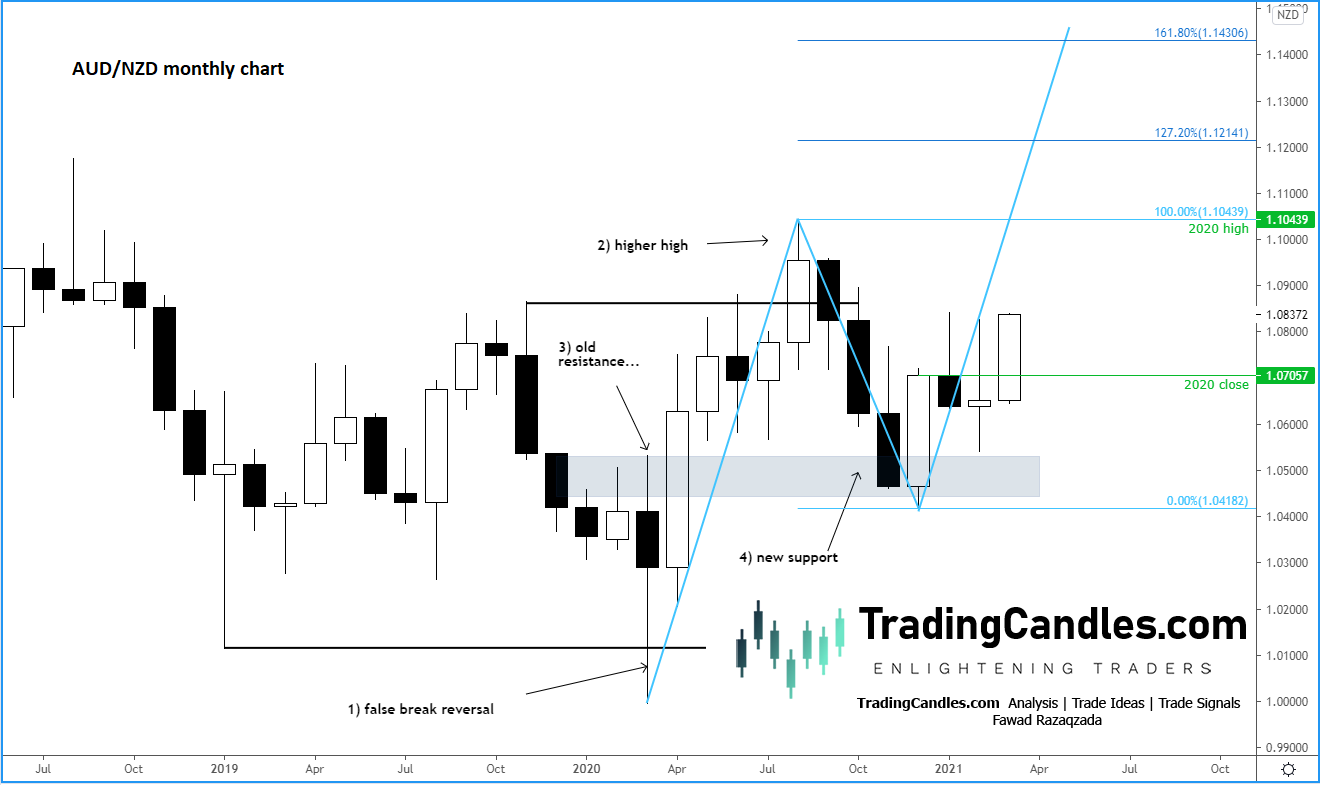

Before I share my long idea, let’s take a look at the monthly chart, below, which shows the AUD/NZD is in the process of potentially staging a sharp breakout:

As per the monthly chart,

- The AUD/NZD formed a false break reversal pattern at the height of the pandemic, when it momentarily broke below the prior swing low at 1.0115, before bouncing strongly

- It then created a higher high above 1.0865 in June, thus ending the long-term series of lower lows and lower highs

- The old resistance (shaded area) turned into strong support at the back end of last year

- The rally that started in December, paused for two months, before resuming higher in March this year

So, it looks like the AUD/NZD is about to break out to the upside in the coming weeks. To take advantage of this, you will need to zoom into your lower time frame charts.

Below, I have provided you a free trade idea on the AUD/NZD, with the entry details on the chart. Please note that this is just a trade idea and not financial advice, as it merely reflects my own opinion. This is the sort of setups I provide for my private group as well.

This trade idea is derived from the monthly chart above, but the trigger is based on the daily chart breaking out of triangle. Hence, the invalidation of this setup is if price were to go back below the most recent low made prior to the breakout. There are two targets, although price does not have to get to those levels for you to profit. But the first targets is the psychotically-important 1.10 handle, while the second target is based on the 127.2% Fib extension, which is a more objective target than the former.