- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Policy Of Targeting 'Monetary Transmission' By The ECB

Here is a quick look at the concept of "monetary transmission" that has basically become the catch phrase to justify periphery bond buying by the ECB.

MNI: Joerg Asmussen [member of the ECB's Executive Board] said the ECB's new bond-buying plan will aim to improve monetary policy transmission that is severely hampered. Currently "monetary signals, like we for example set with the July interest rate cut, filter through to the real economy either unevenly or not at all."

The lack of rate transmission is clear. Portugal's rates for consumer loans for example have remained stubbornly high (discussed here). But the transmission issue is really driven by liquidity conditions that are not balanced across the eurozone. Ambrose Evans-Pritchard discussed it back in December of last year (see discussion) as Italy's M3 showed alarming declines, while Germany's money stock increased (see discussion). And since a great deal of the lending across the eurozone (except to some of the larger firms) is done by domestic institutions (Spanish citizens and companies tend to borrow from Spanish banks), liquidity issues of the domestic banking system translate into fewer loans and higher rates in that nation.

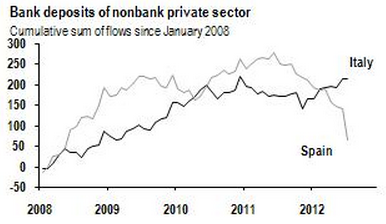

Here is an example. Deposits at Italian banks (surprisingly) have been quite stable recently. Spain on the other hand had a run on its banks.

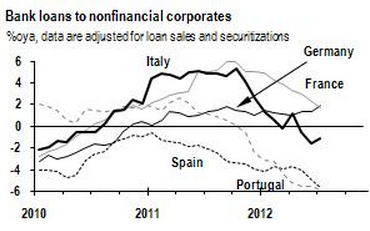

This contributed to (though is not the only cause of) uneven growth in bank lending.

It makes sense therefore to target monetary policy by country in an attempt to even out credit conditions. The belief that monetary policy in the EMU could be managed centrally the way it's done in the US proved to be flawed.

But there are issues with implementation. If "monetary transmission" is indeed the goal, how does the ECB justify making it conditional?

WSJ: If the bond buying program is really about transmitting monetary policy to certain countries, it's hard to justify making that conditional at all. By imposing conditions, the ECB implies that support could be withdrawn in the future. But apart from the practical difficulties of walking away after loading up on Spanish or Italian debt, the conditions themselves suggest that there are circumstances under which the ECB would pull the plug—the opposite of what Mr. Asmussen says the bank is trying to achieve.

And there are significant risks associated with targeted policy conditions.

WSJ: One of the unanswered questions about the ECB's next round of bond buying is what conditions it will impose on the countries that benefit. But one only has to look at Greece to see how double-edged conditionality can become. Two and a half years after being bailed out, Athens is hopelessly behind every target. And yet European and IMF officials aren't considering whether to take Greece off the bailout drip, only how best to fudge the bailout's failure.

Fixing monetary transmission is certainly a sound concept in theory. But in this case is seems to be nothing more than a justification for periphery bailouts by the ECB. The conditional implementation actually looks more like an ESM-style bailout than a central bank monetary policy. To some, this makes the ECB a tool of the European Commission.

Feeling the heat when pressed on ECB's independence, Draghi fired back.

RTT: "It will remain independent. And it will always act within the limits of its mandate...yet it should be understood that fulfilling our mandate sometimes requires us to go beyond standard monetary policy tools."

Related Articles

On May 6, 2010, the US stock markets dropped nearly 10% within minutes. What would be called a “flash crash” wasn’t caused by news, economic data, or a Fed policy decision....

A subscriber wrote to me recently and asked about a research piece put out by a major sell-side investment house that discussed how private rental indices (such as Zillow and the...

MON: US Dallas Fed (Jul), German GfK (Aug) TUE: US Consumer Confidence (Jul), JOLTS (Jun) WED: FOMC & BoC Policy Announcements; ECB Wage Tracker, Australian CPI (Jun/Q2),...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.