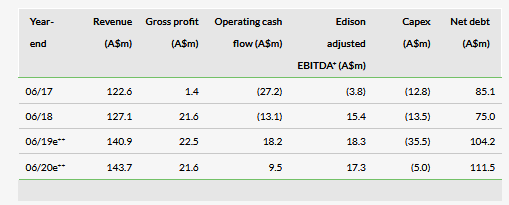

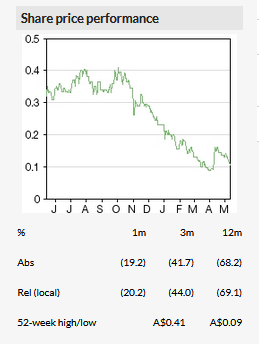

AJ Lucas Group Ltd (AX:AJL) has benefited from a material recovery in profitability from its Australian onshore drilling division, with underlying EBITDA in H119 (31 December 2018) of A$13.1m (17.2% margin), up from A$5.5m (9.7% margin) in the previous year. High rig utilisation and strong coal mine degassing demand support our forecast of revenue sustained at close to H119 levels (A$76.2m). AJL’s track record and tier 1 client relationships support management guidance of FY19 drilling underlying EBITDA in excess of FY18’s A$19.7m (Edison FY19 forecast: A$22.5m). Valuing Lucas Drilling Services (LDS) at 6x Edison adjusted EBITDA (after associated overheads) equates to A$0.15/share or A$0.03/share after consideration of group net debt. This excludes our net P50 UK shale valuation of A$0.91/share. We intend to update our probabilistic value of UK shale based on an improved understanding of key inputs including initial production rate (IP rate), estimated ultimate recovery (EUR) and well costs.

AJL drilling valuation

We value LDS on the basis of 6x FY19e underlying EBITDA (A$22.5m before overheads and A$18.3m after associated overheads). This multiple is towards the bottom end of the Australian domestic OFS sector, which includes a diverse set of businesses, and in line with the US onshore drilling sector. We believe this multiple reflects the cyclical nature of rig demand, utilisation and operating margins visible in LDS’s recent history. LDS is currently experiencing strong top-line and margin growth driven by underlying rig demand, with visibility of earnings from current customers underpinning our FY19 EBITDA forecasts.

UK shale: Evolving model inputs

Model inputs for our probabilistic valuation of UK shale potential continue to evolve, and we expect to provide an update based on Cuadrilla’s estimates of scaled-up IP rates, UK Onshore Oil and Gas (UKOOG) estimates of EUR and estimates of Springs Road well costs.

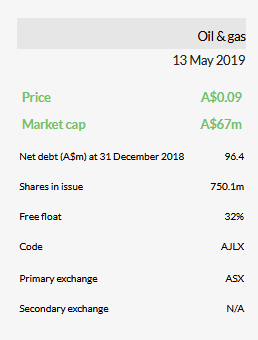

Valuation: Debt a key consideration for equity holders

Including our last published P50 value for UK shale potential to our LDS valuation (see our initiation report, published on 9 April 2018), our group valuation rises to A$0.94/share. Total balance sheet debt at end December 2018 stood at A$108.9m. Despite continued support from debt holders and with senior loan note repayment obligations deferred to September 2019, the 18% (cash and accrued interest) pre-tax cost of debt remains high.

Business description

AJ Lucas Group has investments in the exploration and commercialisation of shale gas in the UK through license equity interests and a stake in Cuadrilla. It also has an Australia-based operating business unit: Lucas Drilling Services (LDS).