Trading in companion animals is spot on

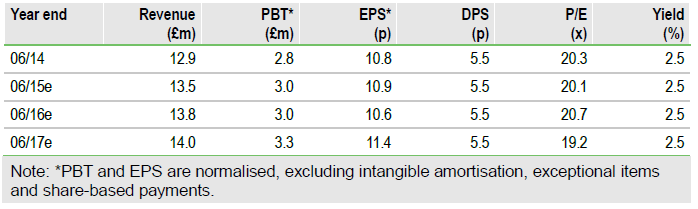

Animalcare Group Plc (LONDON:ANCR) continues to perform very much as expected, with the FY15 trading update showing a 5.1% rise in group revenues to £13.54m. This was driven by the 8.8% increase in Licensed Veterinary Medicines to £8.58m, with Companion Animal Identification down 4.5% to £2.31m and Animal Welfare up 2.6% to £2.65m. Underlying operating profit is expected to be at least £3.0m, slightly higher than our forecast. Cash generation remains strong, higher than expected, with cash of £5.78m at June 2015. Rolling forward our DCF model and adjusting for the higher net cash sees our valuation rise from £41.9m (201p a share) to £48.7m (234p a share).

Licensed Veterinary Medicines sales up 8.8%

Group FY15 revenues rose by 5.1% to £13.54, against our forecast £13.47m. Licensed Veterinary Medicines was up 8.8% to £8.58m (against our expected £8.44m), helped by the launch of five new products, all sourced from its European development partners, during the year. The in-house development programme (which focuses on higher value-adding products) is progressing well, with three projects submitted for regulatory approval during H215.

Companion Animal Identification down by 4.5%

Companion Animal Identification revenues fell by 4.5% to £2.31m (our forecast was £2.30m) as the response to introduction of compulsory dog chipping in England in April 2016 continues to disrupt the market (the charity Dogs Trust is offering free microchipping). Database services continued to grow well, as expected.

To Read the Entire Report Please Click on the pdf File Below