Ashland Global Holdings Inc. (NYSE:ASH) will showcase Soteras binders at the Battery Show from Sep 12-14 in Novi, MI. Soteras leverages Ashland’s broad expertise in specialty ingredients with a focus on water soluble polymers, enabling greater battery integrity with 30% longer cycle life.

BASF SE (BASFY): Free Stock Analysis Report

Ashland Global Holdings Inc. (ASH): Free Stock Analysis Report

Kronos Worldwide Inc (KRO): Free Stock Analysis Report

Chemours Company (The) (CC): Free Stock Analysis Report

Original post

Soteras MSi, a unique binder for high capacity silicon based anodes in lithium ion batteries can be processed using standard industry practices. Besides offering electrochemical stability, it can control swelling during superior cycle performance.

Soteras CCS, a unique binder for lithium ion batteries enables effective ceramic coating on polyolefin separators to reduce film shrinkage during thermal stress. Apart from providing wettability and uniform coatings, it works effectively on both polyethylene (PE) and polypropylene (PP) separator substrates.

The expanding market for electric and hybrid vehicles has created higher demand for safer and long-lasting batteries to expand the driving range. Ashland noted that it has helped improve battery capacity and driving range and also contributed to make batteries safer for their intended purpose.

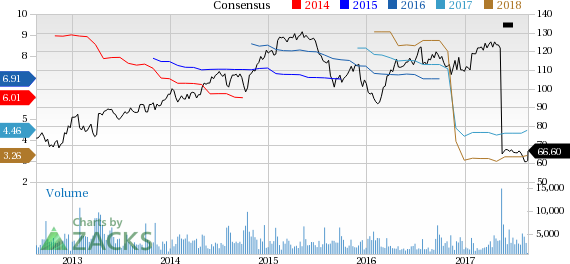

Shares of Ashland have declined 7.3% in last three months, underperforming the industry’s 2.4% fall.

Ashland reported a net loss from continuing operations of $16 million or 26 cents per share in the third quarter of fiscal 2017 (ended Jun 30), against a net income of $24 million or 38 cents in the year-ago period. Barring one-time items, adjusted earnings were 83 cents per share which beat the Zacks Consensus Estimate of 70 cents. Revenues increased roughly 10% year over year to $870 million. The figure topped the Zacks Consensus Estimate of $839.3 million.

According to Ashland, the Specialty Ingredients unit recorded a 7% year-over-year increase in revenues while the sales of Composites grew by 20% on the back of disciplined pricing and robust volume expansion in various global end markets. Intermediates and Solvents unit also witnessed a 9% increase in sales owing to continued recovery in butanediol pricing and improving global demand.

Ashland closed the acquisition of Pharmachem Laboratories, Inc., in May 2017. The company expects to achieve meaningful cost synergies from leveraging combined capabilities along with tax synergies resulting from Pharmachem integration.

Ashland Global Holdings Inc. Price and Consensus

BASF SE (BASFY): Free Stock Analysis Report

Ashland Global Holdings Inc. (ASH): Free Stock Analysis Report

Kronos Worldwide Inc (KRO): Free Stock Analysis Report

Chemours Company (The) (CC): Free Stock Analysis Report

Original post