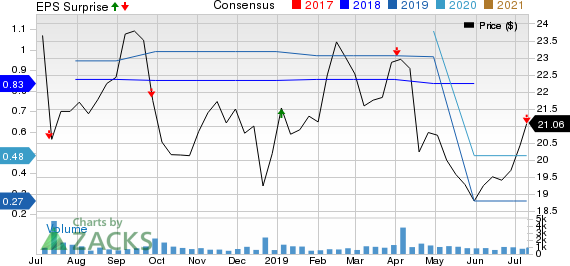

AngioDynamics Inc. (NASDAQ:ANGO) reported fourth-quarter fiscal 2019 adjusted earnings per share (EPS) of 25 cents, which fell short of the Zacks Consensus Estimate by a penny. The bottom line, however, increased 25% on a year-over-year basis.

Revenues of this Zacks Rank #3 (Hold) stock totaled $96.3 million, which came well ahead of the Zacks Consensus Estimate of $92.9 million. The top line also increased 9% on a year-over-year basis. Organically, the figure rose 5.2%.

FY19 at a Glance

For fiscal 2019, AngioDynamics’ adjusted EPS was 83 cents, which missed the Zacks Consensus Estimate by a penny but increased 12.2% from last year.

Revenues of the company came in at $359.5 million, surpassing the Zacks Consensus Estimate of $356.1 million. The reported figure rose 4.4% from fiscal 2018 and 1.6% organically.

Geographical Analysis

In the quarter under review, U.S. net revenues totaled $73.4 million, up 4.4% year over year.

International revenues summed $22.9 million, up significantly by 27% year over year.

Per management, foreign currency did not have any impact on the company’s revenues.

Segmental Analysis

Vascular Interventions and Therapies (VIT) Business

VIT revenues in the fourth quarter grossed $56.2 million, up 6.9% from the year-ago quarter’s figure.

Per management, strong growth in AngioVac and Core product line was partially offset by a decline in the Venous Insufficiency business.

Vascular Access (VA) Business

Revenues at this segment amounted to $24.8 million, which increased 4.9% on a year-over-year basis. Per management, strong revenues were driven by higher sales of midlines, ports and dialysis.

Oncology/Surgery Business

Revenues at the Oncology segment improved 26.5% year over year to $15.3 million. Per management, strong sales of Solero along with the recent BioSentry and RadiaDyne acquisitions helped offset lower NanoKnife capital sales during the reported quarter.

Margin Analysis

In the quarter under review, gross profit totaled $51.6 million, up 8.7% from the year-ago quarter number. Also, gross margin was 53.6%, up significantly from 40.9% in the prior-year quarter.

Research and development expenses were $7.2 million, up 11.6% year over year. Sales and marketing expenses totaled $21.8 million, up 4.5% on a year-over-year basis. General and administrative expenses were $8.6 million, up 7.7% year over year.

Net adjusted operating income summed $14 million, up 15.1% year over year. Also, operating margin in the quarter was 11.5%, up 650 basis points year over year.

Guidance

For fiscal 2020, AngioDynamics expects its revenues in the $280-$286 million band. The Zacks Consensus Estimate is pegged at $283.2 million, within the projected range.

Adjusted EPS is expected between 25 cents and 30 cents. The Zacks Consensus Estimate stands at 27 cents, within the guided range.

The company expects gross margin to be in the 58-59% range.

Wrapping Up

AngioDynamics exited the fiscal fourth quarter on a mixed note. However, the company is consistently gaining from its core VIT business unit, which witnessed solid growth backed by impressive performance at the Fluid Management and AngioVac units. Recent acquisitions of BioSentry and RadiaDyne are favoring the company at the moment.

These apart, the company recently completed its sale of NAMIC Fluid Management business to Medline Industries. Additionally, enrolment of the first patient in NanoKnife DIRECT Clinical Study for the treatment of stage III pancreatic cancer is commendable. AngioDynamics also received approval to initiate pilot study for the use of NanoKnife to treat prostate cancer.

Nonetheless, setbacks in the company’s Venous Insufficiency business and dismal show by the radiofrequency ablation products raise concerns.

Key Picks

Some better-ranked stocks in the broader medical space are DENTSPLY SIRONA (NASDAQ:XRAY) , AmerisourceBergen Corporation (NYSE:ABC) and Stryker Corporation (NYSE:SYK) . While DENTSPLY SIRONA sports a Zacks Rank #1 (Strong Buy), AmerisourceBergen and Stryker carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here

The Zacks Consensus Estimate for DENTSPLY SIRONA’s second-quarter 2019 revenues is pegged at $1.03 billion. The same for adjusted EPS stands at 61 cents, indicating an increase of 1.7% from the year-ago reported figure.

The Zacks Consensus Estimate for AmerisourceBergen’s third-quarter fiscal 2019 revenues is pegged at $45.3 billion, suggesting 4.9% growth from the prior-year reported figure. The same for adjusted EPS stands at $1.63, implying a 5.84% improvement from the year-ago reported number.

The Zacks Consensus Estimate for Stryker’s second-quarter 2019 revenues is pegged at $3.6 billion, indicating an 8.5% rise from the year-ago reported figure. The same for adjusted EPS stands at $1.93, suggesting 9.7% growth from the year-earlier quarter's reported figure.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

AngioDynamics, Inc. (ANGO): Free Stock Analysis Report

Stryker Corporation (SYK): Free Stock Analysis Report

DENTSPLY SIRONA Inc. (XRAY): Free Stock Analysis Report

AmerisourceBergen Corporation (ABC): Free Stock Analysis Report

Original post