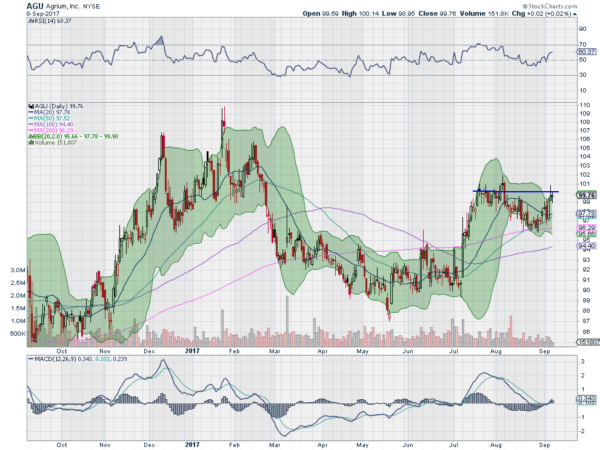

Agrium Inc (NYSE:AGU)

Agrium, $AGU, made a Tweezers Top in January and then started to move lower. It found a bottom in May in the middle of a broad consolidation that did not end until July. A fast move higher then and a pause led to retracement to the 200 day SMA and then a bounce. Now it is back at prior resistance. The RSI is moving up into the bullish zone while the MACD is crossed up, positive and rising. Look for a push over resistance to participate higher…..

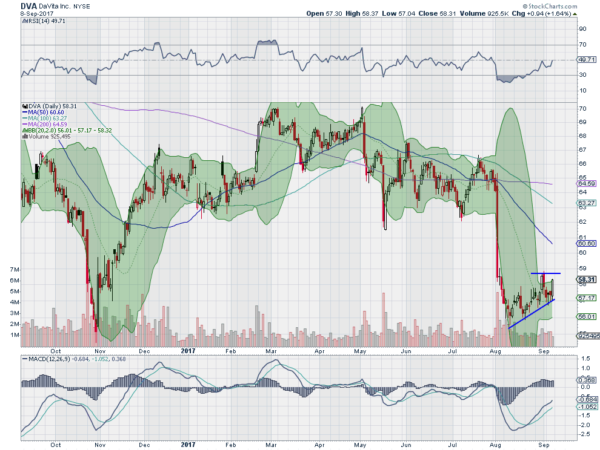

DaVita HealthCare Partners Inc (NYSE:DVA)

DaVita, $DVA, rose off of a bottom in November, eventually peaking in March. It consolidated for 2 months but then reversed lower. It dropped precipitously to start August and then drifted lower to a bottom. Since then it has been trending higher. The RSI is about to cross the mid line while the MACD is rising and nearing zero. The Bollinger Bands® have squeezed, often a precursor to a bigger move. Look for a push over last week’s high to participate…..

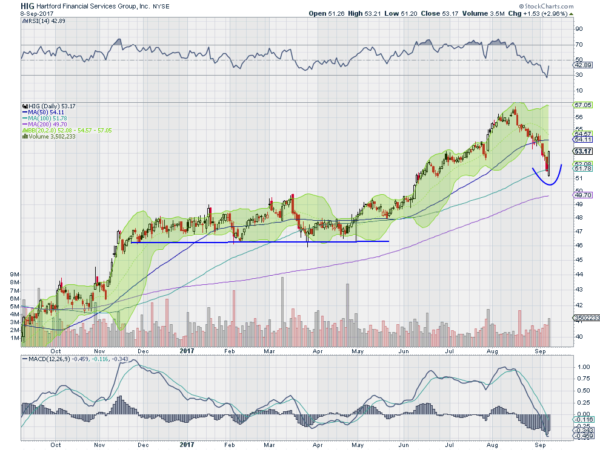

Hartford Financial Services Group (NYSE:HIG)

Hartford Financial Services, $HIG, popped after the election but quickly settled and had a long consolidation for 5 months. In May it finally started moving higher and it peaked in August. From that high it was pulling back for 3 weeks until it hit the 100 day SMA Thursday and then put in a Key Reversal Day Friday with a bullish engulfing candle. The RSI is reversing higher and the MACD is leveling but deep in bearish territory. Look for continuation to participate higher…..

Progressive Corporation (NYSE:PGR)

Progressive, $PGR, has a similar set up to Hartford Financial above. A pop after the election stalled in March, consolidated and then pushed higher again. That reached a top in August and pulled back to the 100 day SMA. Friday it also put in a Key Reversal Day. It has a RSI that is rising off of an oversold condition while the MACD is starting to level. Look for continuation higher to participate…..

JM Smucker Company (NYSE:SJM)

J.M. Smuckers, $SJM, has been making a stair step retreat from a top in August last year. The last piece was a severe drop after their earnings report in late August. It seems to have found support last week and started to turn higher. The RSI has also turned up and is moving out of oversold territory while the MACD is heading towards a cross up. Look for continuation to participate higher…..

Up Next: Bonus Idea

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which saw the joy in the equity markets that was there when the week started fade to just a subtle fist pump at the end of the holiday shortened week.

Elsewhere look for Gold to continue in its uptrend while Crude Oil pulls back in its move higher. The US Dollar Index continues to melt down while US Treasuries are biased to the upside. The Shanghai Composite is pausing in its break out and Emerging Markets are biased also consolidating at long term resistance in their uptrend.

Volatility looks to remain low keeping the bias higher for the equity index ETF’s SPDR S&P 500 (NYSE:SPY), iShares Russell 2000 (NYSE:IWM) and PowerShares QQQ Trust Series 1 (NASDAQ:QQQ). Their charts show some short term retrenchment as they hit highs, while the long term rising trend remains unperturbed. Use this information as you prepare for the coming week and trad’em well.

DISCLAIMER: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.