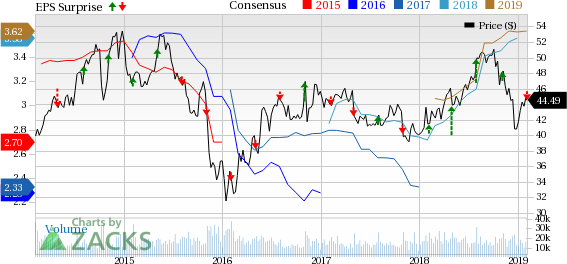

Archer Daniels Midland Company (NYSE:ADM) reported lower-than-expected results in fourth-quarter 2018, wherein the bottom line delivered a negative earnings surprise after four straight beats along with second consecutive top-line miss.

A glimpse of this Zacks Rank #1 (Strong Buy) stock’s price trend reveals that it has outperformed the industry in a year’s time. Shares of the company have gained 6% against the industry’s 2.4% decline.

Q4 Highlights

Archer Daniels’ fourth-quarter adjusted earnings of 88 cents per share increased 7.3% from the year-ago quarter. However, the bottom line lagged the Zacks Consensus Estimate of 92 cents.

On a reported basis, the company’s earnings came in at 55 cents per share, significantly down from $1.39 earned in the prior-year quarter.

Revenues totaled $15,947 million, which dipped 0.8% year over year and also missed the Zacks Consensus Estimate of $17,097 million. Decline in revenues at company’s most of the segments led to the downside.

Going by segments, quarterly revenues at the Origination, Carbohydrate Solutions and Other segments fell 8.4%, 10.1% and 4.3% to $6,389 million, $2,497 million and $90 million, respectively. However, revenues at the Oilseeds and Nutrition improved 12.9% and 5.9% to $6,071 million and $900 million, respectively.

Operational Discussion

Archer Daniels reported adjusted segment operating profit of $860 million in fourth-quarter 2018, up 8.4% from the year-ago quarter. On a GAAP basis, the company’s segment operating profit grew 7.2% year over year to $786 million.

On a segmental adjusted basis, adjusted operating profit at the Oilseeds segment rose more than double year over year to $432 million. The upside can be attributed to solid Crushing and Origination results. Moreover, solid performance at Refining, Packaging, Biodiesel and Other backed by higher biodiesel volumes and margins with impressive results from food oils drove the performance. Robust Wilmar results in Asia too aided growth.

However, adjusted operating profit at the Origination segment amounted to $183 million, down 29.9% from the year-ago quarter. This downside was mainly due to lower Merchandising and Handling results on a year-over-year basis, comprising important insurance settlements and other income. Meanwhile, North American results witnessed gains from wheat coupled with strong execution that boosted export margins and volumes. Further, North American exports of corn, and soybeans to markets outside China remained robust. Also, Global Trade’s effective utilization of the company’s network of origination assets and destination marketing aided the segment’s performance. Transportation results were driven by higher freight rates, mitigated with elevated operating expenses.

At the Nutrition segment, adjusted operating profit decreased 15.1% to $62 million as robust WFSI results were offset by dismal performance at Animal Nutrition. In fact, the WFSI business delivered 14% growth in constant currency. Recent buyouts in WILD and Health & Wellness coupled with robust demand for lecithin fueled the results. At Animal Nutrition, results were significantly hurt by continuous production issues, which dented margins in amino acids.

The Carbohydrate Solutions segment’s adjusted operating profit plunged 30.9% to $197 million. The downside can mainly be attributed to soft Bioproducts results along with lower ethanol margins and volumes. Also, lower margins and sales in EMEA as well as elevated costs in North American liquid sweeteners negatively impacted the results. However, North American volumes in Starches and Sweeteners were robust.

Financials

Archer Daniels ended the quarter with cash and cash equivalents of $1,997 million, long-term debt including current maturities of $8,280 million and shareholders’ equity of $18,996 million.

In 2018, the company generated negative cash flows of $4,784 million from operating activities. However, the company’s trailing four-quarter adjusted ROIC came in at 8.3%, 200 basis points above the annual WACC.

Additionally, the company repurchased shares worth $77 million and paid dividends of $758 million to its shareholders in 2018. Also, the board has approved the quarterly dividend hike by 4.5% to 35 cents. The new dividend will be paid on Mar 12, 2019, to its shareholders of record as on Feb 19.

Moving Ahead

Despite soft quarterly results, management remains encouraged with its year-over-year earnings improvement, stemming from growth initiatives and cost-saving efforts.

Going into 2019, Archer Daniels remains committed toward maximizing shareholders’ value. Further, the company has been making strategic efforts such as solid execution in select businesses, gains from Readiness and investments in organic growth and acquisitions.

Want More of Solid Consumer Staples Stocks? Check These

Blue Apron Holdings, Inc. (NYSE:APRN) has outpaced the earnings estimates in the trailing four quarters, the average being 19.9%. It sports a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Simply Good Foods Company (NASDAQ:SMPL) delivered average positive earnings surprise of 13.3% in the last four quarters. It currently carries a Zacks Rank #2 (Buy).

Nomad Foods Limited (NYSE:NOMD) has an impressive long-term earnings growth rate of 11% and a Zacks Rank #2.

Zacks' Top 10 Stocks for 2019

In addition to the stocks discussed above, would you like to know about our 10 finest buy-and-holds for the year?

Who wouldn't? Our annual Top 10s have beaten the market with amazing regularity. In 2018, while the market dropped -5.2%, the portfolio scored well into double-digits overall with individual stocks rising as high as +61.5%. And from 2012-2017, while the market boomed +126.3, Zacks' Top 10s reached an even more sensational +181.9%.

Archer Daniels Midland Company (ADM): Free Stock Analysis Report

Blue Apron Holdings, Inc. (APRN): Get Free Report

The Simply Good Foods Company (SMPL): Free Stock Analysis Report

Nomad Foods Limited (NOMD): Get Free Report

Original post

Zacks Investment Research