More to the point, today’s employment data reduced the odds of RBA cutting in February. For now.

Considering there were some itchy trigger fingers from the bear camp today, in hope of a weak print to confirm a February rate cut, today’s employment figures were annoyingly good. Not great, but in context for a bearish move, annoying.

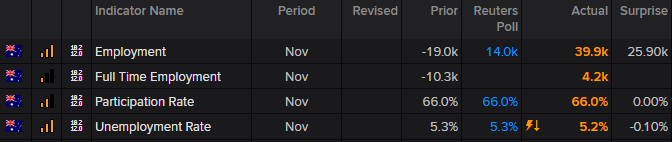

The lower unemployment rate and higher job creation is the icing on the cake, although it loses a mark for having last month’s job creation revised into negative territory. Still, the Aussie bounced across the board and AUD/JPY is today’s biggest gainer.

Yet there’s still a long way to go before we can be confident RBA won’t cut rates, with another round of employment data and inflation (among many others) to go. For that reason, we still see limited upside on the Aussie from this employment set alone.

Earlier in the session, New Zealand’s GDP figures beat estimates with ‘robust retail figures’ leading the way. This saw AUD/NZD break to fresh lows before Australian employment took it back within range.

We retain our core bearish view on AUD/NZD as outlined yesterday, although today’s data sees it remain within a holding pattern. The failed spike lower lays the potential for a bear-trap, yet whilst prices remain below 1.0500 we anticipate a break lower.

AUD/JPY shows the potential to bounce a little high, although the size of any bounce is likely dependant upon risk appetite overall. 74.85 has been respected as support (prior resistance) and the 50-period eMA also acted as springboard for today’s employment set. The 50, 100 and 200-period eMA’s are in bullish sequence and pointing higher, and price action from the highs is reminiscent of a bullish wedge correction pattern.