- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

ESM Armed With A Banking License: The Ultimate Bailout "Bazooka"

Should the ESM, the Eurozone's permanent bailout facility, be granted a banking license? Apparently some within the ECB believe that it should.

Bloomberg: - European Central Bank council member Ewald Nowotny said there are arguments in favor of giving Europe’s rescue fund a banking license, reviving the debate on bolstering its firepower as leaders face the prospect of a full-scale Spanish bailout.

“I think there are pro arguments for this,” Nowotny, who heads Austria’s central bank, said in an interview in his office in Vienna yesterday. “There are also other arguments, but I would see this as an ongoing discussion,” he said, adding he’s “not aware of specific discussions within the ECB at this point.”

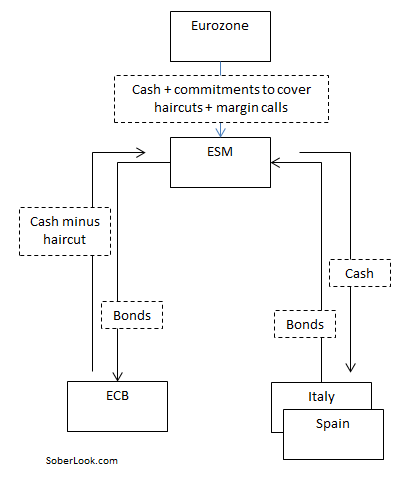

It's a powerful concept because being a bank, the ESM could tap the ECB's unlimited lending facilities to leverage its holdings of sovereign paper. By granting the ESM a banking license, it can effectively buy Spanish and Italian bonds "on margin", with the ECB being the margin provider. This entity would wield buying power several times larger than the Eurozone's original ESM commitment, making it the ultimate bailout "bazooka".

So far Mario Draghi had not been supportive of the idea - at least officially.

Bloomberg: - ...ECB President Mario Draghi said on May 24 that such a move amounts to the central bank financing governments, which is prohibited by European Union law...

The issue of EU laws is a major one, but it's not without a precedent. As the Bloomberg article points out, "publicly-owned credit institutions such as the European Investment Bank (EIB) are exempt". In fact the EIB has been involved in buying government debt of Eurozone nations for some time, even ending up stuck with some Greek bonds (see this post).

Bloomberg: - The EIB, which was founded in 1958 and is owned by the member states of the EU, was granted access to ECB refinancing in July 2009. Nowotny said the fact that the ESM has missed a July deadline to become operational is a “weakness that has to be overcome.”

However there is a political problem with this scenario. The ESM now has a €500bn cap on total debt purchases. That means no matter what leverage is available to the entity, it can only purchase bonds of up to the amount of the cap. An increase in its buying power would require (among other things) Germany's approval. And with the elections coming up in Germany next year, the chances of German politicians agreeing to this increase are quite low.

Barclays Capital: - From a political perspective and in view of the German national elections scheduled for September 2013, we do not see much of a chance that the German government would agree to another increase in the ceiling until then, or to more fundamental changes implying the mutualisation of national, public debt. This constraint may be relaxed if the crisis picks up pace rapidly and moves into the core.

Nevertheless the rumors of the ESM being armed with a banking license are flying (and even moving the "risk" markets on Friday).

CNBC: - Reports (vague rumors) that ECB head Mario Draghi may have reached out to Bundesbank head Jens Weidmann moved the Dow more than a hundred points in the middle of Friday's trading day.

It certainly wouldn't be surprising that they talk, but the rumor mill threw in a rich tidbit: that they had discussed giving the EU's permanent bailout fund (the ESM) a banking license.

The danger of course is that after this buildup, the "bazooka" and other expectations from the Eurozone may not materialize. Without a decisive follow-through, the "risk" markets may retrace their recent gains and then some. After all when it comes to the Eurozone crisis, the EU leadership has a knack of over-promising and under-delivering.

Related Articles

It’s July. Back in March, we expected that Trump’s Tariff Turmoil (TTT) would become less tumultuous by the end of the summer. We figured that President Donald Trump would start...

Historically, we are entering the period of the year when 1-month implied correlations typically bottom, and when implied correlations bottom, markets often top. This pattern is...

Stocks are set to open slightly lower - are they forming a topping pattern? On Friday, the S&P 500 index closed 0.33% lower amid tariff-related uncertainty. Over the weekend,...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.