Air Products (NYSE:APD) has landed an agreement with TP JGC Coral France. Per the deal, Air Products will supply its proprietary cryogenic coil wound heat exchanger technology and the liquefaction process license for a floating liquefied natural gas (FLNG) facility to be located in the Indian Ocean, offshore Mozambique, Africa.

BASF SE (DE:BASFN) (BASFY): Free Stock Analysis Report

Air Products and Chemicals, Inc. (APD): Free Stock Analysis Report

Kronos Worldwide Inc (KRO): Free Stock Analysis Report

Arkema SA (ARKAY): Free Stock Analysis Report

Original post

Zacks Investment Research

Being built by TP JGC Coral France, the FLNG facility is an incorporated joint venture formed by TechnipFMC and JGC Corporation, along with Samsung (KS:005930) Heavy Industries. The facility will utilize Air Products' dual mixed refrigerant process.

Air Products' proprietary technology helps in meeting the world's increasing energy needs and desire for clean energy processes and cryogenically liquefies valuable natural gas for consumer and industrial use.

The company’s LNG process technology takes natural gas from some of the remotest locations around the world and unlocks its value by liquefying it. Thereafter, the company ships it around the world. The LNG is eventually re-gasified for energy use. Air Products provides process technology and key equipment for the natural gas liquefaction process for large export plants, small and mid-sized LNG plants, floating LNG plants and LNG peak shavers.

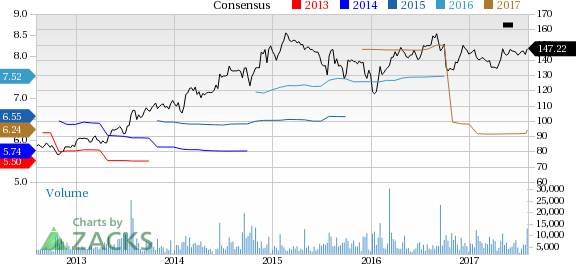

Air Products has underperformed the industry over the last six months. The company’s shares have moved up around 6.2% over this period, compared with roughly 8.2% gain recorded by the industry.

The company has increased its adjusted earnings per share guidance for fiscal 2017. For the full year, Air Products expects adjusted earnings per share of $6.20–$6.25 (up from $6.00–$6.25 expected earlier), which at midpoint, represents a 10% increase over last year. For the fourth-quarter fiscal 2017, Air Products anticipates adjusted earnings per share from continuing operations of $1.65–$1.70 per share, which at midpoint, also represents a 12% increase over last year.

Air Products is well placed to leverage the cyclical recovery in core industrial end-markets. The company has built a strong project backlog. These projects are expected to be accretive to earnings and cash flow over the next few years. Acquisitions and new business wins are expected to continue to drive results. The company is also progressing well with its $600 million cost-cutting program.

Air Products also has significant amount of cash to invest in its core industrial gases business. The company expects to have roughly $8 billion to deploy in strategic, high-return opportunities to create shareholders value over the next three years.

Air Products and Chemicals, Inc. Price and Consensus

Air Products currently carries a Zacks Rank #2 (Buy).

Other Stocks to Consider

Other top-ranked companies in the chemical space include Arkema S.A. (OTC:ARKAY) , BASFY SE (OTC:BASFY) and Kronos Worldwide (NYSE:KRO) . All three stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Arkema has an expected long-term earnings growth of 12.8%.

BASF has an expected long-term earnings growth of 8.6%.

Kronos Worldwide has an expected long-term earnings growth of 5%.

5 Trades Could Profit "Big-League" from Trump Policies

If the stocks above spark your interest, wait until you look into companies primed to make substantial gains from Washington's changing course.

Today Zacks reveals 5 tickers that could benefit from new trends like streamlined drug approvals, tariffs, lower taxes, higher interest rates, and spending surges in defense and infrastructure. See these buy recommendations now >>

BASF SE (DE:BASFN) (BASFY): Free Stock Analysis Report

Air Products and Chemicals, Inc. (APD): Free Stock Analysis Report

Kronos Worldwide Inc (KRO): Free Stock Analysis Report

Arkema SA (ARKAY): Free Stock Analysis Report

Original post

Zacks Investment Research