September restart beckons

Arian Silver Corp's (AGQ.LSE) operational update confirms that its plan to refurbish and relocate the El Bote mill from Zacatecas to San José to provide integrated owner-operator milling capacity remains on track. Commissioning is expected before the end of the year, after which the stage is set for mine and mill to ramp up to 1,200tpd by March 2015 and 1,500tpd by March 2016.

Fourfold significance of the El Bote mill

The relocation of the El Bote mill to San José is significant for four reasons. Firstly, it will be correctly sized for the San José mine. Secondly, because it comprises a three-stage crushing circuit with four ball mills and has been used to process ore from the San José mine in the past, it will provide an homogenous crush to the correct size. Thirdly, because it was designed for San José’s abrasive ore, the El Bote mill has steel liners (cf rubber liners in previous mills, which therefore suffered from excessive wear). Fourthly, it will only treat ore from the San José mine and not third-party material that may have become significantly oxidised.

Cheapest in-situ valuation since pre-resource stage

Arian’s enterprise value currently equates to just US$0.21 per resource ounce of silver. While that is above its all-time low of US$0.10/oz achieved earlier this year, it still remains at an 80% discount to its US$0.97/oz average since Arian declared its maiden resource in March 2008. Not only is Arian’s resource multiple at levels comparable to late 2008 and early 2009, but its enterprise value (in US dollars) is actually lower than in January 2008 (before it declared a maiden resource). Note, that in gold terms, San José hosts a resource equivalent to two million ounces of gold, on which basis it has a gold equivalent resource multiple of US$13.83/oz AuE.

Valuation: 99p plus 79.3% of the resource intact

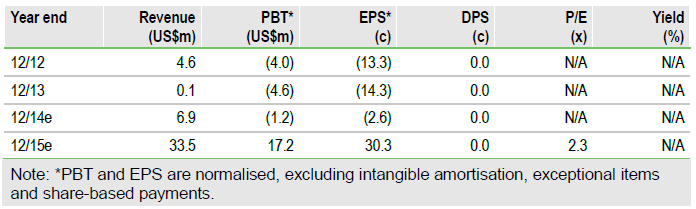

Arian’s updated schedule involves mining 4.2Mt over 10 years at an average grade of 180g/t to produce 19.3Moz Ag at a C1 cash cost of US$9.88/oz. This compares to its previous mine schedule, which was to mine 12.1Mt over 24 years to produce 46.8Moz Ag at a C1 cash cost of US$7.97/oz. Notwithstanding the shorter life of the operation, the selective focus on higher grade areas allows c 90% of the value of the previous plan to still be captured at equivalent silver prices (inter alia, as a result of lower capex). In addition, the majority (79.3%) of the resource will still remain available for exploitation at the end of the formal life of the mine. At our current silver price forecasts, Edison estimates a value for future potential dividend flows to investors over ten years of US$1.64 (99p) at a 10% discount rate if Arian’s convertible loan note is converted – and US$1.94 (117p) if it is not.

To Read the Entire Report Please Click on the pdf File Below