In the last 24 hours, the AUD/USD has been able to halt the decline a little and rally back towards 95 cents after find some support around 94 cents. Over the last couple of weeks it has shown some positive signs of rallying higher breaking back through to 0.9850 and then towards 0.9800 in the last week, however it has been all too little too late falling to as low as 0.9326 in the last day. It has now moved through the bottom of the recent trading range and to a new 20 month low near 0.9300. During the last few weeks the Australian dollar established and traded within a range between two key levels at 0.9550 and 0.97, which was able to halt the strong decline it experienced through May. A few weeks ago the 0.97 level provided some support and in recent weeks has provided stiff resistance to any rally efforts, which is why it was significant that the AUD/USD broke through that level a week ago, despite its recent reversal. It had attempted on a few occasions to rally however the Australian dollar had run into a brick wall of resistance at this level.

About a month ago the AUD/USD experienced its worst week in a long time which saw it continue to move to new lows near 0.98, from highs not so long ago above 1.0250, although it did settle a little and find some support at the long term support level at 97 cents. Although presently appearing unlikely in the short term, should it recover and move back, it is likely the 1.00 level may now provide some resistance to higher prices, as well as the 0.97 level and around 0.9800. The AUD/USD has now experienced an ordinary last month as it wasn’t so long ago it was moving up above 1.03 and threatening the key level at 1.0360, and before that it was approaching 1.06. Up until earlier in May, the 1.02 level was one of significance and presented as a long term support level however this has now clearly been broken. It had been showing some bearish as it continued to place selling pressure on the 1.0220 and 1.02 levels and the RBA rate cut last month was the catalyst for a strong push lower, seeing it just fall very heavily as if all support gave way.

The last couple of months have seen the AUD/USD establish a strong medium term down trend with lower peaks and lower troughs, as it has moved from near 1.06 down to below 0.94 in that time. In doing so, it has completely ignored any likely support at either 1.04 or 1.0360, and more recently the long term support level at 0.97. Up until mid April, the Australian dollar was enjoying its best move higher since October and November last year. Up until a month ago, the AUD/USD spent the best part of a month trading between the two key levels of 1.0220 and 1.0360 and it will take some effort to return it to this range, with the resistance being offered at the 1.02 level and now likely at 1 too.

In economic news, Australian Home Loans and NAB Business Confidence did not impress the markets. About the only sure-proof method of stemming the Australian dollar’s slide is to close the financial markets. This worked on Monday, as a holiday in Australia resulted in thin trading and little movement by the Australian dollar. However, the markets were back in action on Tuesday, and the Aussie resumed its downward journey. The struggling currency has now dropped to its lowest levels since September 2010. Tuesday’s Australian releases did not look sharp. Home Loans posted a gain of just 0.8%, much weaker than the 5.2% in the previous release. The estimate stood at 2.1%. NAB Business Confidence was also a disappointment, registering its second straight reading below zero, which indicates worsening conditions.

AUD/USD June 12 at 03:10 GMT 0.9475 H: 0.9497 L: 0.9326

During the early hours of the Asian trading session on Wednesday, the AUD/USD is continuing to rally higher and move towards 95 cents. The Australian dollar continues it free-fall, as the currency has lost almost nine cents since the beginning of May. In moving through to 1.0580 only a couple of months ago, it moved to its highest level since January. Current range: trading just below 0.9500 around 0.9480.

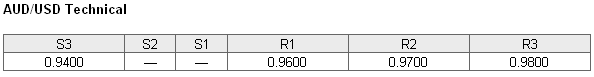

Further levels in both directions:

• Below: 0.9400

• Above: 0.9500, 0.9700 and 0.9800

(Shows the ratio of long vs. short positions held for the AUD/USD among all OANDA clients. The left percentage (blue) shows long positions; the right percentage (orange) shows short positions.)

The long position ratio for the AUD/USD has moved back below 75% as the Australian dollar has rallied a little back towards 95 cents. The trader sentiment remains strongly in favour of long positions.

Economic Releases

- 00:30 AU Westpac Consumer Confidence (Jun)

- 05:00 JP BoJ’s Monthly Economic Report for June

- 08:30 UK Average Earnings (incl. bonus) (Apr)

- 08:30 UK Claimant Count Change (May)

- 08:30 UK Claimant Count Rate (May)

- 08:30 UK ILO Unemployment Rate (Apr)

- 09:00 EU Industrial production (Apr)

- 12:15 CA Housing starts (May)

- 18:00 US Budget (May)