During the last few months I have not written anything about the Australian stock market since there didn’t really seem to be much to write about. As I mentioned at the start of the year, I was not optimistic about the outlook for the S&P/ASX 200 range of stocks and I haven’t even bothered to make a prediction where the S&P/ASX 200 Index might finish in 2018. As usual many in the mainstream finance media and assorted podcasters got very excited when the ASX 200 moved past 6,000 recently. But as sure and night follows day it’s back below that level once again.

That’s hardly a surprise considering that the banking royal commission has savaged stocks in the financial sector and the downturn in the property market is putting the brakes on property trusts and the real estate sector. Thankfully the resources sector for now is providing some support for the ASX 200, but if that rolls over as well then it could easily fall to around the 5,500 level. On the positive side though, the Crude Oil ETF (BetaShares Crude Oil Currency Hedged (AX:OOO)) I mentioned in June has kept creeping upwards and even Telstra (ASX:TLS) has posted a small gain since then. (see Oil, Telstra, Macquarie & the ASX 200)

As it stands now the Australian stock market has given up all the gains for this year and the ASX 200 is close to a 52 week low as we can see on the chart below.

The recent market pull-back has caused the XJO to fall quite sharply and it wouldn’t be unusual if we went through a period for a few weeks of mini- recoveries and further falls. This might provide some good opportunities for short term traders but as a longer term investor I don’t see too many reasons to be a buyer, unless there’s a stock that appears to have been oversold. If we step back now and look at a 5 year chart of the ASX things look a little better. But just a little.

S&P/ASX 200 Index (XJO) 5 Year Chart

Around mid 2015 the ASX was nudging near 6,000 so basically 3 years later it’s back to the same level. Some pundits pushing stock market newsletters might be keen to talk the market up but as far as I can tell not a lot is happening. When the Australian stock market rallies, the finance media starts running stories as if a massive bull market is unfolding and then the market falls back again and the cycle repeats. It’s true the market is higher than the GFC low, but after 10 years the ASX 200 & All Ords have still not reached their pre-GFC highs.

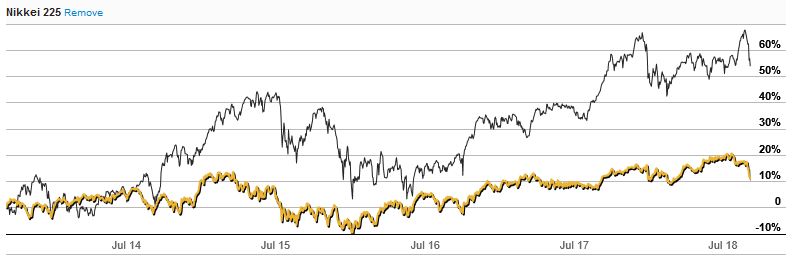

To put things in perspective let’s look at the ASX 200 versus the Nikkei 225 Index (Japan).

S&P/ASX 200 Index versus Nikkei 225 Index 5 Year Chart

Certainly Japan’s Nikkei 225 has had its ups and downs but the reality is that over the last 5 years it has generally outperformed the ASX 200. Though you might not get that impression from the media coverage in Australia about Japan, and that’s a good reason not to rely on Australian based coverage of most if not all overseas markets. It’s also a good reason to think about adding some international exposure to your investment portfolio or reviewing your holdings if you do, because it’s hard to imagine that the Australian stock market is going to be a star performer over the next few years.

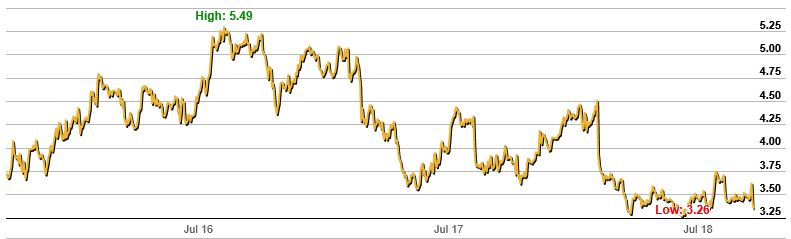

Lastly there’s been a bit of news about Harvey Norman Holdings Ltd (AX:HVN) and from what I’ve read Gerry Harvey isn’t that worried about online competition from companies like Amazon (NASDAQ:AMZN). Gerry certainly knows his business, but I think he might be underestimating how quickly the ground might be shifting under his feet. In any case when I look at a chart of the HVN stock price I’m not that inclined to buy into his confidence.

Harvey Norman Holdings Ltd (ASX:HVN) 3 Year Stock Price Chart

The next few weeks could be a bumpy ride so I’ll come back and review things in a few weeks time.