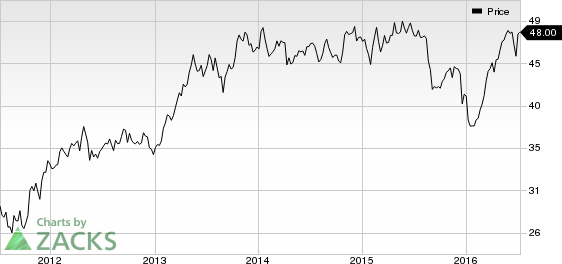

Share price of Arthur J. Gallagher & Co. (NYSE:AJG) gained about 0.9% in the last two trading sessions following the company’s acquisition of a 85% stake in Brim AB. The acquisition will widen the broker’s Scandinavian presence.

Stockholm, Sweden based Brim AB was established in 2001. Brim is a specialty insurance and reinsurance broker providing commercial property/casualty, credit/political risk and affinity insurance products and services.

While credit and political risk practice provides financing support to major infrastructure projects, construction practice supports residential and commercial building development. Arthur J. Gallagher has been associated with Brim AB for many years. Brim AB generates about $11 million revenues annually. The acquisition will also add capabilities to its product and service portfolio to better serve its clients across the globe.

Arthur J. Gallagher & Co. remains focused on international expansion through both acquisitions and organic measures. The company’s international operations, primarily in Australia, Bermuda, Canada, the Caribbean, Singapore, New Zealand and the U.K., generated about 30% of its revenues. With this flurry of acquisitions, the number is expected to grow further.

Arthur J. Gallagher & Co.’s growth story looks impressive. While the buyouts widen its geographical footprint, these also support its enhanced portfolio of services and strengthen its position in retail and wholesale insurance brokerage services and risk management industries. This marks the first buyout in the ongoing third quarter while in the last quarter the company wrapped up 10 buyouts.

The Zack Consensus Estimate moved south over the last 60 days. With optimism surrounding the company’s compelling inorganic growth story, we expect analysts to pull up their estimates. Arthur J. Gallagher is set to report its second-quarter results on Jul 26. The Zacks Consensus Estimate is currently pegged at 96 cents per share, which translates into a year-over-year increase of 2.4%. Though the company’s favorable Zacks Rank #2 increases the predictive power of an earnings beat, but an Earnings ESP of 0.00% makes prediction difficult.

As insurers choose the inorganic route for growth, the takeover saga rages the space. Recently, Assurant, Inc. (NYSE:AIZ) acquired American Title, Inc. to strengthen its capabilities in the housing market. Last month, AmTrust Financial Services, Inc. (NASDAQ:AFSI) acquired Total Program Management LLC to expand its esteemed fee-based businesses while Fidelity National Financial, Inc. (NYSE:FNF) acquired Motivity Solutions to better control customers’ regulatory risk.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

GALLAGHER ARTHU (AJG): Free Stock Analysis Report

ASSURANT INC (AIZ): Free Stock Analysis Report

AMTRUST FIN SVC (AFSI): Free Stock Analysis Report

FNF GROUP (FNF): Free Stock Analysis Report

Original post

Zacks Investment Research