The AUD/USD has returned to a level that was providing it support only a couple of weeks ago in 97 cents. Over the last few days, as the Australian dollar has rallied, it has run into a brick wall of resistance at this level which has temporarily halted its rally. It had spent the best part of the last week not moving a lot and remaining within a range between 0.96 and 0.97. The last couple of days have also seen support kick in at 0.9550 which has halted the strong fall. Last week it enjoyed a relatively solid few days which saw it halt the falls and rally back up towards 0.9850 before a sharp which saw it drop two cents. The week prior it experienced its worst week in a long time which saw it continue to move to new lows near 0.98, from highs not so long ago above 1.0250, although last week it did settle a little and find some support at the long term support level at 97 cents.

Although presently appearing unlikely in the short term, should it recover and move back, it is likely the 1.00 level may now provide some resistance to higher prices. The AUD/USD has now experienced an ordinary last few weeks as it wasn’t so long ago it was moving up above 1.03 and threatening the key level at 1.0360. Up until earlier in May, the 1.02 level was one of significance and presented as a long term support level however this has now clearly been broken. It had been showing some bearish as it continued to place selling pressure on the 1.0220 and 1.02 levels and the RBA rate cut a few weeks ago was the catalyst for a strong push lower, seeing it just fall very heavily as if all support gave way. The last month or so have seen the AUD/USD establish a strong medium term down trend with lower peaks and lower troughs, as it has moved from near 1.06 down to below 0.96 in that time.

Over the course of the last month, the Australian dollar has fallen very sharply from near 1.06 to its lows near 0.9500, and in doing so, it also completely ignored any likely support at either 1.04 or 1.0360. In contrast, the week prior, it enjoyed a solid week moving strongly off the key level of 1.0360 towards 1.06 and to its highest levels since January. Up until mid April, the Australian dollar was enjoying its best move higher since October and November last year. Up until a few weeks ago, the AUD/USD spent the best part of a month trading between the two key levels of 1.0220 and 1.0360 and it will take some effort to return it to this range, with the resistance being offered at the 1.02 level and now likely at 1 too.

In economic news, key Australian data was mixed, as Building Approvals sparkled, while Private Capital Expenditure recorded a sharp drop. The Aussie will want to delete the month of May and move on, as the currency has plunged more than seven cents against the US dollar this month. The greenback has taken advantage of the RBA interest rate cut, lukewarm Australian data and the government’s budget which pointed to the high value of the Australian dollar as an impediment to economic growth. These factors have resulted in nervous investors shifting their funds to US assets, resulting in the Aussie plunging in value. On Thursday, Building Approvals jumped to 9.1%, blowing past the estimate of 4.1%. However, Private Capital Expenditure posted its sharpest drop in four years, declining by -4.7%. The estimate stood at 0.7%.

AUD/USD May 31 at 01:15 GMT 0.9673 H: 0.9697 L: 0.9583

During the early hours of the Asian trading session on Friday, the AUD/USD is continuing to trade within a narrow range right around 0.9670, after surged higher from new one year lows near 0.9500 over the last couple of days. A month ago the AUD/USD was spending a fair amount of time trading roughly between 1.02 and 1.0550, however that range seems a distant memory as it has fallen down to near a 12 month low below 0.9600 late last week. In moving through to 1.0580 only a month ago, it moved to its highest level since January. Current range: trading right around 0.9670.

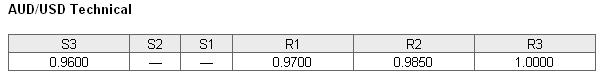

Further levels in both directions:

• Below: 0.9600.

• Above: 0.9700, 0.9850 and 1.0000.

(Shows the ratio of long vs. short positions held for the AUD/USD among all OANDA clients. The left percentage (blue) shows long positions; the right percentage (orange) shows short positions.)

The long position ratio for the AUD/USD has moved back above 70% after recent highs of over 75% as the Australian dollar has rallied a little back towards 97 cents. The trader sentiment remains strongly in favour of long positions.

Economic Releases

- 01:00 NZ NBNZ Business Confidence (May)

- 01:30 AU Private Sector Credit (Apr)

- 05:00 JP Housing Starts (Apr)

- 05:00 JP Construction Orders (Apr)

- 07:00 CH KOF leading indicator (May)

- 08:30 UK BoE – Mortgage Approvals (Apr)

- 08:30 UK BoE – Net Consumer Credit (Apr)

- 08:30 UK BoE – Secured Lending (Apr)

- 08:30 UK M4 Money Supply (Apr)

- 08:30 UK BSA Mortgage Statistics (Mar)

- 09:00 EU HICP (Flash) (May)

- 09:00 EU Unemployment (Apr)

- 12:30 CA GDP (Q1)

- 12:30 CA GDP (Mar)

- 12:30 US Core PCE Price Index (Apr)

- 12:30 US Personal income & spending (Apr)

- 13:55 US Univ of Mich Sent. (Final) (May)