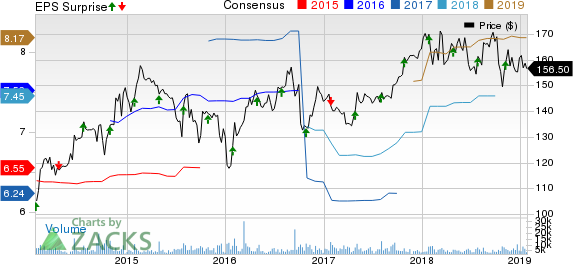

Air Products and Chemicals, Inc. (NYSE:APD) logged profit from continuing operations of $347.5 million or $1.57 per share for first-quarter fiscal 2019 (ended Dec 31, 2018), a more than two-fold jump from $155.6 million or 70 cents a year ago.

Barring one-time items, adjusted earnings for the reported quarter were $1.86 per share, up 4% from the year-ago quarter earnings of $1.79 per share. However, it trailed the Zacks Consensus Estimate of $1.87.

The industrial gases giant reported fiscal first-quarter revenues of $2,224 million, flat year over year as 1% higher pricing and 5% favorable energy pass-through were offset by 3% lower volumes and 2% unfavorable currency impact. Sales also missed the Zacks Consensus Estimate of $2,289 million.

Segment Highlights

Revenues from the Industrial Gases — America segment went up 9% year over year to $989 million in the reported quarter, supported by higher volumes and pricing as well as higher energy pass-through, partly offset by unfavorable currency. Merchant gases volumes were favorable.

Sales from the Industrial Gases — Europe, Middle East, and Africa (EMEA) segment rose 2% year over year to $524 million driven by favorable energy pass-through and positive volumes and pricing, partly masked by unfavorable currency.

Sales from the Industrial Gases — Asia segment fell 3% year over year to $627 million. Barring the impact of a plant sale in the prior-year quarter, sales rose 16% on the back of contributions of the Lu'An gasification project.

Financial Position

Air Products ended the quarter with cash and cash equivalents of $2,923.3 million, up 7% year over year. Long-term debt was down roughly 13% year over year to $2,954.4 million.

The company also raised its quarterly dividend by more than 5% to $1.16 per share, marking the 37th straight year of dividend hike.

Outlook

Air Products continues to expect adjusted earnings for fiscal 2019 to be in the range of $8.05 to $8.30 per share, reflecting a 10% increase at the midpoint year over year. The company expects adjusted earnings to be in the band of $1.80 to $1.90 per share for second-quarter fiscal 2019, up 8% at the midpoint year over year. The company also continues to anticipates capital expenditure of $2.3-$2.5 billion for fiscal 2019.

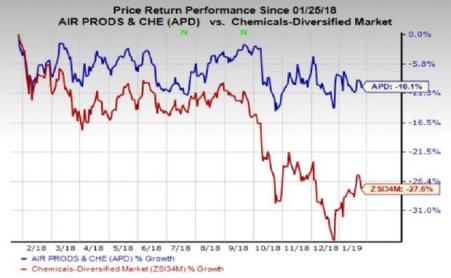

Price Performance

Air Products’ shares have lost 10.1% over a year, outperforming the industry’s decline of 27.6%.

Zacks Rank & Stocks to Consider

Air Products currently carries a Zacks Rank #3 (Hold).

A few better-ranked stocks worth considering in the basic materials space include Ingevity Corporation (NYSE:NGVT) , Quaker Chemical Corporation (NYSE:KWR) and Israel Chemicals Ltd. (NYSE:ICL) .

Ingevity has an expected earnings growth rate of 21.5% for the current year and carries a Zacks Rank #1 (Strong Buy). Its shares have gained 16% in the past year. You can see the complete list of today’s Zacks #1 Rank stocks here.

Quaker Chemical has an expected earnings growth rate of 21.1% for the current year and carries a Zacks Rank #1. Its shares have gained 23% in the past year.

Israel Chemicals has an expected earnings growth rate of 5.4% for the current year and carries a Zacks Rank #2 (Buy). The company’s shares have rallied 29% over the past year.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Air Products and Chemicals, Inc. (APD): Free Stock Analysis Report

Ingevity Corporation (NGVT): Free Stock Analysis Report

Israel Chemicals Shs (ICL): Free Stock Analysis Report

Quaker Chemical Corporation (KWR): Free Stock Analysis Report

Original post