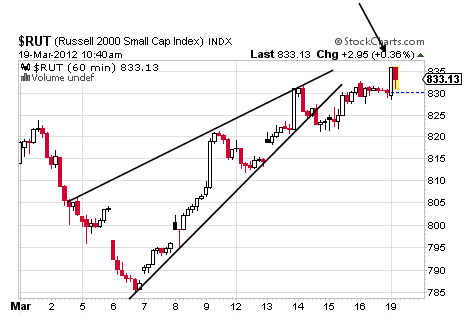

It is interesting to see how the various equity indices have danced around the Bear Pennants detailed last Friday with the Russell 2000 climbing to this year’s high as the Dow was dropping down with it seeming that the former would try to evade that pattern or put in a better apex as the latter was putting in some attempt on confirmation.Such a tension remains present and how it will be resolved may rest, in part, in a possible intraday Pipe Top in the Russell 2000 as shown below.

As can be seen, the Russell 2000 is busting out of that Bear Pennant and so its original form is on the cusp of being invalid but if the Pipe Top confirms at 828 for a target of 820 it will bring this small cap index close to confirming its Bear Pennant at 818 for a target of 785. Above 836, however, any maybe, not necessarily, this pattern fails.

Turning to the other side of the spectrum, the Dow could be trying to confirm its Bear Pennant or it may be simply widening or just putting in a little intraday consolidation before turning higher.

Below 13210 and the Dow will probably try to confirm its pattern at 13166 for a target of 12735 but above 13288 and the Dow will climb higher and perhaps by a lot with that level representing a clearance of the 3% rule around the index’s long-standing sideways trend.

It will be interesting to see how these patterns play out with some of the possibilities outlined in this update on those beautiful Bear Ps.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

An Update on those Bear Ps

Published 03/20/2012, 12:21 AM

Updated 07/09/2023, 06:31 AM

An Update on those Bear Ps

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.