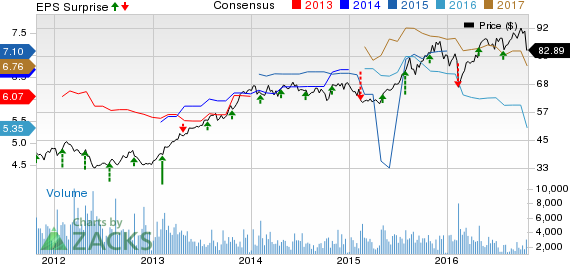

Assurant, Inc. (NYSE:AIZ) reported third-quarter 2016 net operating income of $1.00 per share that missed the Zacks Consensus Estimate by 12.3%. Moreover, the bottom line plunged 34.6% from $1.53 per share earned in the year-ago quarter. Higher reportable catastrophe losses, ongoing normalization of lender-placed insurance business, and declines in mobile and legacy extended service contracts and credit insurance led to the year-over-year deterioration. However, lower Corporate net operating loss partially offset the downside.

Total revenue plunged 33.2% year over year to $1.68 billion due to lower premiums earned and a decline in net investment income. However, it surpassed the Zacks Consensus Estimate of $1.64 billion by 2.7%.

Net investment income, excluding Assurant Health runoff operations, declined 16.1% year over year to $124.8 million.

Total benefits, losses and expenses decreased 37.1% to $1.6 billion mainly due to a significant decline in policyholder benefits and selling, underwriting, general and administrative expenses.

Segmental Performance

Net earned premiums, fees and others at Assurant Solutions inched up 3.3% year over year to $971 million on increase in mobile subscribers as well as vehicle protection contracts. However, the effect of foreign exchange volatility as well as decline in legacy retail clients and credit insurance partially offset the improvement.

Net operating income declined 18.5% year over year to $42.7 million. Lower contributions from mobile, legacy extended service contracts and credit insurance led to the downside.

Net earned premiums, fees and others at Assurant Specialty Property declined 3.1% year over year to $579.1 million. The deterioration was primarily attributable to the ongoing normalization of lender-placed insurance business. Growth in mortgage solutions, which includes fee income from the recently acquired title and valuation business, and multi-family housing businesses partially offset the downside.

Net operating income of $44.6 million plunged 48.9% year over year. The downside was attributable to higher weather-related claims and the ongoing normalization of the lender-placed insurance business.

Financial Position

Assurant’s financial position remains strong with around $875 million in corporate capital as of Sep 30, 2016. Total assets dipped 0.8% year over year and amounted to $30.3 billion as of Sep 30, 2016.

Share Repurchase and Dividends Update

The company’s total share buybacks and dividends amounted to $266 million in the third quarter. Also, Assurant bought back around 2.7 million shares worth $236 million over the same period. From Oct 1, 2016, through Oct 21, 2016, the company spent about $66 million to repurchase an additional 0.7 million shares and has $199 million remaining in the current repurchase authorization. Moreover, the company paid dividends worth $30 million to its shareholders.

Business Update

In the third quarter, Assurant completed the previously announced acquisition of a title and valuation business. In addition, the company invested an amount of $11 million for the capabilities in targeted growth areas.

2016 Outlook

The company expects Assurant Solutions to witness a modest decline in its operating income from the level in 2015. Growth registered from new and existing mobile programs in 2016 is not anticipated to offset the declines in legacy extended service contract, credit insurance and the loss of the tablet program. Nonetheless, the company expects net earned premiums, and fees to increase owing to growth in mobile subscribers and vehicle service contracts. However, lower service contract revenues from legacy North American retail clients as well as continued declines in credit insurance are likely to adversely impact results.

Assurant Specialty Property’s net earned premiums and net operating income are likely to decline due to the ongoing normalization of lender-placed insurance business. However, increased efficiencies and expense-saving initiatives will somewhat mitigate the deterioration. The company envisions expansion in multi-family housing and mortgage solutions businesses through gain in market shares. However, overall results are likely to be affected by catastrophe losses, including claims from Hurricane Matthew.

Assurant Health is anticipated to substantially complete the process to fully exit the health insurance market in 2016. During the remainder of the period before exit, the company is likely to incur $13–$20 million pre-tax of extra exit-related charges and overhead expenses, which had been excluded from the premium deficiency reserve calculation. Dividends from this segment are expected to be around $475 million for the full year, of which $338 million was received in the first nine months of 2016.

Zacks Rank

Currently, Assurant carries a Zacks Rank #4 (Sell). You can see the complete list of today’s Zacks #1 Rank stocks here.

Performance of Other Insurers

Among the other players from the insurance industry that have reported their third-quarter earnings so far, the bottom line at Progressive Corp. (NYSE:PGR) and The Travelers Companies Inc. (NYSE:TRV) beat their respective Zacks Consensus Estimate, while RLI Corp. (NYSE:RLI) missed the same.

Confidential from Zacks

Beyond this Analyst Blog, would you like to see Zacks' best recommendations that are not available to the public? Our Executive VP, Steve Reitmeister, knows when key trades are about to be triggered and which of our experts has the hottest hand. Click to see them now>>

ASSURANT INC (AIZ): Free Stock Analysis Report

RLI CORP (RLI): Free Stock Analysis Report

TRAVELERS COS (TRV): Free Stock Analysis Report

PROGRESSIVE COR (PGR): Free Stock Analysis Report

Original post

Zacks Investment Research