Reportedly, Alibaba Group Holding Limited (NYSE:BABA) has acquired a China-based firm, Teambition. However, other details related to the acquisition have been kept under wraps.

Teambition is a provider of mobile and desktop apps that facilitate teamwork. It provides basic applications such as Tasks, Files, Group Chat and many plug-in functions that allow team members to work together at any time. Its investors include Tencent, Microsoft (NASDAQ:MSFT), IDG Capital and Gobi Ventures.

With this buyout, Alibaba aims to accelerate enterprise-related technologies, and further develop a collaborative management platform across office departments and business units.

This agreement will help the company strengthen its position in the Chinese market, and gain a stronger foothold in the growing Asian region and beyond.

Deal Rationale

Nowadays, the need of a platform through which enterprises can communicate, collaborate and effectively manage their projects has been gaining a lot of momentum.

Teambition is a firm that has vital platforms designed to plan and manage projects competently. It provides real-time communication services for modern enterprises, and helps users to store and distribute files.

At a time when Alibaba is focused on cloud business, streaming services and other growth areas, expanding into infrastructure technologies makes complete sense.

Bottom Line

Alibaba has introduced several products and enhancements over the past few years. The company has invested in big data and AI technologies. Moreover, it has expanded itself on a global basis, which is considered to be a key differentiator, giving it a competitive advantage.

Acquisitions and partnerships have helped the company in shaping its growth trajectory and diversifying business. Early this year, Alibaba acquired an open source big data firm, Data Artisans, for a total of €90 million ($103 million), in order to expand its share in the enterprise space.

Alibaba’s cloud computing has significant growth opportunities, driven by robust product portfolio, strengthening IoT capabilities and key offerings. Given the growing position of the company’s cloud business in China and aggressive international expansion strategies, we believe that cloud computing will be one of the major growth drivers in the long run.

Just recently, Alibaba unveiled A100 business partnership program in a bid to boost digital transformation in a large number of companies. Per the partnership, the company will provide an array of enterprise services to its members on a single unified platform.

All these endeavors will boost Alibaba’s stake in the enterprise project management and collaboration space.

Zacks Rank & Stocks to Consider

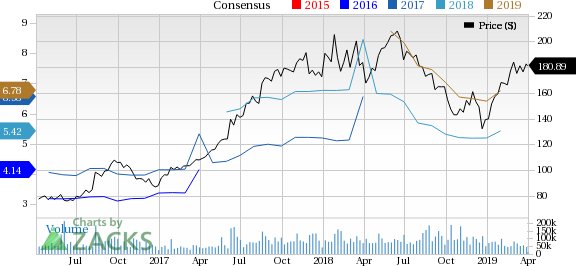

Currently, Alibaba carries a Zacks Rank #3 (Hold). Some better-ranked stocks in the same industry include Expedia Group, Inc. (NASDAQ:EXPE) , Ctrip.com International, Ltd. (NASDAQ:CTRP) and ASOS (LON:ASOS) Plc (OTC:ASOMY) , each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Long-term earnings growth for Expedia, Ctrip.com and ASOS Plcis currently projected at 13.4%, 23% and 8%, respectively.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2018, while the S&P 500 gained +15.8%, five of our screens returned +38.0%, +61.3%, +61.6%, +68.1%, and +98.3%.

This outperformance has not just been a recent phenomenon. From 2000 – 2018, while the S&P averaged +4.8% per year, our top strategies averaged up to +56.2% per year.

See their latest picks free >>

Alibaba Group Holding Limited (BABA): Free Stock Analysis Report

Expedia Group, Inc. (EXPE): Free Stock Analysis Report

Ctrip.com International, Ltd. (CTRP): Free Stock Analysis Report

ASOS PLS ADR (ASOMY): Free Stock Analysis Report

Original post

Zacks Investment Research