95% refurbished

Today’s operational update by Arian Silver Corp (AGQ.LSE) confirms that the plan to acquire, refurbish and relocate the El Bote mill from Zacatecas to San Jose to provide integrated owner-operator milling capacity remains on track. Refurbishment is reported to be 95% complete and transportation underway to a pre-prepared site with electrical supply, with commissioning expected before the end of the year. As such, the stage is set for mine and mill to ramp up to 1,200tpd by March 2015 and 1,500tpd by March 2016.

Four-fold significance of the El Bote mill

The relocation of the El Bote mill to San Jose is significant. Firstly, it will be correctly sized for the San Jose mine (cf previous mills, which have lacked capacity in the floatation circuit and therefore provided insufficient residence time for optimal metallurgical recoveries). Secondly, because it comprises a three-stage crushing circuit with four ball mills and has been used to process ore from the San Jose mine in the past, it will provide an homogenous crush to the correct size (NB this compares to past mills, which have had only two-stage crushing circuits and no hydrocyclones to manage oversized material – thereby resulting in a high proportion of oversized ore, a poor metallurgical float and a high grade of silver in the tailings). Thirdly, because it was designed for San Jose’s abrasive ore, the El Bote mill has steel liners for its mills (cf rubber liners in previous mills, which therefore suffered from excessive wear). Fourthly, it will only treat ore from the San Jose mine and not third-party material that may have become significantly oxidised.

Valuation: Inching higher

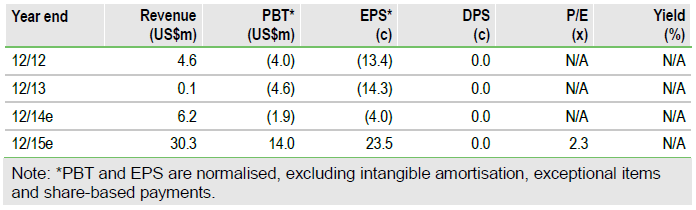

In our last note, we valued Arian at US$2.26 (141p) per share on the basis of the maximum potential dividend stream available to investors discounted at 10% (including dilution from the conversion of the recently issued senior secured convertible notes etc) at a US$28.15/oz silver price. It was US$2.68 (167p) assuming no conversion. At the spot price of US$21.80/oz, the valuation was US$1.30 (81p) per share. Since then, we have revised our mine plan for San Jose (entailing slightly lower tonnages at higher grades for a shorter period) and, consequently, also our earnings and dividend forecasts. The result of the process is a revised US$2.33 (140p) valuation at US$28.15/oz Ag with the equity dilution associated with the conversion of the convertible note and US$3.20 without (192p). At the current spot silver price of US$19.87/oz, the valuation is US$1.24 (75p) with dilution and US$1.53 (92p) without. Note that these valuations assume no change to Arian’s tax regime. They also assume a full fluorine penalty deduction, which Arian management is currently working to mitigate.

To Read the Entire Report Please Click on the pdf File Below