AK Steel (NYSE:AKS) is increasing base price for all stainless steel products, effective with shipments on Sep 3, 2017.

BASF SE (BASFY): Free Stock Analysis Report

Kronos Worldwide Inc (KRO): Free Stock Analysis Report

Chemours Company (The) (CC): Free Stock Analysis Report

AK Steel Holding Corporation (AKS): Free Stock Analysis Report

Original post

Zacks Investment Research

The price increase for commodity sheet and strip, specialty sheet and strip, and pipe and tube sheet and strip products will be achieved through a reduction in the functional discount of two percentage points.

The base price of remaining stainless steel products, including automotive sheet and strip, will increase by $40 per ton.

AK Steel is witnessing volatility in pricing that reflects the challenges from steel imports that continue to make inroads in the American market. The company is taking appropriate pricing actions amid this backdrop.

AK Steel has underperformed the industry over a year. The company's shares have moved up 13.5% during the period while the industry witnessed a gain of about 28.4%.

AK Steel topped earnings and sales estimates in second-quarter 2017. The company reported net income of $61.2 million or 19 cents per share, up 253.7% from net income of $17.3 million or 8 cents recorded in the prior-year quarter. Earnings for the quarter surpassed the Zacks Consensus Estimate of 13 cents. The company recorded net sales of $1,557.2 million for the quarter, up 4.3% from the year-ago quarter, exceeding the Zacks Consensus Estimate of $1,530 million.

According to AK Steel, the second-quarter performance reflects continued benefits of strategic initiatives implemented over the past one-and-a-half year. The acquisition of Precision Partners will help to strengthen its position as a value-added design and materials solutions provider.

The company expects shipments in the third quarter to be relatively flat compared with the second quarter as higher shipments of the carbon distributing and converting market are expected to be offset by lower automotive shipments. Average selling price in the third quarter is expected to be modestly lower than the second quarter. The expected decline assumes a change in the mix of shipments related to an anticipated reduction in automotive shipments and decline in raw material surcharges.

AK Steel remains focused on expanding its core automotive business. The company generates a major portion of its sales from the automotive sector. AK Steel is also laying importance on de-emphasizing commoditized products and launching new value-added products.

The company also remains committed to reduce cost. It is looking for cost saving opportunities in 2017 through a number of means including process improvement and reduction in process time and procurement activities.

However, AK Steel remains exposed to weakness in electrical steel pricing in the overseas markets. Prices remain under pressure in the international markets due to global overcapacity. The company expects the global electrical steel market to remain volatile in the near future due to production overcapacity.

The U.S. steel industry is also not out of the woods yet. The American steel industry continues to be hit by cheaper imports, notwithstanding the recent trade actions.

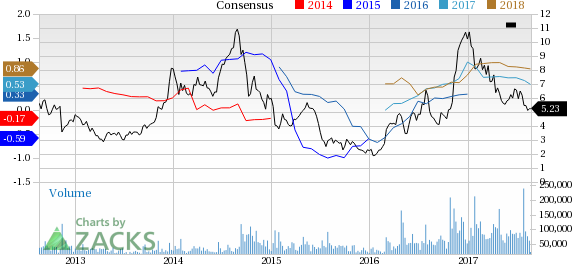

AK Steel Holding Corporation Price and Consensus

BASF SE (BASFY): Free Stock Analysis Report

Kronos Worldwide Inc (KRO): Free Stock Analysis Report

Chemours Company (The) (CC): Free Stock Analysis Report

AK Steel Holding Corporation (AKS): Free Stock Analysis Report

Original post

Zacks Investment Research